- December 13, 2022-2022 Semiconductor Materials Market Concludes as Another Solid Year Amid Rising Economic Challenges

- November 16, 2022-US Semiconductor Wet Chemicals Supply-Chain Restructuring to accommodate Chip Expansions – Supply-demand gaps will exist unless more domestic production is developed

- November 8, 2022-Fab Expansions in Europe Impact Materials Supply Chain – Can European Materials Supply Keep up with Growing Demand?

- October 25, 2022-Semiconductor Advanced Precursors Press Forward – Russia Dependencies on Supply Chain and Looming Recession show minimal impact

- October 18, 2022-Ceramic Fabricated Parts Market – Positive Demand from OEMs and Fabs-Restructured Supply Chain Responding with Investment Plans

- October 11, 2022-New Tech Ramp for Semiconductor Lithography Materials-High EUV manufacturing and increased layer counts contribute towards growth

- October 6, 2022-ICPT 2022 Conference Highlights-Industry experts collaborate on new and coming science for CMP

- October 4, 2022-CHIPS Act Benefits Rolling Out for Material Companies-Tips for making the most out of government benefits for US semiconductor growth

- October 1, 2022-We Haven’t Yet Solved Our Semiconductor Dilemma

- September 27, 2022-Electronic Wet Chemicals Price Volatility Sparks Concern-Price volatility in chemicals used for semiconductors further strains market

- September 20, 2022-CMP Slurry Suppliers Struggle with Balancing Costs and Increased Demand

- September 13, 2022-Electroplating Materials – Any Slowdown in Sight? – Advanced logic device expected to drive metal plating market forward

- September 8, 2022-Semiconductor Equipment Consumables – Silicon Parts, in High Demand with Continued Shift Toward Asia

- August 31, 2022-Supply Tightening Expected for Specialty Electronic Gases – Demand to outpace supply for NF3 and WF6 unless alternatives come into play

- August 25, 2022-Sputtering Targets Driven by Robust Semiconductor Demand – Metal supply chains to face increased demand given broader chip applications

- August 19, 2022-ADVISORY ALERT on CHIPS Act Featuring Washington DC Professionals Hon. Bonnie Glick and Mr. Madison Smith

- August 16, 2022-Silicon & SOI Wafers – A Record Year Amidst Tightening Supply – New production expansions needed, but will not take effect until 2024

- August 9, 2022-US CHIPS ACT Now Approved by President Biden – What’s Next?

- July 26, 2022-Advanced Lithography Drives Extension and Ancillary Materials – Will growth slow enough to meet PFAS environmental challenges?

- July 18, 2022-2022 Semiconductor Photoresists – Advanced Nodes Ramp – Growth continues strong through 2026

- July 6, 2022-2022 Semiconductor Materials Outlook – Supply chain limited by Russia / US CHIPS Act a game changer

- June 27, 2022-ALD/CVD Precursor Markets – Burgeoning Applications – Advanced Logic and Memory Applications require more deposition materials

- June 21, 2022-Specialty Cleans Markets – Advanced Nodes Drive Growth – In the midst of mounting technical challenges for wet chemical suppliers

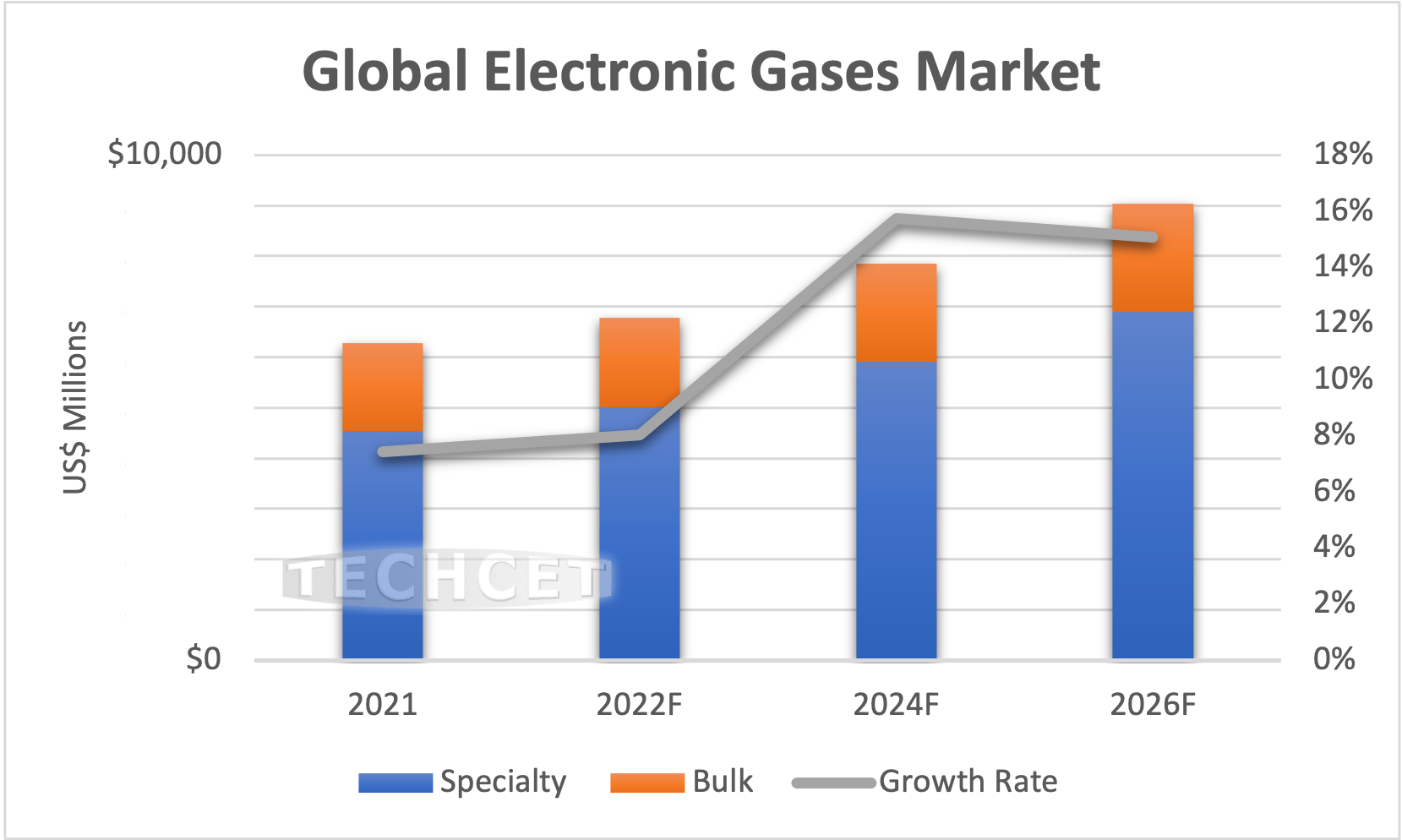

- June 15, 2022-Electronic Gases Markets – To Approach a US$9 Billion Market in ‘22 – New materials and increasing chip design complexity drives supply-chain problems for Specialty Gases, Rare Gases and Helium

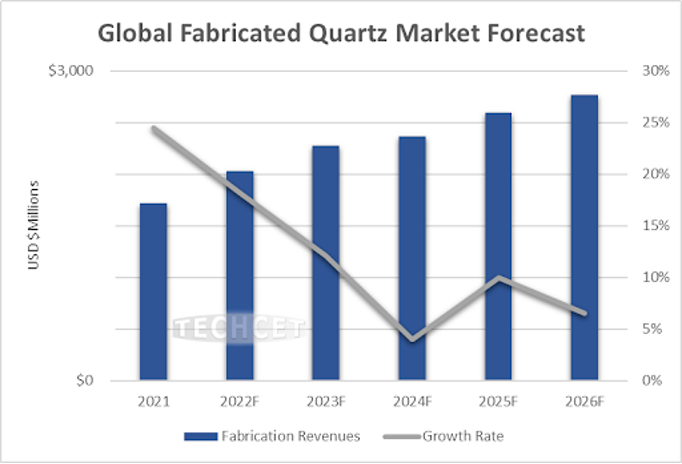

- May 31, 2022-Semiconductor Quartz Materials Market – Positive Demand – Strained but Expansion Plans being Pulled-in

- May 24, 2022-CMP Consumables – Supply is Tight and Costs Expected to Rise – as legacy products are replaced by leading edge

- May 17, 2022-Europe Chemical Supply Chain – Impact of Fab Expansions- Risk of Supply Interruption Grows With an Increase in Imports

- May 10, 2022-Semiconductor Materials at a Critical Tipping Point –Key Industry Issues Revealed

- April 21, 2022-2022 Strong Demand Straining Litho Material Supply-Chains –Supply Chain Pressures Expected to Drive Pricing Upward.

- April 7, 2022-Semiconductor Wafers Supply-Chain Critically Tight –Threat of Shortages Increasing

- March 22, 2022-Sputtering Target Demand Remains Strong – Metal Supply Chain Stressed – Metal Pricing on the Rise Driven Further by Russia/Ukraine Turmoil

- March 15, 2022-Wet Chemicals Challenges to Growing Demand and Imports – Double-Digit Growth; Changing Market Landscape- Acquisitions and Investments to Alter Supply Chains

- March 3, 2022-Electronic Gas Markets – Strong Growth, Pressing Supply-Chain Issues- Neon Gas Faces Supply Issues Due to the Russia/Ukraine Conflict; Supply Constraints for Helium Gas in 2022

- February 1, 2022-Supply-Chain Threats from Russia-US Tensions- Can Dependencies on Russia Materials Impact US Chip Production?

- January 17, 2022-2022 Semiconductor Materials Outlook- COVID-19 Pandemic Still Having Lasting Effects on All Materials

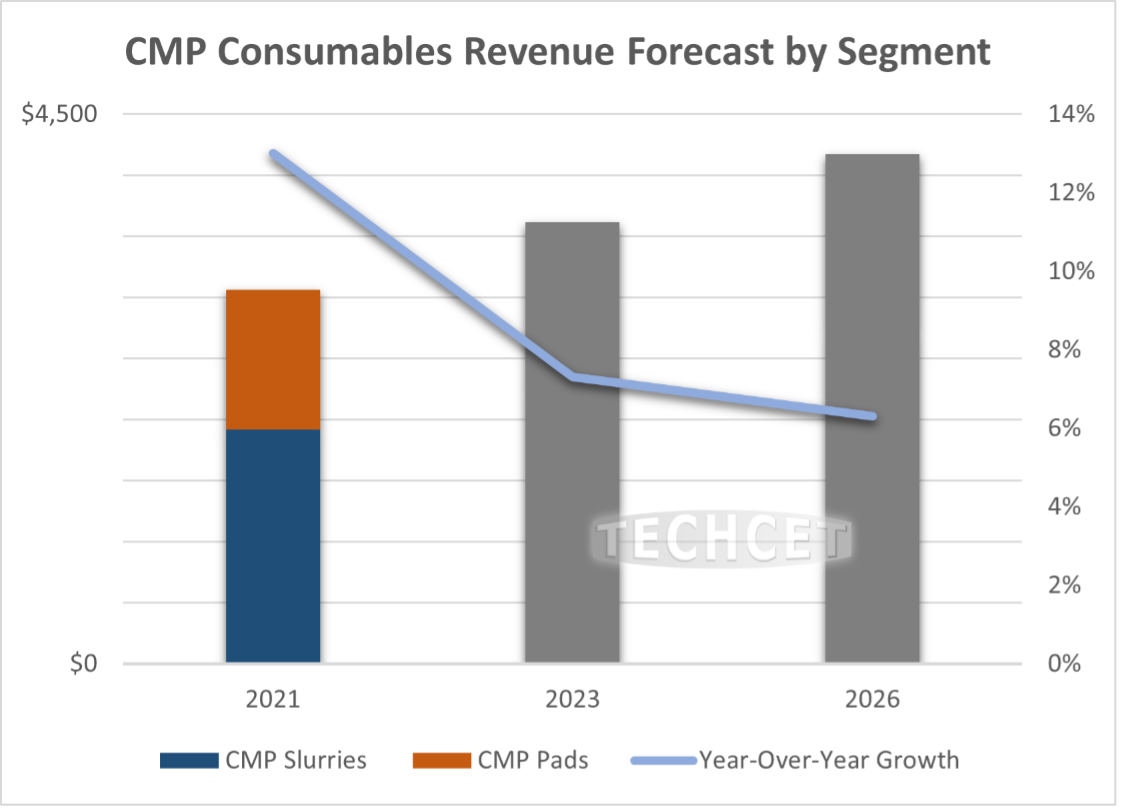

- January 6, 2022-Consumables Industry Feeling a Swell in Demand- CMP Slurry and Pad Market Forecasted 13% Growth for 2021

December 13, 2022

2022 Semiconductor Materials Market Concludes as Another Solid Year Amid Rising Economic Challenges

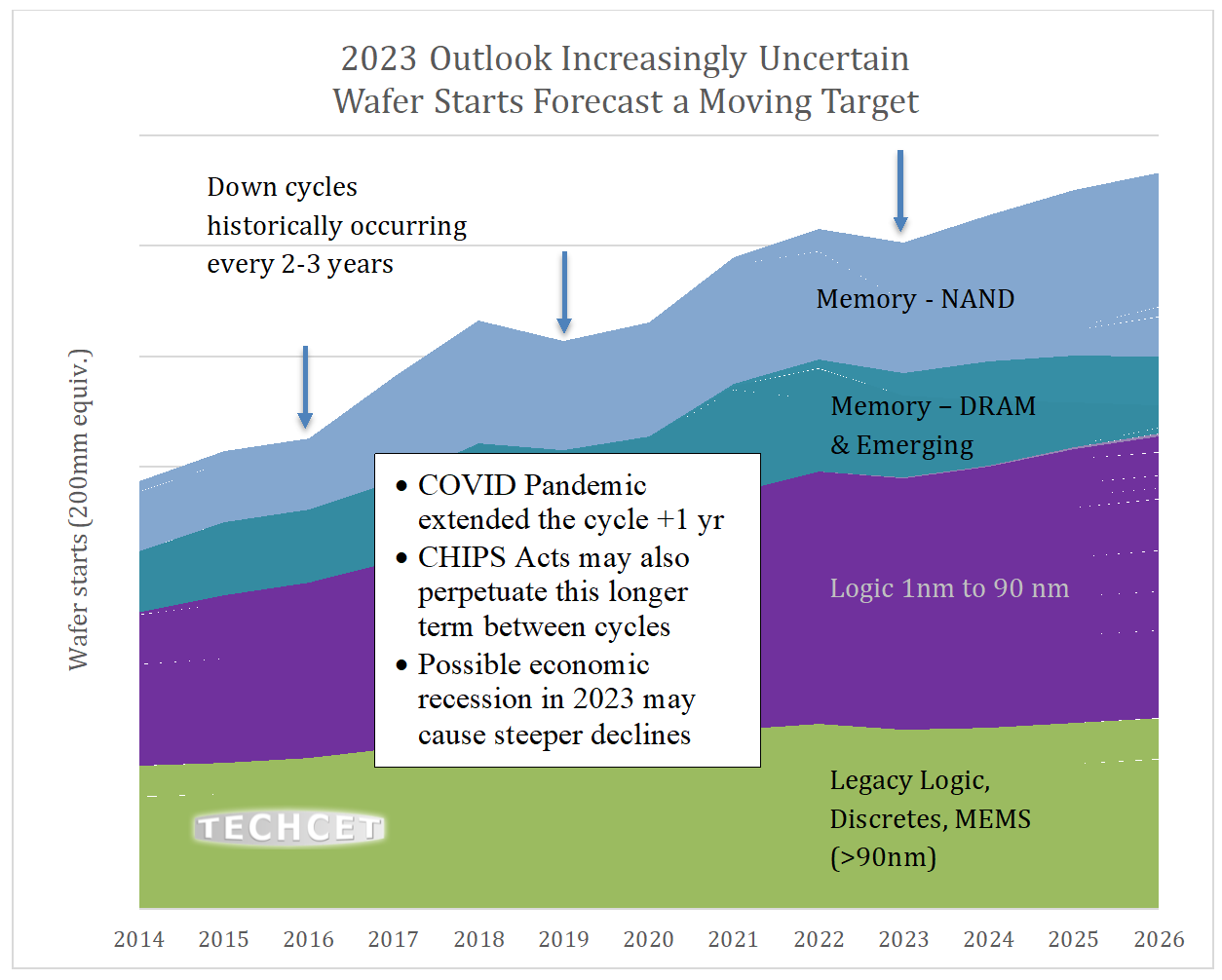

San Diego, CA, December 13, 2022: TECHCET—the advisory firm providing information on the electronics and semiconductor materials market supply-chain — announced that the Total Semiconductor Materials market in 2022 is expected to top US$66 billion after strong semiconductor demand through the first three quarters of the year. The growth represents almost 8% revenue growth versus 2021, with material segments such as CMP Pads, Specialty Gases, Precursor Materials, and SOI Wafers growing at double-digits year-over-year.

The 2023 outlook has become increasingly uncertain in recent months given global economic challenges, alongside concerns with high energy costs and inflation that will impact consumer spending. TECHCET is anticipating a decline in 2023 semiconductor revenues, with the decline currently forecasted to be steeper for Memory devices.

TECHCET is forecasting a relatively flat 2023 for materials revenues, although volumes may have slightly negative growth. “We see a decline of at least 1.5% in wafer starts for 2023,” states Lita Shon-Roy, MS/MBA, TECHCET President. “Any decline in memory wafer starts will dampen the market for some precursors, specialty gases, cleaning chemistries, and other advanced materials for capacitors and multi-layer structures.”

Advanced logic devices, below 10 nm, will be the leading volume drivers of materials for 2023, forecasted to grow > 5%. “The wildcard will be the economy,” Lita added. “Should we fall into a recession, wafer starts will likely decline further. However, given CHIPS Act funding expected to be infused into the market in 2H2023, growth should return by third quarter of next year.”

For more information on the 2023 Semiconductor Materials Market Forecast, please reach out to TECHCET at [email protected]. Or browse our published Critical Material Reports™ on materials like ALD/CVD Precursors, CMP, Gases, Silicon Wafers, Wet Chemicals, and more at https://techcet.com/product-category/critical-materials-reports/.

ABOUT TECHCET: TECHCET CA LLC is an advisory research firm focused on analyzing the electronics materials supply chains for the global semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, supply chain analysis reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

November 16, 2022

US Semiconductor Wet Chemicals Supply-Chain Restructuring to accommodate Chip Expansions

Supply-demand gaps will exist unless more domestic production is developed

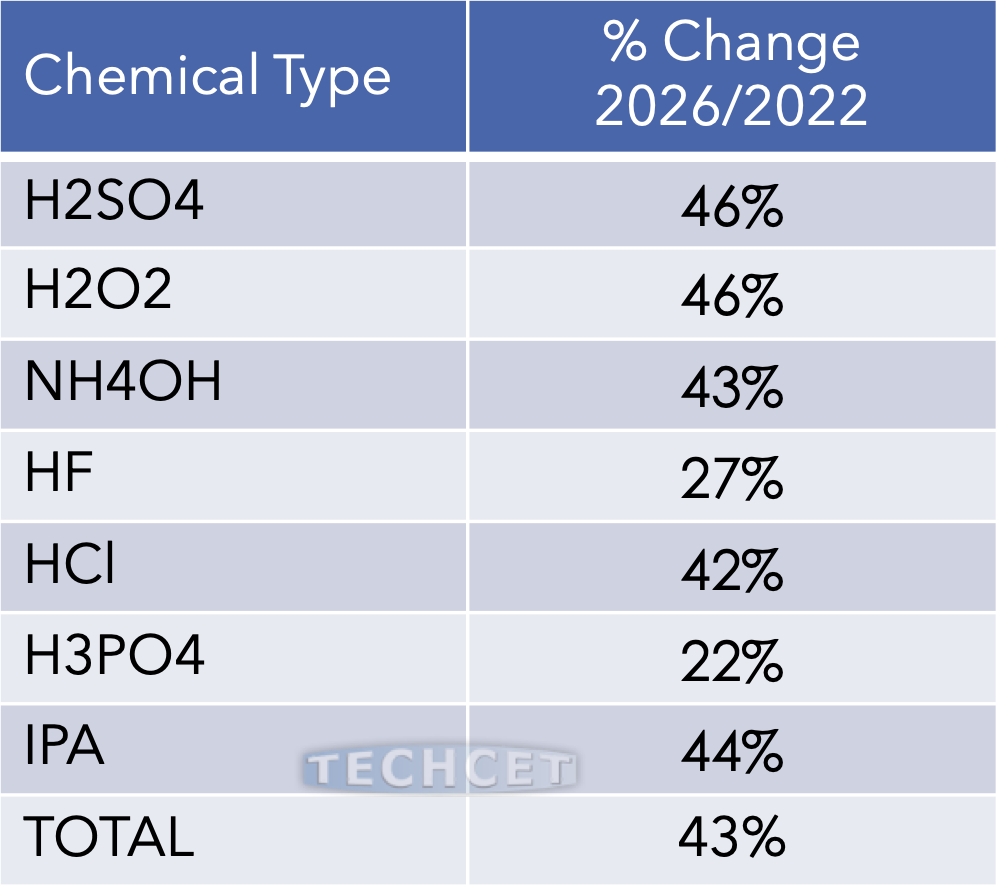

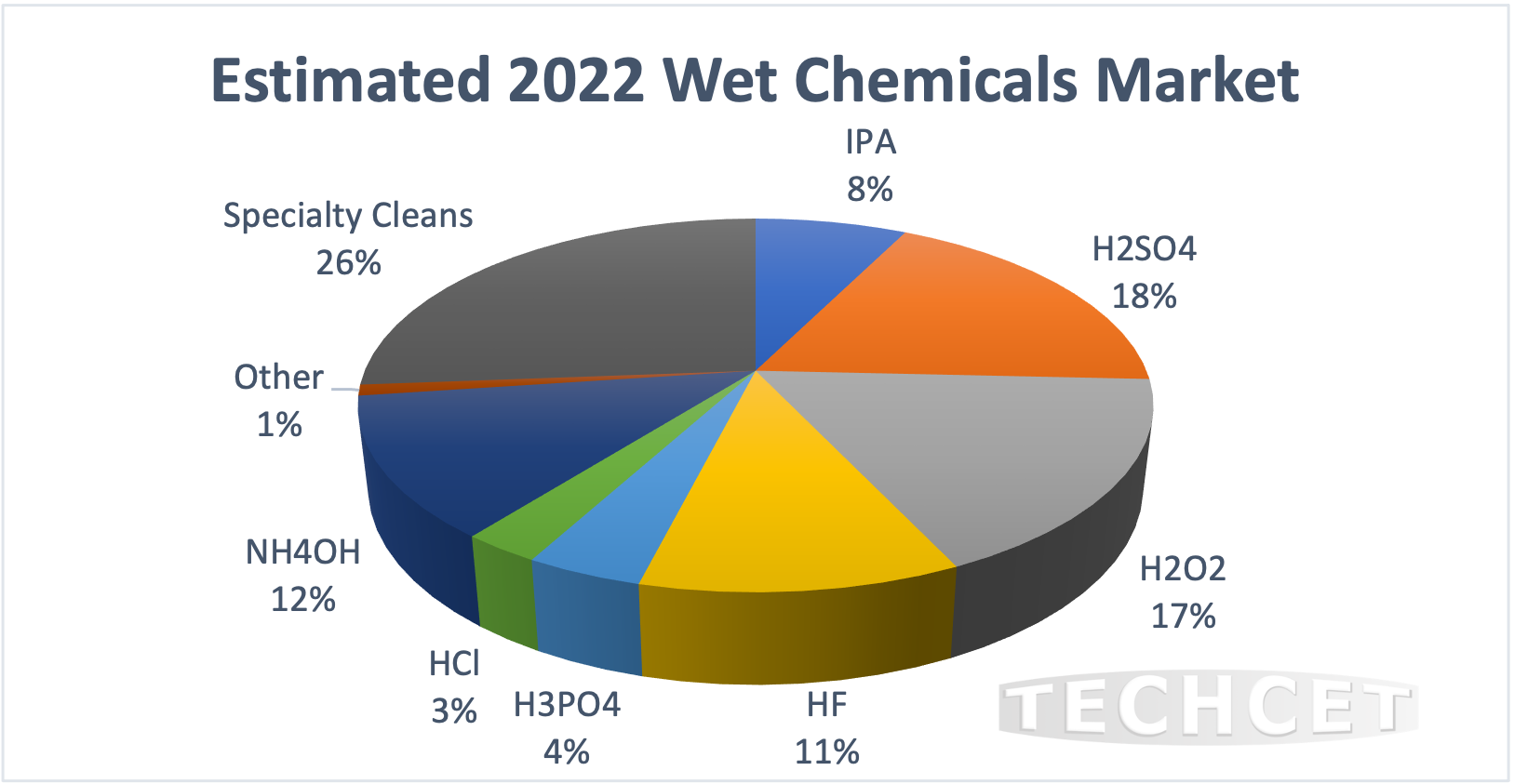

San Diego, CA, November 16, 2022: TECHCET—the advisory firm providing electronics and semiconductor materials market supply-chain information—forecasts that the US Basic Wet Chemicals demand will exceed 210 K metric tons in 2022, as highlighted in TECHCET’S most recent study on the US Chip Expansion Impact on the Wet Chemical Supply-Chain. This increase in demand is expected to run into a supply crunch as chip fabs ramp in demand by 2026, especially due to increased interest in US fab expansions, acquisitions, and joint ventures following the recent passage of the US CHIPS Act. While chemical suppliers have been announcing their commitment to support these expansions, it is still unclear whether it will be enough to meet the growing demand. Announcements for new chemical facilities have been announced by Kanto / Chemtrade, ChanChung, Sunlit, and MGC, to name a few. Estimates on volume demand from chip expansions is provided below:

Growth in Chemical Demand Expected to Support US Chip Expansions

Note: several of the chip fabs that are included in these estimates will not be fully ramped until 2028. Therefore, chemical demand will grow even larger than what is stated above.

“The expansion announcements by material suppliers show positive domestic support for new H2SO4 and H2O2 capacity, while UHP HF and IPA may continue to be supported with imported material until volumes and pricing can justify full plant investments,” states Lita Shon-Roy, President and CEO of TECHCET. As a result, TECHCET expects to see continued supply constraints in these areas until container and shipping availability stabilizes and inventory management adjusts to the new volumes.

For NH4OH, 45% more volume will be required by 2026. This increased demand could be supported by local production, but commitments for expansions and new capability have yet to be publicly announced. For high purity chemicals like HNO3 and H3PO4, increasing local production has been a challenge as old plants have been shut down over the years without any new facilities to replace them. As a result, imports have started to increase. The small demand volumes associated with these two chemicals may make imports more attractive to suppliers, rather than building a new plant that has poor ROI and may encounter challenges associated with stringent US environmental regulations.

The risk of US recession will also invariably impact short term demand. However, given CHIPS Act funding and the persistent growing need for more semiconductor devices for modern technology, demand for consumer products is expected to continue on a steep growth curve over the next decade.

For more details on the Impact on the Wet Chemical Supply Chain from US Chip Expansions go to:

https://techcet.com/product/impact-of-chip-expansion-on-us-chemical-supply-chain-3/

ABOUT TECHCET: TECHCET CA LLC is an advisory research firm focused on analyzing the electronics materials supply chains for the global semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, supply chain analysis reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

November 8, 2022

Fab Expansions in Europe Impact Materials Supply Chain

Can European Materials Supply Keep up with Growing Demand?

San Diego, CA, November 8, 2022: TECHCET—the advisory firm providing business and technology information for the semiconductor materials supply chains — anticipates increased strain on European chemical availability as semiconductor fabrication companies continue to expand in the region. Samsung Foundry and TSMC are two examples of companies that have recently announced their intentions to build fab expansions in Europe (following Intel’s announcement earlier this year to build in Germany). These activities highlight the need to stabilize a reliable supply of chemicals and materials to these facilities. Additionally, near-term issues of rising energy costs and lower economic activity are currently impacting Europe’s semiconductor industry, so future growth and investments in manufacturing will need to address potential chemical and materials supply issues in the region.

Image from Dragon Claws – stock.adobe.com

As noted in TECHCET’s Analysis Report on “The Impact of Chip Expansions on The Europe Wet Chemical Supply Chain”, fab expansions in Europe will require the support of additional chemical supplier investments otherwise semiconductor fabricators should prepare to look for alternative sources for key chemicals. In the report, TECHCET stated six chemicals were deemed to be at the highest risk of supply interruption, as confirmed by major Europe chip fabricators. These chemicals are hydrochloric acid (HCl liquid & gas), sulfuric acid (H2SO4), hydrofluoric acid (HF), ammonia hydroxide (NH4OH), and isopropyl alcohol (IPA).

In the past several years, Europe’s electronics wet chemicals (and gases) supply-chain has been suffering from interruptions at an increasing frequency, and they were expected to worsen for a number of reasons. For one, there has been a general lack of interest from chemical & gas suppliers to invest in upgrading older facilities for local wet chemical supply. Additionally, there have been increased dependencies on Asia / China that are plagued by logistics issues. Finally, stringent environmental regulations have made it difficult for companies to keep up with.

“Some chemical suppliers in Europe will consider investments if market conditions warrant the IT and capital support/co-investment is in place. If economically viable, a new plant, rather than an expansion of an existing plant, is advantageous in providing improved quality and higher purity chemicals needed to support advanced process nodes,” states Dan Tracy, Sr. Director at TECHCET.

TECHCET has determined the 16 nm and below process segments will undergo the strongest fab expansion growth over the next six years in Europe. For the supplier, building a new facility will better enable the manufacturing of higher-grade chemical, but the demand and volume projections need to be there to justify this type of supplier investment.

For more details on the Europe Chemical market segments, issues, and growth trajectory go to:

https://techcet.com/product/the-impact-of-chip-expansions-on-the-europe-wet-chemical-supply-chain-new/

Don’t miss Lita Shon-Roy’s talk on “Semiconductor Market Expansion Driving Materials Innovation – Materials Market Outlook and Challenge” at the SEMICON Europa Materials Innovation Session next week on November 16th in Munich, Germany. To register, visit https://www.semiconeuropa.org/about/register

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

October 25, 2022

Semiconductor Advanced Precursors Press Forward

Russia Dependencies on Supply Chain and Looming Recession show minimal impact

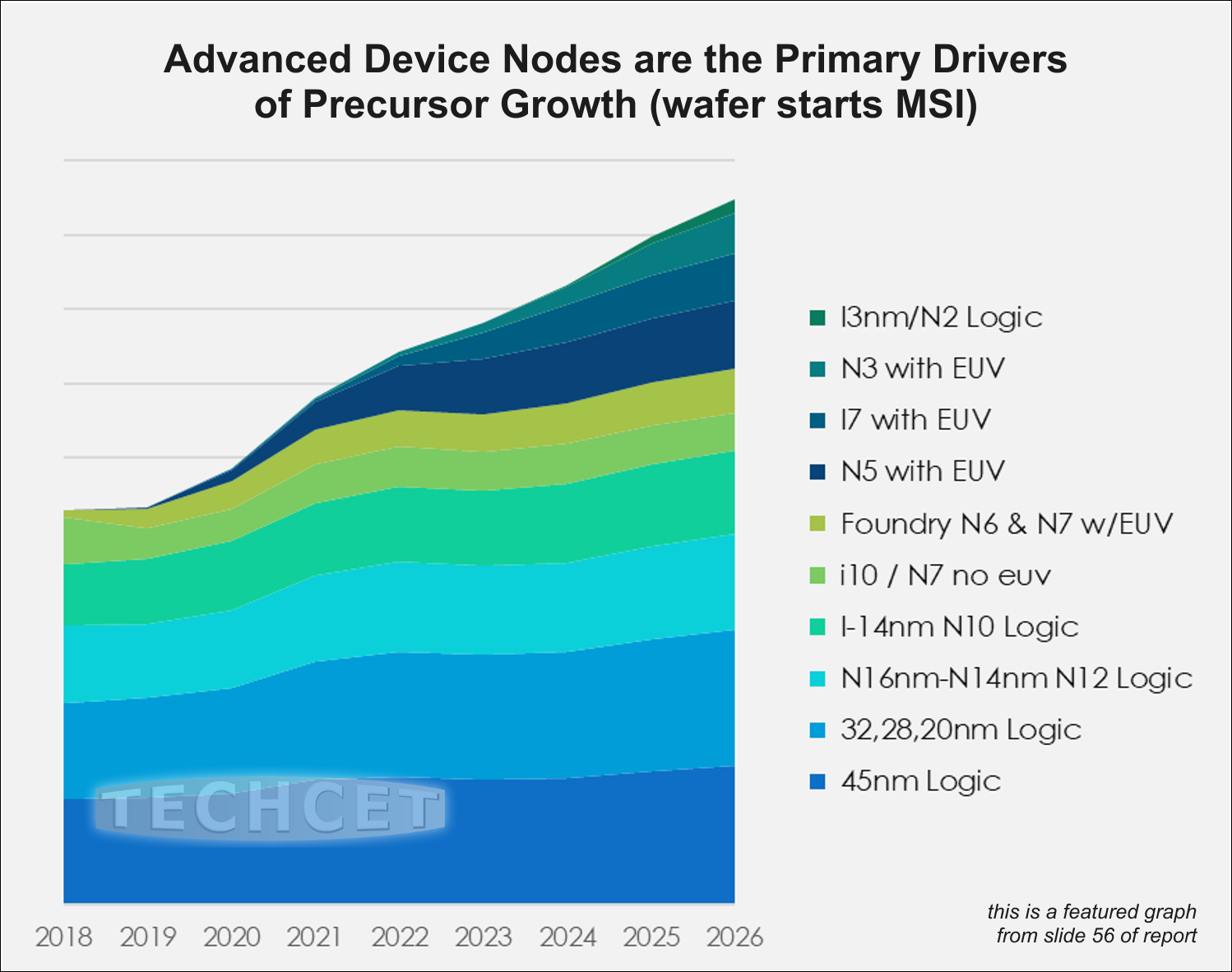

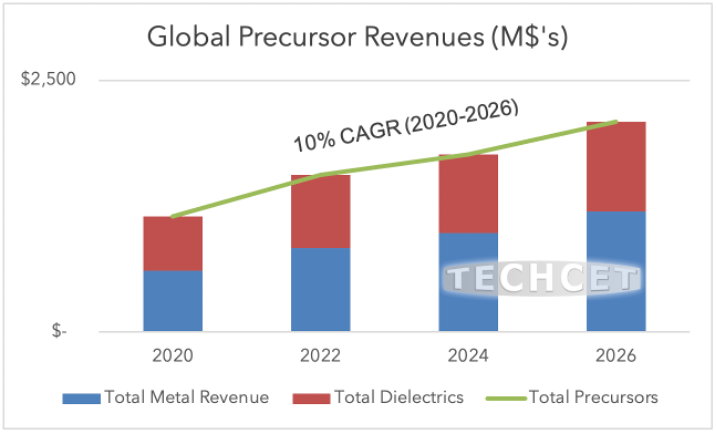

San Diego, CA, October 25, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— reports that the Metal and High-ĸ Atomic Layer Deposition (ALD)/Chemical Vapor Deposition (CVD) precursor market will reach US$835 million in 2022, almost a 13% growth from 2021. Market growth is expected to slow slightly in 2023 due to conditions with the global economy. However, growth will soon after accelerate through 2026 due to fab expansions in leading edge Logic and Memory, as highlighted in TECHCET’S ALD and CVD CMR™ Market Reports.

“Overall, this Precursor segment will experience a 2021 to 2026 CAGR of almost 9% as strong growth is forecasted for Hafnium, Cobalt, and Tungsten precursors. Although we see saw supply interruption of some cobalt precursors coming out of Russia, this will not impact the overall market which is expected to top US$1.1 billion by 2026,” states Lita Shon-Roy, President/ CEO of TECHCET.

Device producers in the semiconductor industry are seeking out new manufacturing solutions designed to improve both cost and performance. This will increase opportunities for CVD and especially ALD processing to deposit new materials, device structures, and features like the following:

- Hafnium (HfO2) to continue as high-k dielectric in Logic Gate Stack with minor contribution from Lanthanum VT-doping material (La2O3)

- Tungsten (WF6) growth is driven by 3DNAND vertical scaling

- Potentially Molybdenum (Mo) using solid precursors to transit from R&D to HVM in the next few years; this could then capture market share from the WF6 segment

- Cobalt precursor consumption is driven by higher growth in sub 20 nm Logic nodes than older nodes and high potential use in additional metallization layers

Future technology for improved devices center on new precursor development for transistors such as high-κ gate dielectrics, metal gate electrodes, strain/stress epi of the channel and channel materials, memory cells and high-κ capacitors, interconnect wiring, barriers, seed layers, and photolithography (with associated multi-patterning techniques).

There are numerous challenges to be addressed around continued dimensional scaling and new device features for new materials deposited by ALD. Film uniformity, deposition coverage, and integrity are all needed to meet requirements for manufacturability and yield. Area selective deposition has gained popularity in the past 5 years as the growing R&D community aims to implement this approach in future devices.

For more details on the ALD/CVD Precursor market segments and growth trajectory including profiles on suppliers like ADEKA, Air Liquide, DNF Co., Entegris, Gelest, Hansol, and more, go to:

https://techcet.com/product-category/ald-cvd-precursors/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

October 18, 2022

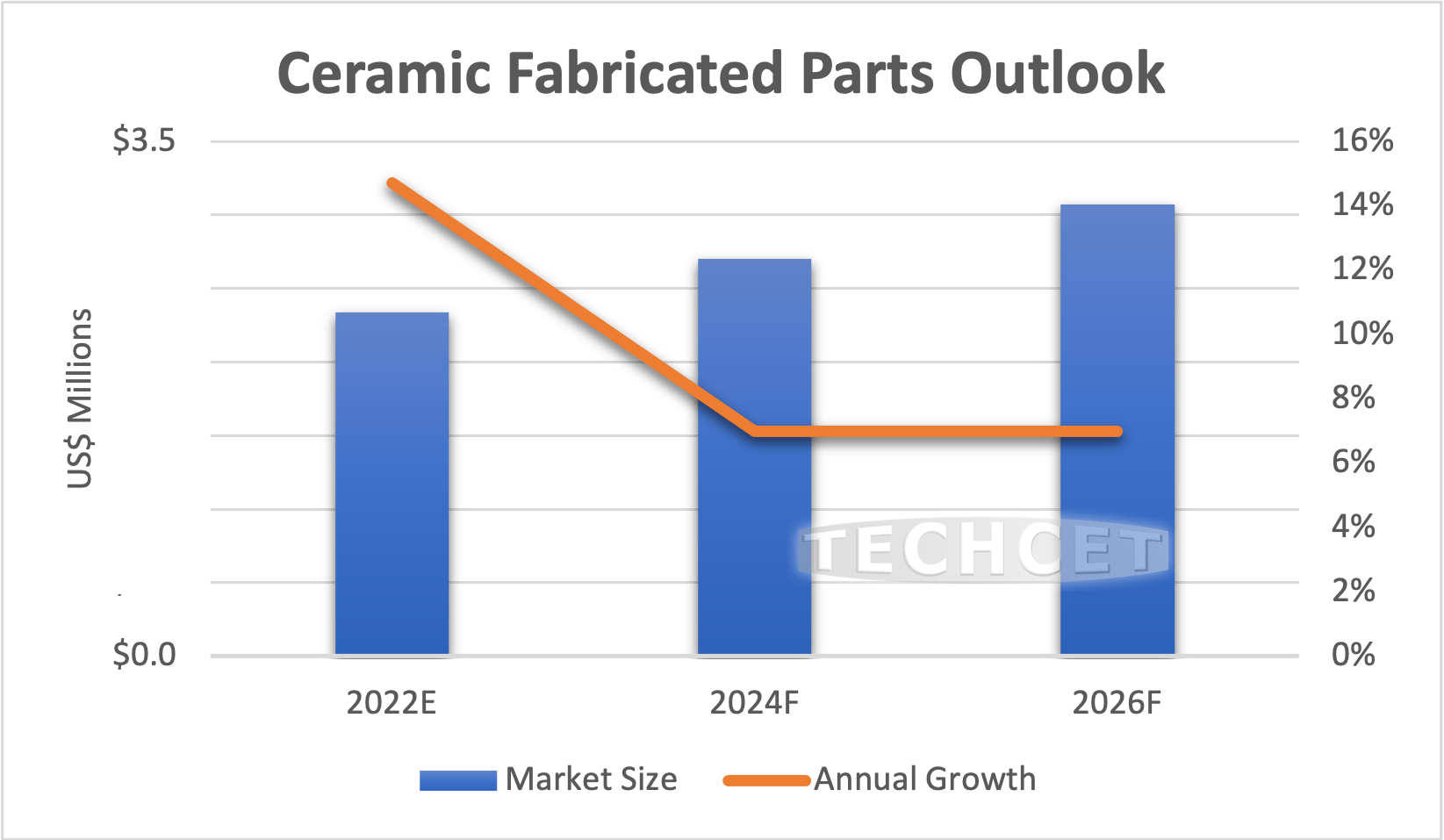

Ceramic Fabricated Parts Market – Positive Demand from OEMs and Fabs

Restructured Supply Chain Responding with Investment Plans

San Diego, CA, October 18, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— recently announced that the Ceramic Fabricated Parts market for semiconductor fabrication equipment consumables is expected to reach US$2.3 billion in 2022, a 15% jump from US$2.0 billion in 2021. The fabricated ceramic components market is strongly affected by the semiconductor production and demand for wafer fabrication equipment, as highlighted in TECHCET’s new Ceramics CMR™ Market Report. The segment includes alumina, aluminum nitride, SiC, and other ceramic materials (e.g., Yttria coated ceramics) used in thermal processing, etch, epitaxial, and other semiconductor process equipment.

“Market demand from existing installed equipment in semiconductor fabs and the demand for new processing equipment grew significantly as the equipment market heated back in 2020,” states Karey Holland, PhD., senior analyst at TECHCET. Since then, demand has been sustained through the first half of 2022. Recently, there have been some slight signs of weakness in the memory market, though the ceramic parts market should continue growing into 2023 as current equipment orders get delivered. In the longer term, all the planned fab expansions and new fab investments will drive >8% CAGR through the 2026 forecast period.

Demand for replacement parts is largely supported by spares sold by local suppliers. New equipment OEM sales during an upturn strongly favor parts from suppliers with exclusive agreements with OEMs. There are indications of some price increases over the past years as fabs increased consumption of consumable parts and OEM increased production, resulting in a strain on supply capacity. As such, ceramic parts are sourced from different areas of the world to maximize efficiency and minimize turn-around time. This is possible because many of the leading parts fabricators have multiple locations for manufacturing.

For parts suppliers adding manufacturing capacity, there are some challenges facing the supply chain. For one, it usually takes a year to build a new ceramic fabrication factory and half a year to source the CNC equipment. There is currently 15% price increase for CNC systems, and companies expect delays in shipping CNCs. Additionally, kilns for sintering ceramic components now have lead times of 12 to 15 months. Therefore, a typical ceramic fabrication plant expansion can take up to 2-2.5 years to plan and implement. It takes even longer planning for setting up a high purity ceramic powder production. Historical downturns have caught suppliers by surprise, making them cautious when it comes to new investments, and now part suppliers are cautious about possible changes affecting the 2023 outlook.

For more details on the Ceramic Fabricated Parts Material market segments and growth, including profiles on suppliers like ADMAP Inc, Applied Ceramics, Ariake Material Company, Asahi Glass Company, Ltd., Asuzac, and more, visit

https://techcet.com/product/ceramics/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

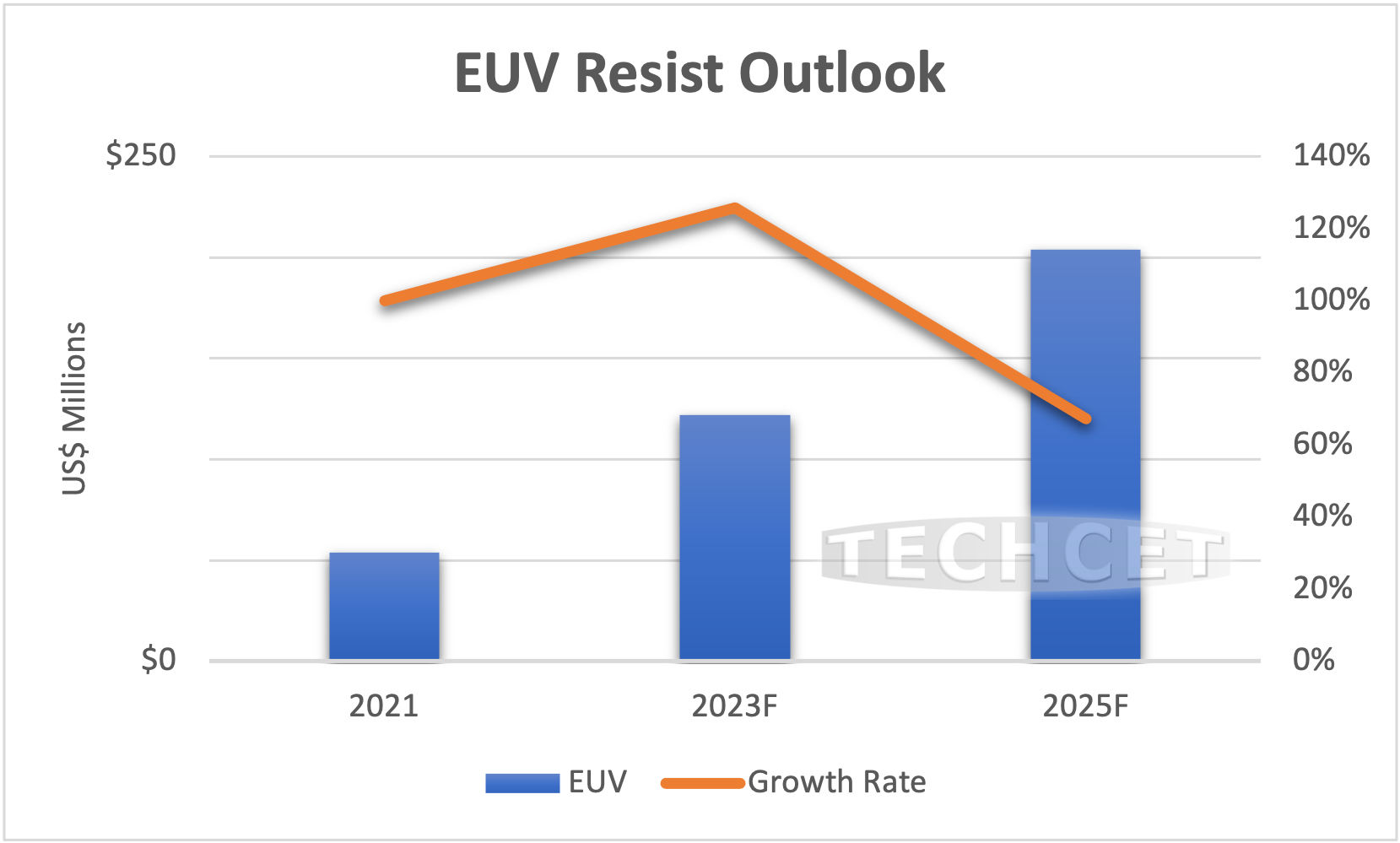

October 11, 2022

New Tech Ramp for Semiconductor Lithography Materials

High EUV manufacturing and increased layer counts contribute towards growth

San Diego, CA, October 11, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— reveals that Extreme Ultraviolet (EUV) applications have resulted in several photoresist technology platforms including Metal Oxide photoresists, Dry Deposited photoresist, and Multitrigger photoresists, all driven by the process technologies required in advanced chip manufacturing. Combined, these resist platforms will up the market to reach more than $200M by 2025, as highlighted in the recently released Critical Materials CMR™ Market Report on photolithography.

Metal Oxide photoresists have a high etch resistance that can eliminate additional layers required above the resist. Dry deposited photoresist offers the opportunity to eliminate liquid development and deposition, thus decreasing ancillary consumption and lowering waste requirements. Multitrigger Photoresists enable the continued use of lower exposure energy, making it useful in multiple exposure regimes while demonstrating improvements over the photoresist of record.

With EUV in high-volume manufacturing, the photoresists and related ancillary have firmly ‘arrived’ and are now officially being used at multiple chip makers. EUV photoresist will grow rapidly as new logic nodes continue to be introduced. Additionally, advanced DRAM enters production with EUV and as scanners are placed into production. In addition to photoresists, EUV is ushering in a number of changes such as scanners optics and 3D patterning techniques.

“Photolithography materials are critical in semiconductor manufacturing and are an important component in lithographic processing as semiconductor fab costs are rising at the leading-edge. Thus, materials and process innovation, as in the example of EUV, will ramp,” states Lita Shon-Roy, CEO at TECHCET.

These newer materials, are giving a boost to the lithography materials market, and are expected to grow 5X over the next 3-4 years with the advancement in fine line-width device manufacturing.

For more details on the lithography materials market segments, including supplier profiles for Avantor, BASF, Brewer Science, Chang Chun Petrochemical, Dongjin Chemical, and more, go to: Lithography Materials-NEW | TECHCET CA LLC

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

October 6, 2022

ICPT 2022 Conference Highlights

Industry experts collaborate on new and coming science for CMP

San Diego, CA, October 6, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— attended The International Conference on Planarization Technology (ICPT) last week, September 27-29, at the historic Benson hotel, in Portland, Oregon. “The conference is a perfect mix of university and industry experts coming together to understand and advance the science and process of CMP,” commented Diane Scott, Ph.D., TECHCET’s CMC Director. For the first time, this conference was a hybrid event with some 300 live attendees and close to 100 online attendees. Each afternoon, poster sessions filled the conference rooms with great scientific insight and conversations. Talks and posters encompassed innovative CMP pads designs, SiC CMP, surface modeling, brushes, particle characterization and more.

This year, ICPT gave out two awards to recognize pioneers in this industry. The ICPT Outstanding Achievement Award was given to Dr. Toshiro Doi Professor Emeritus of Kyleshu University and Saitama University for his development of the Pac-Rim conference back in 2004, which has now evolved into this ICPT. The second achievement award was presented to Dr. Duane Boning, Professor at MIT. Dr. Boning led the research into pattern density sensitivity in CMP. Dr. Robert Rhoades announced the 2023 ICPT will be held in Japan.

To see photos and get more information on the ICPT 2022 conference, go to https://www.icpt2022.org/.

For more information on the TECHCET Market Report on CMP pads and slurries, check out our website at https://techcet.com/product-category/cmp-consumables/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

October 4, 2022

CHIPS Act Benefits Rolling Out for Material Companies

Tips for making the most out of government benefits for US semiconductor growth

San Diego, CA, October 4, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— has been monitoring the status of the U.S. Chips Act rollout to help semiconductor material companies obtain legislative benefits for new expansions. The funding application process will be announced in February 2023. The fine details are still evolving and may be influenced by lobbying or world events. However, there are steps companies can begin taking in order to more easily and quickly obtain legislative benefits. For one, the government wants companies to have “ready-to-go” expansion plans so that there is a clear pathway and benefit for any monetary support. This means companies should consider having detailed plans for new facilities already laid out, including having land already pinpointed or purchased, and showing progress already made with state and local government. The Federal Register has yet to release the Funding Opportunity Announcement (FOA), but once this is out, companies should have plans in place to help facilitate the application process.

Another step that companies can take to improve their chances of obtaining governmental funding is to work with lobbyists, grant writers, attorneys, or other external experts. Companies can work with these individuals to help identify areas in the application that may need fortification to meet the Department of Commerce’s expectations. Because of the uncertainty of the official criteria to qualify for grants, having pre-established government connections and input can be helpful.

As mentioned, the official protocol and criteria for CHIPS Act support is still being worked on, so it is important to frequently check governmental websites for updates. Key websites include www.chips.gov and www.federalregister.gov, among others. It may also be helpful for companies to register their company with the U.S. government at www.sam.gov. To get a copy of TECHCET’s “CHIPS Act Check List” available for free to CMC and DSS member subscribers, or for more information on materials markets and consulting, please contact TECHCET at [email protected].

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

October 1, 2022

We Haven’t Yet Solved Our Semiconductor Dilemma

By Lita Shon-Roy, President / CEO, TECHCET and Bonnie Glick, Director, Krach Institute for Tech Diplomacy at Purdue

Passage of the bipartisan CHIPS and Science Act should alleviate semiconductor chip shortages that have increased prices and reduced supplies of cars, medical devices, and consumer electronics. But it would be premature to declare victory. Russia’s war on Ukraine has squeezed the market for rare gases like helium and neon that are vital to semiconductor production – highlighting our continued vulnerability in an unstable world.

The CHIPS and Science Act will bolster U.S. semiconductor research, development, and production, making critical investments in domestic production of the building blocks of all modern technology. But the legislation does not solve the quandary of sourcing rare earth materials and gases from China, Russia, and other geopolitical rivals. There is a vital need for more financial support for materials producers. Without it, building a semiconductor gases and chemicals plant in the United States will be prohibitively expensive for most chemical manufacturers – forcing us to continue to rely on imports from unstable regions. Additionally, the aftermath of COVID-19 will continue to increase production uncertainty and risk of logistics interruptions, putting U.S. supply-chain imports at further risk.

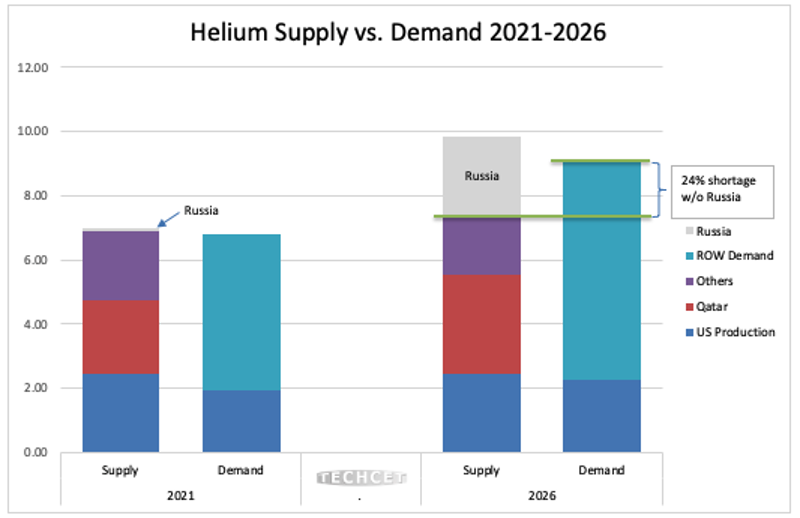

Figure 1. Currently, Helium is on Allocation to Chip Fabs because of Inadequate Supply;

by 2026 Helium Supply will Run 24% Short of Demand without Russia

TECHCET and the Critical Materials Council have been actively tracing supply chain origins and disruptions emanating from Russia and elsewhere. The Russia-Ukraine disruptions are especially alarming since both countries are major global sources of semiconductor-grade rare gases. To put this into perspective, TECHCET estimates that 40-50% of the world’s semiconductor grade neon comes from Ukraine. Additionally, Russian state-owned Gazprom, one of the world’s largest natural gas and helium providers, ramped up production in response to global helium supply concerns following COVID-19. This put Russia on track to produce a third of the world’s helium. However, sanctions on Russia have made it much more difficult to obtain helium from Gazprom and other material suppliers.

Furthermore, the U.S. Bureau of Land Management is scheduled this month to dispose of the Federal Helium System, which will cause severe delays in the delivery of helium located in BLM stores. As a result, the helium supply in the U.S. barely outpaces demand, which has caused higher prices and longer lead times. As shown above in Figure 1, without Russia sources, TECHCET predicts a shortage in helium of approximately 1.5 Billion cubic feet (BCF) by 2026.

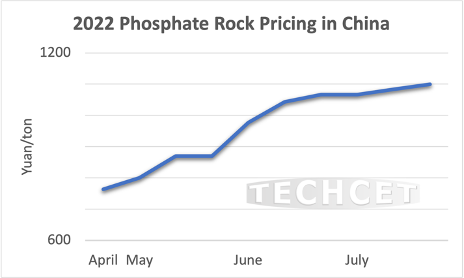

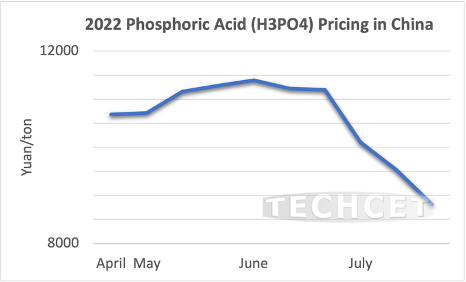

China presents its own complications. Due to tariffs on Chinese exports, the ongoing effects of the pandemic on global commerce, and sporadic price spiking, the flow of materials such as chemicals and metals from China has become irregular. In the past, Chinese material companies have unexpectedly lowered their prices in order to gain market share, while increasing prices for raw/starting material as illustrated with phosphate used for phosphoric acid in Figure 2 below. This practice, sometimes characterized as dumping, often damages the profitability and viability of competitor companies, causing chipmakers to be more dependent on materials from the Chinese market. Today, China is a leading supplier of raw materials needed for chip manufacturing.

Figure 2. Unstable Chinese Pricing on Phosphate Rock and Phosphoric Acid (H3PO4)

(Phosphor rock is a mineral used to make phosphoric acid.)

Asia also dominates the market for Ultra-High Purity (UHP) wet chemicals that are used to oxidize the silicon in semiconductor chips. Currently, all of the UHP purity sulfuric acid in the United States is imported from Asia– and many of the material supply chains in Asia are dependent upon raw materials from China. For all semiconductor grade wet chemicals, TECHCET estimates that there needs to be a 37-49% increase in supply over the next four years to meet projected needs for U.S. chip expansions. Without adding capacity to produce ultra-high purity chemicals, the U.S. will have to import 97% or more of the ultra-high purity chemicals needed for chip fabricators.

All of these challenges converge on a single point: the need for more local and dispersed production of these vital components of semiconductor production. When unexpected problems hit – such as war, pandemics, and trade complications – supply chains strain and cannot successfully keep up with required demand. This is especially problematic given that chip demand is only expected to keep growing in 2024-2025 and beyond.

Fortunately, there is an alternative to our reliance on problematic foreign sources. It starts with increasing materials production expansion efforts in the U.S., which must draw on support from the CHIPS and Science Act. By taking the right steps today, we can ensure that our domestic semiconductor industry continues to power innovation and economic growth for decades to come.

Lita Shon-Roy is President/CEO of TECHCET CA LLC, an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. Bonnie Glick is the director of the Krach Institute for Tech Diplomacy at Purdue and former Chief Operating Officer and Deputy Administrator of the United States Agency for International Development.

September 27, 2022

Electronic Wet Chemicals Price Volatility Sparks Concern

Price volatility in chemicals used for semiconductors further strains market

San Diego, CA, September 27, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— has witnessed a wide range of price volatility for multiple wet chemical and specialty cleans market segments. This in combination with the high demand across the semiconductor industry is causing concern among chip makers and suppliers alike. TECHCET’s current forecast shows a 6.7% revenue growth for the wet chemicals segment, expected to reach US 4.2 billion for 2022. However, forecasting has been a moving target as costs and prices have fluctuated unexpectedly, as highlighted in TECHCET’s latest 2022 Wet Chemicals Critical Materials Market Report™.

Isopropyl Alcohol (IPA) saw price decreases at the end of the second quarter in both North America and Europe due to decreasing costs of chemicals used in its manufacture. Acetone, a chemical used as a replacement process for generating IPA, initially had inflated prices due to rising crude oil pricing, but eventually dropped due to high inventories. Similarly, upstream propylene pricing impacted the price declines in the IPA market.

Other chemicals like Hydrochloric Acid (HCL) and Sulfuric Acid (H2SO4) faced price increases as a result of high demand and other supply chain events. For HCL, high demand from the steel industry and a high inflation rate due to other global events caused upward pressure on prices in the USA. Additionally, Olin, a primary chlor-alkali plan, faced a force majeure leading to crippled availability of inventories for HCl in North American region. In Europe, H2SO4 demand rose though crude oil prices rose and other raw materials experience price fluctuations.

“Price fluctuations are expected to continue until we come out of this uncertain period of rising inflation and energy costs,” stated Lita Shon-Roy, President / CEO of TECHCET. “In 2023, we expect to see a slowing of total electronic wet chemical revenues to 1.8% growth.” The slowdown will be the result of normal cycles of chip inventory corrections combined with uncertainties in the global economy. In the short term, inflation and rising costs of energy and raw materials adds to the threat of recession. This combined with on-going trade issues between the U.S. and China, alongside tensions in the Ukraine-Russia region can threaten the overall wet chemical industry growth. However, more than US$500 billion of investments have been announced for chip expansions to be built over the next 5 years. Approximately US$130 billion of this is planned just for the US. Given that many of these fabs are planned to begin production by mid-2024, another strong growth cycle is expected to start in 2024 and carry the industry into the next decade.

For more details on the Wet Chemicals market and growth trajectory, including supplier profiles on companies like Atotech, AUECC, Avantor, FujiFilm, Eastman, Chemtrade, Dupont, and more, go to: https://techcet.com/product/specialty-cleaning-chemicals/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

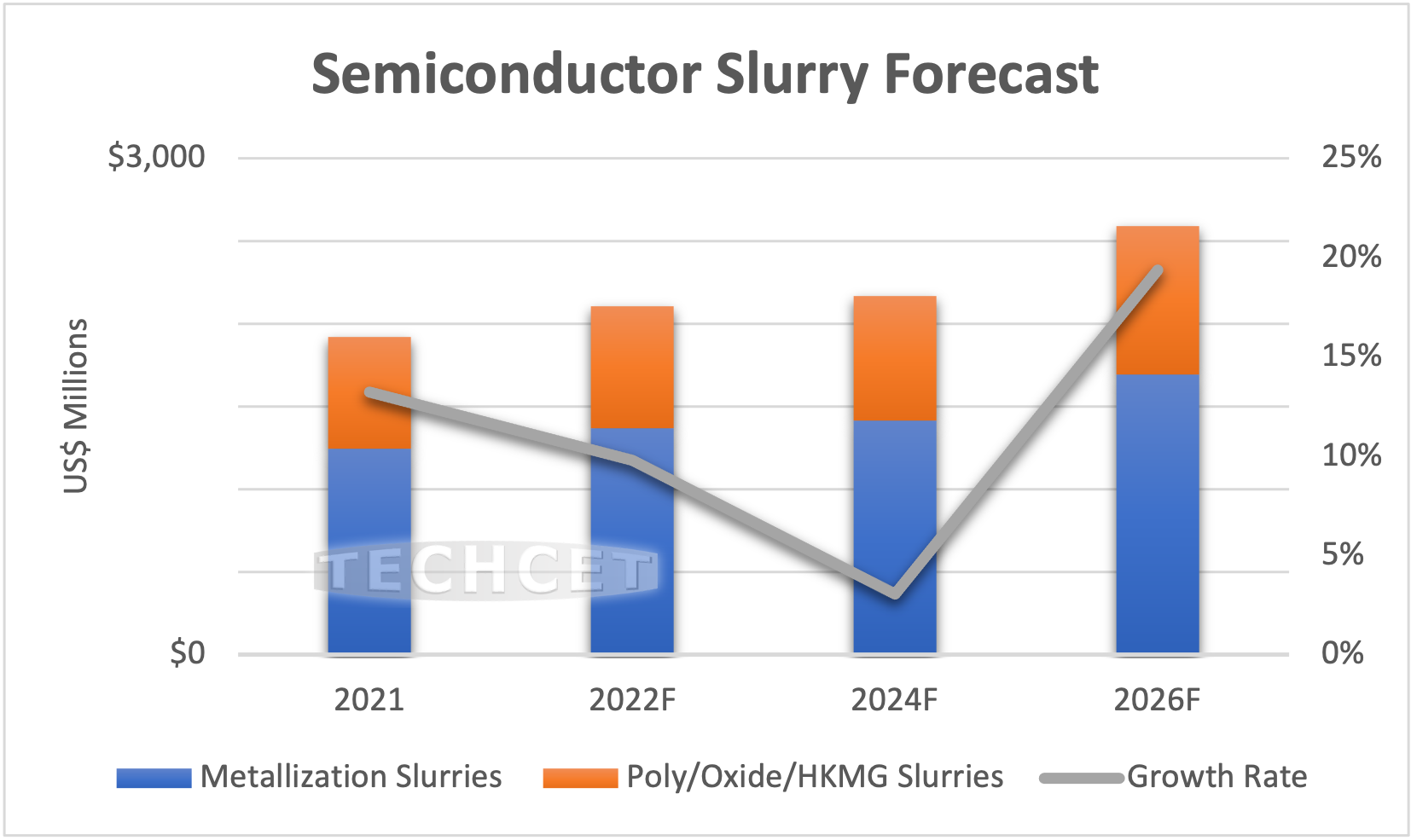

September 20, 2022

Electroplating Materials – Any Slowdown in Sight?

San Diego, CA, September 20, 2022: TECHCET—the electronic materials advisory firm providing business and technology information to chip fabricators and material suppliers — is closely tracking issues in the critical materials supply chain, including those related to CMP (chemical mechanical planarization) slurries needed for semiconductor production. The CMP slurry supply chain is experiencing strain from limited production capacity in the midst of continued strong demand from chip fabricators. Slurry suppliers are struggling to balance the demands for more product with the cost of adding capacity, especially if more infrastructure is needed. Hesitant to trust grandiose market predictions, suppliers continue to rely on short term forecasts in their capacity planning. Since the consumables shelf life varies from roughly 6 to 12 months for most products, there is a limit to the inventory that device makers can carry. Therefore, suppliers and fab customers must work closely together to manage inventories and to control costs. The latter is key as fabs seek for ways to reduce consumables costs as layer counts for logic and 3DNAND devices increase.

TECHCET forecasts the Chemical Mechanical Planarization (CMP) slurries market for semiconductors to grow almost 9% in 2022 from the previous year. The total slurry market will top US$2.0 billion for the current year and will reach US$2.6 billion by 2026, as highlighted in TECHCET’S CMP Market Report (CMR ™). The strongest growth over the forecast period will be for polysilicon, new metals (i.e., ruthenium, cobalt, molybdenum, and zirconium) and oxide (ceria).

“Overall, the copper CMP slurry market will grow over 6% CAGR through the 2026 forecast period as logic device wafer starts continuing to increase,” stated Dan Tracy, Sr. Director at TECHCET. Similarly with growing wafer starts and increased layer counts, tungsten CMP, consumed primarily in 3DNAND Flash, will also grow at over 6%. The newer metal segment is forecasted to grow at 14% CAGR as new interconnect structures ramp up in the industry. With such steep growth projections, chip fabricators hope for more investment in slurry capacity, especially in the US where chip expansions are expected to exceed US$130B over the next 5-years. Suppliers will remain cautious, seeking longer long-term agreements and subsidies for material expansions, i.e., CHIPS Act funding.

For more details on the CMP Consumables market, including dielectric/ oxide/ polysilicon slurries, and supplier profiles of BASF, Cabot, Dupont, Fujifilm, Asahi Glass, Fujimi, and more, go to: https://techcet.com/product/cmp-slurry-and-pads-only/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

Back to top

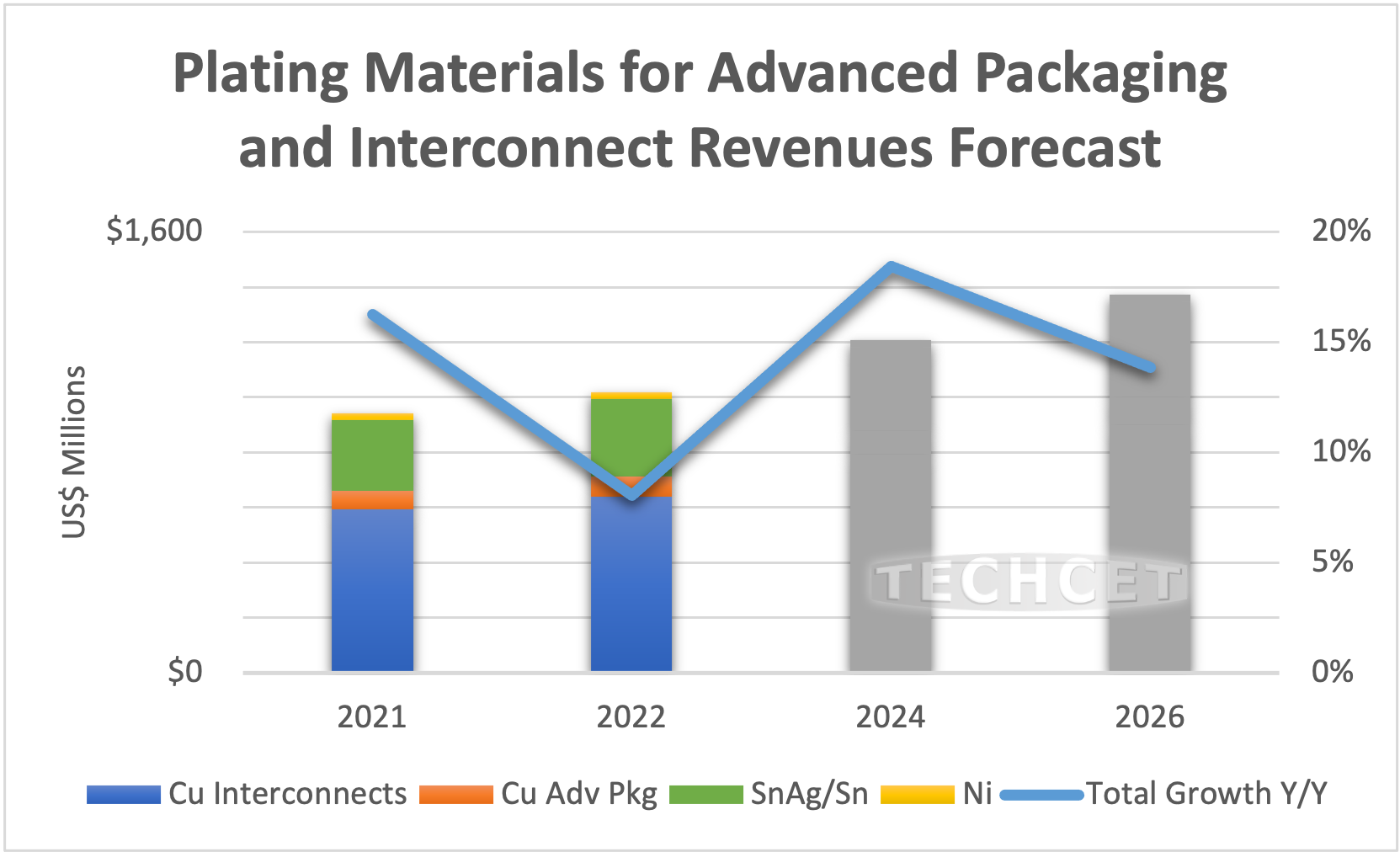

September 13, 2022

Electroplating Materials – Any Slowdown in Sight?

San Diego, CA, September 13, 2022: TECHCET—the electronic materials advisory firm providing business and technology information to chip fabricators and material suppliers — forecasts the total 2022 IC electroplating (Metal Chemicals) revenues to grow 8.1% to reach US$1,019 million. “A key growth driver for the electroplating market includes increases in interconnect layers in next generation advanced logic device nodes,” states Karey Holland, Ph.D., TECHCET’s Chief Strategist and Sr. Analyst. This is soon to be followed with buried power rails and backside copper wiring, increased use of advanced packaging for redistribution layers and copper pillar structures, and general overall strong demand for all semiconductor devices requiring copper interconnects.

The recently published Critical Materials Market Report on Metal Chemicals CMR™ highlights advanced Logic devices at < 14 nm as key drivers of growth, and expected show a CAGR of 7.4% through 2026. While chemical vapor deposition (CVD) or atomic layer deposition (ALD) are used to deposit metal interconnects at the lower device levels, the upper layers will continue to be electroplated copper as the bulk interconnect wiring. Thus, overall growth in advanced logic and number of layers continues to push up copper plating revenues for logic devices.

Copper metal electroplating is the largest segment of the IC electroplating segment and will top US$710 million in 2022. The forecasted 2021 to 2026 Compound Annual Growth Rate (CAGR) for this segment is 8.6%.

While smaller of the two copper plating chemical segments, advanced packaging applications are soaring in terms of use. The 2021 to 2026 CAGR for advanced packaging wafer starts is approaching 10%. The fastest growing segment is Fan-Out WLP which boosts application of RDL plating. Plating chemical volume consumption is increasing; however, TECHCET expects downward price pressure on CuSO4 as emerging suppliers in Asia are hungry to get a piece of the action.

For more details on the Metal Chemicals IC Electroplating Chemicals market and growth trajectory go to: https://techcet.com/product/metal-chemicals-for-fe-advanced-packaging/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

September 8, 2022

Semiconductor Equipment Consumables – Silicon Parts, in High Demand with Continued Shift Toward Asia

San Diego, CA, September 8, 2022: TECHCET—the electronic materials advisory firm providing business and technology information to chip fabricators and material suppliers — reports that the demand for high-purity Silicon Parts for semiconductor manufacturing equipment will continue strong in 2022. This forecast is expected as equipment sales grow and fabs expansions continue to ramp. The Silicon Parts market is expected to top US $900 million, a 10% increase from US $824 million in 2021. TECHCET forecasts the 2021 to 2026 CAGR for this market to grow at an almost 6% rate, as shown in the graph below and described further in TECHCET’s Newly Released Critical Materials Report™ (CMR) on Silicon Equipment Components.

“Silicon Parts are primarily consumed in etch equipment systems, so market growth is heavily tied to chip production and influenced by new etch equipment sales,” states Dan Tracy, senior analyst at TECHCET. Additionally, the replacement part segment represents about 70% of the market as these consumable parts have a finite lifetime, and need to be replaced per a fab’s maintenance schedule. Given industry fab investment trends, about 66% of the new and replacement parts are for the 300 mm fab manufacturing segment.

Silicon parts development and specifications are aligned to the requirements of the Etch Equipment makers, as these OEMs influence silicon parts per tool and the design of each part. TECHCET estimates that sales from part fabricators to equipment OEMs represent approximately 50% of total silicon fabricator sales. This is due to huge equipment growth in 2021, and direct sales from fabricators to chip fabs representing approximately 50%.

A major shift in market shares from US to Asia fabricators has been happening over the past 5-10 years as can be seen from the data provided in TECHCET’s CMR. Key Silicon Part fabricators include Hana Materials, who now leads with nearly 30% share followed by Lam/Silfex, WorldEx, and Coorstek. TECHCET expects China-based silicon part suppliers to play an increasing role in the market, especially in working with equipment makers and fabs in China. These companies will develop their business to serve the global market as well.

For more details on the Silicon Parts market and growth trajectory, including supplier profiles on companies like Silfex, Worldex, Hana Materials, FerroTec, Global Wafers, Hayward Quartz Technology, and more, go to: https://techcet.com/product/silicon-equipment-components-research-report/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

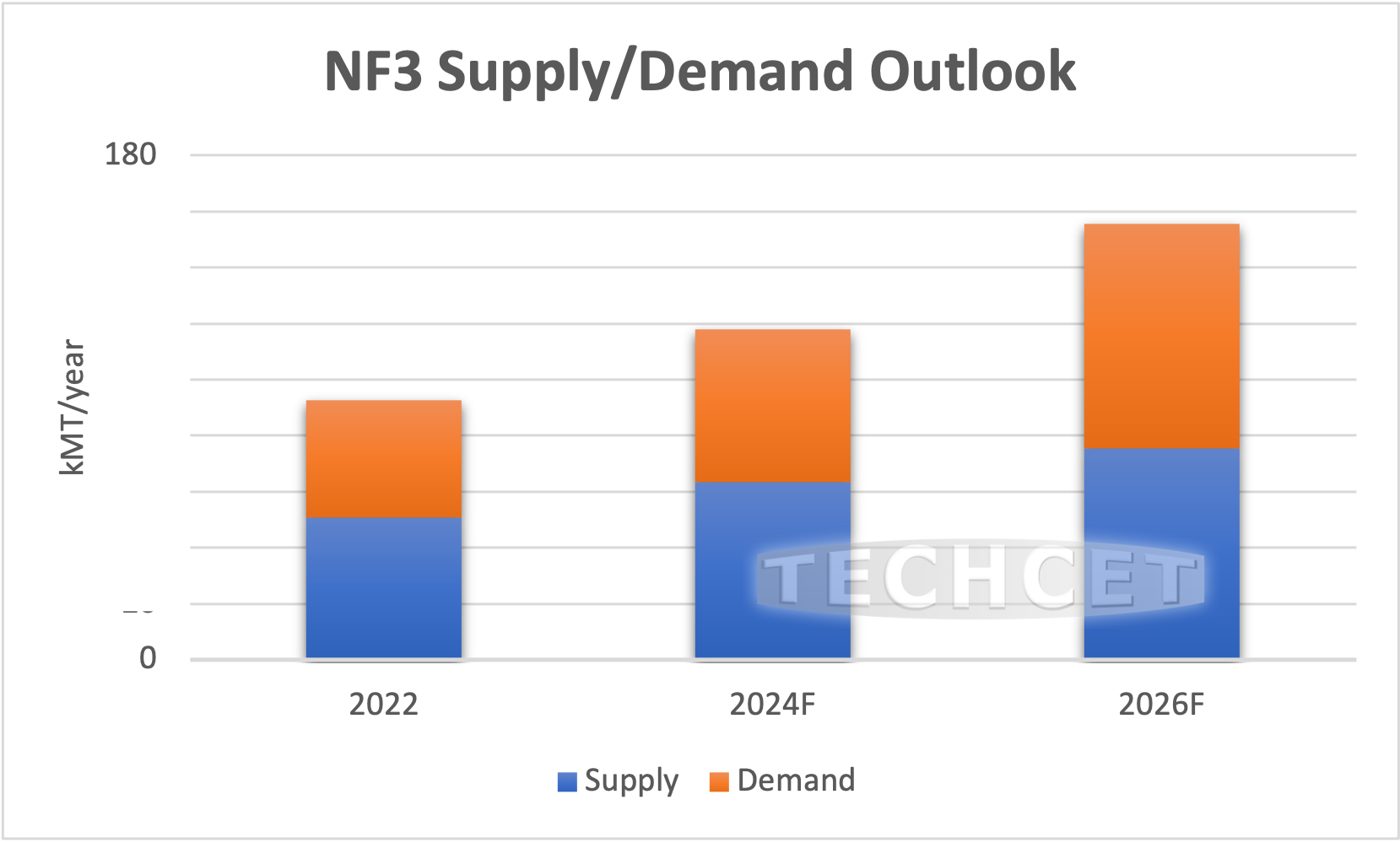

August 31, 2022

Supply Tightening Expected for Specialty Electronic Gases

Demand to outpace supply for NF3 and WF6 unless alternatives come into play

San Diego, CA, August 31, 2022: TECHCET—the electronic materials advisory firm providing business and technology information to chip fabricators and material suppliers — reports that the supply of Specialty Gases, nitrogen trifluoride (NF3) and tungsten hexafluoride (WF6) for electronics could tighten amongst high projected demand by 2025-2026. This forecasted steep trajectory will challenge supply-chains to keep pace. However, alternatives being developed could interrupt this trend. Both NF3 and WF6 are part of a larger US$5 billion specialty gas segment forecasted to grow 30% over the next 5 years, to total US$6.5 billion by 2026. As shown below, NF3 is expected to grow even more steeply, 72% over the forecast period (as highlighted in TECHCET’s 2022 Critical Materials Report™ on Electronic Gases).

Alternatives for these gases are currently in development which could cause a shift in growth trends. The increasing demand for NF3 in electronic manufacturing, including flat-panel displays, has triggered concern among atmospheric scientists over emissions of nitrogen trifluoride, a potent greenhouse gas. Particularly, NF3 gas has a high Global Warming Potential (GWP) compared to other gases. Consequently, the electronics industry is looking at and considering processes for on-site fluorine generation that can use F2, in place of NF3, for chamber cleaning.

Demand for WF6, although increasing in conductor applications for 3DNAND production, is not ideal in its performance for advanced memory. Currently, memory makers are researching new processes which use Molybdenum (Mo) as an alternative to tungsten for the conductor in hopes of improving performance. Thus, there is a potential to replace WF6 over the next several years. If Mo deposition processes (using solid precursors) can be successfully developed, then the transition from R&D to high volume manufacturing could occur by 2025. This will then shift market share away from the WF6 segment. However, information on implementation is still uncertain since no Mo precursor product has been found in the field, and device makers have not made any official announcements concerning a change in conductor material. If Mo materials and processes can match the cost of ownership to replace W, it could grow rapidly and diminish future WF6 demand.

Among the sources of electronic gases highlighted in TECHCET’s CMR are Air Products, Air Liquide, EMD / Merck, Linde, Matheson Gas, SK Materials, Gazprom, Huate Gas, Peric, and many others. For more details on the Electronic Gases market segments and growth trajectory go to: https://techcet.com/product/gases/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

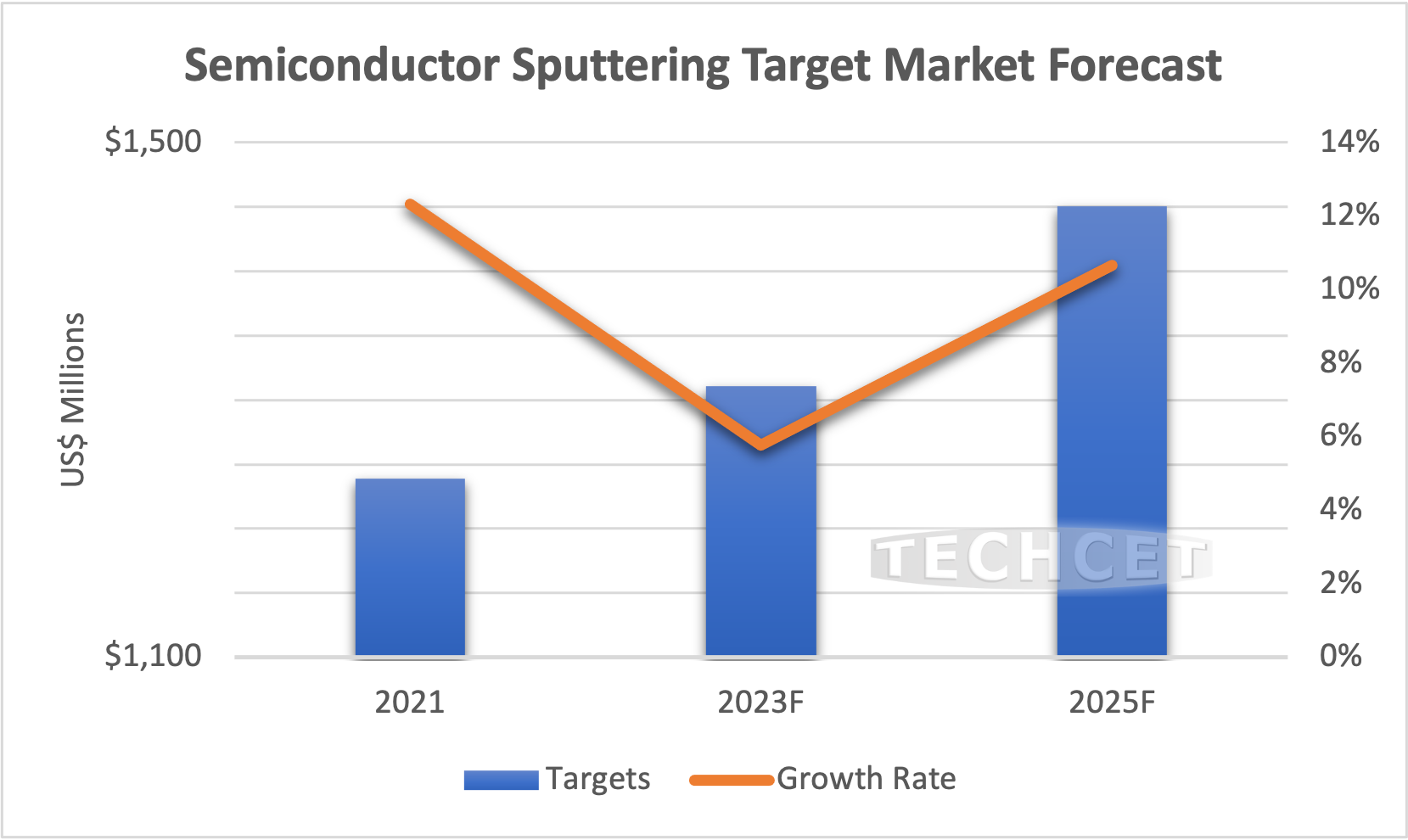

August 25, 2022

Sputtering Targets Driven by Robust Semiconductor Demand

San Diego, CA, August 25, 2022: TECHCET—the electronic materials advisory firm providing business and technology information to chip fabricators and material suppliers — announced that the Semiconductor Sputtering Target market is expected to reach US$1.33 billion in 2022, up 7% from US$1.24 billion in 2021. Target suppliers are planning for 2023 deliveries to remain on track to meet high forecasted customer demand. TECHCET also forecasts a slight decline of -1.1% YoY for 2023, due to inventory corrections, as shown below.

As highlighted in the newly released 2022 Sputtering Targets Critical Material Report™, target suppliers indicate that the supply/demand balance for Copper/Copper Alloy targets remains very tight. While new investments have been announced to boost Copper target manufacturing capacity, these will take time to ramp as manufacturing equipment lead-times can be one-year or more. For the year of 2022, the Copper/Copper Alloy target segment is forecasted to grow 11% in revenues. Some suppliers now report the focus is on delivering forecasted target volumes to meet 2023 customer demand.

The metal supply chain appears to be stable, although metal pricing did see a surge in 2021 and into early 2022. Unfortunately, near-term recession fears have resulted in recent price declines for commodity metals. In the future, demand for many metals used for chip production is predicted to be especially strong given broader application drivers. This has created uncertainty in predicting longer-term supply and pricing for metals.

“Globally, ‘green’ economy and zero emissions initiatives have boosted the need for increasing mining production to meet targeted projections for needed electrification infrastructure,” states Dan Tracy, senior analyst at TECHCHET. For example, copper metal demand could double between now and 2035-2040, so significant investments are needed to increase Copper mining production. While copper usage in semiconductor target fabrication is negligible compared to other applications, any future supply issues will still mean higher pricing for targets.

In addition to copper, new mining activity for Cobalt, Tungsten, Silver and other materials will need to expand so industries can satisfy green economy/zero emissions objectives. New mining developments can take 15 years or more, so any supply/demand imbalance could also result in higher commodity metal pricing. As these initiatives move forward, recycle, reclaim, and reuse will be critical components of most metal supply chains – including sputtering targets.

While current metal supply is generally viewed as being stable, higher energy costs are also impacting the mining, smelting, and refining of metals in the near-term, and customers will encounter surcharges due to these factors.

For more details on critical materials used for semiconductor device manufacturing including wet chemicals, gases, wafers, CMP consumables,packaging materials, photoresist /litho materials and Sputtering Targets (including profiles on Honeywell, Grikin, Materion, KFMI, JX Nippon, and more), go to: https://techcet.com/product/sputter-targets/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

August 19, 2022

ADVISORY ALERT on CHIPS Act Featuring Washington DC Professionals Hon. Bonnie Glick and Mr. Madison Smith

San Diego, CA, August 19, 2022: TECHCET—the electronic materials advisory firm providing business and technology information to chip fabricators and material suppliers — just completed their 3rd Quarter CMC Advisory Alert Meeting focused on the US CHIPS Act and the future of materials supply. This virtual event of over 150 attendees, featured the Honorable Bonnie Glick, Director of the Krach Institute for Tech Diplomacy, and Madison Smith, Principal, Washington DC Communications, of Cozen O’Connor Public Strategies. These two policy professionals highlighted key points of the US CHIPS Acts and shared their opinions about what is next for funding the US semiconductor industry.

The Hon. Bonnie Glick emphasized that the CHIPS Act “… took a long time to get here, … and started over three years ago to make America, American manufacturing and American industry more competitive …” Glick spoke about how the US government wants to make the US more competitive in advanced manufacturing with tax incentives and government funding. US policy makers realized there was an urgent need to support the domestic supply chain. Now that the CHIPS act has passed and been signed into law by President Biden, the Dept of Commerce will be the lead agency in the US responsible for distributing the funds. NIST is a subgroup within the DOC that will be responsible for R&D grants.

“It is pretty hard to view the passage for the CHIPS ACT as anything but a benefit to material suppliers,” said Mr. Smith. The US government has taken a strong and unique step to grow the domestic semiconductor industry and this includes a robust supply chain. The direct effect of the US CHIPS act will allow chip fabricators and material supplier access to $39Billion in grant money over the next 5 years. The timeline expected going forward will be dependent on the Department of Commerce working with other factions of the government from which RFQ’s will be released. Timing for RFQ release is expected sometime in 4Q 2022.

For access to the meeting recording and surprising results of the poll question on “Is your company seeing signs of an industry-wide slowdown in the second half of 2022 and throughout 2023?,” CMC Members can log into the portal at www.techcet.com, and go to the “Meeting Downloads” page; others may contact TECHCET at [email protected]. The summary results between the morning session of mostly US and EU members versus the evening session with mostly Asian member may surprise you.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

August 16, 2022

Silicon & SOI Wafers – A Record Year Amidst Tightening Supply

New production expansions needed, but will not take effect until 2024

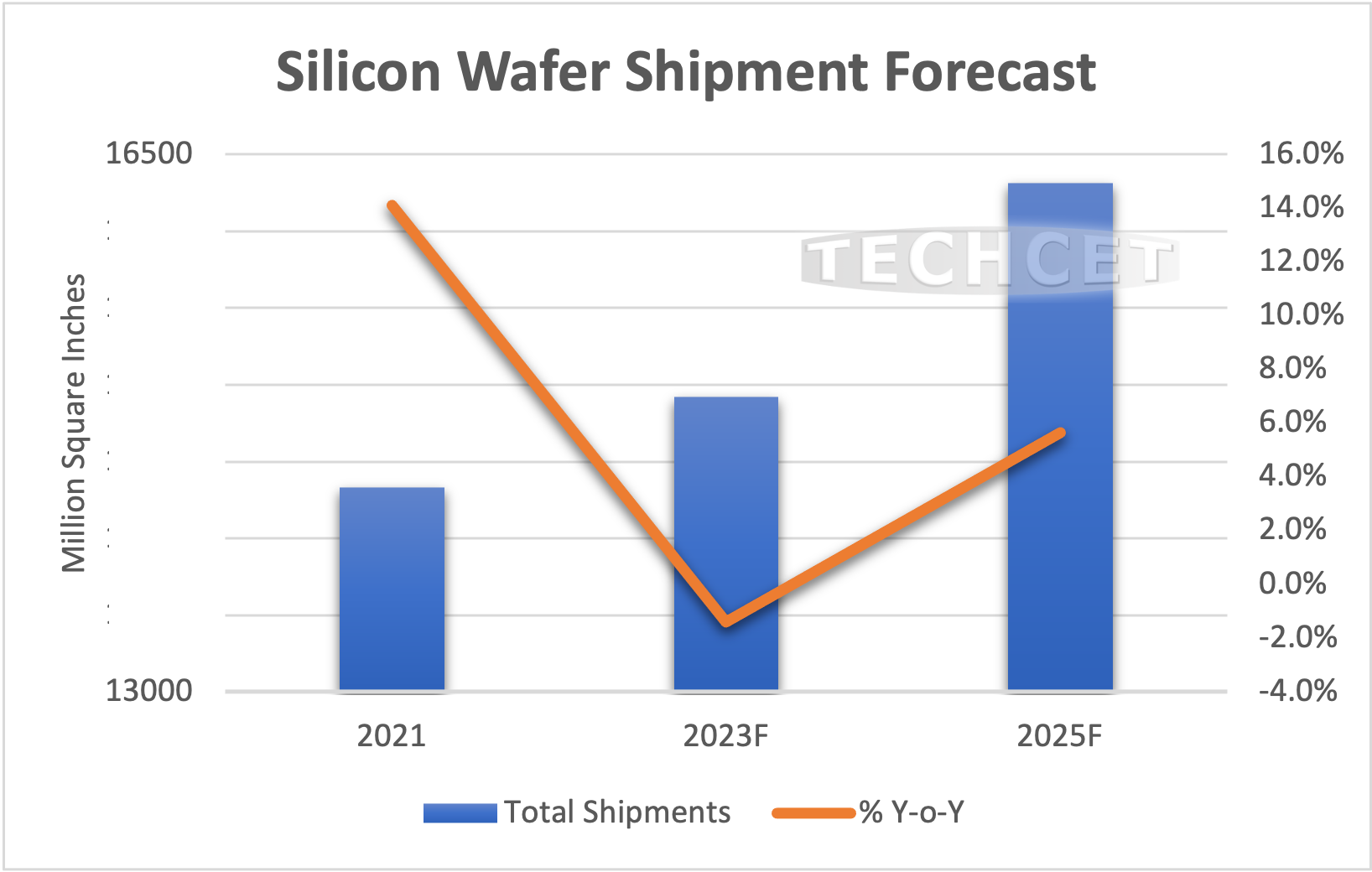

San Diego, CA, August 16, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— announced the Silicon Wafer market for semiconductor applications, including SOI wafers, will grow to US$16 billion in 2022, about 12% above the US$14.2 billion recorded in 2021. Wafer shipments are expected to reach a record, with a forecasted 6% growth to 15.1 billion square inches. Shipment growth is essentially going to “cap out” given the limitations in available capacity for increased production. Any brownfield expansion is constrained and new greenfield capacity by suppliers will not have any appreciable impact until 2024, as explained in TECHCET’s 2022 Critical Materials Report™ on Silicon Wafers.

“2022 revenue growth is stronger than shipment growth as average selling prices are higher and products with leading-edge Logic and Memory production are favored,” states Dan Tracy, Sr. Director at TECHCET. This higher wafer pricing is critical to suppliers to support announced capacity expansions. Namely, the top five wafer suppliers have all announced coming greenfield capacity expansion. These large investment projects cost US$2 billion or more, and will take 2+ years to bring production on-line, meaning any significant capacity addition will not take effect until around 2024-2025.

Until then, industry will need to get by with incremental brownfield capacity expansion. TECHCET has forecasted a slowdown next year, meaning 2023 could be an opportunity for the tight supply/demand balance in the silicon supply chain to be alleviated.

It is interesting to note that leading wafer suppliers are considering a major plant investment in the U.S. In the past, major investment prospects in the U.S. were minimal given industry trends of new fabs being primarily constructed in the Asia-Pacific region. However, with the US Chips Act finally being signed into law, supporting the US semiconductor manufacturing supply chain via new silicon wafer plants has become a more realistic possibility. GlobalWafers, for instance, announced in July that it will construct a new plant in Sherman, Texas, and the expectation is that this project will move forward with US Chips Act and other governmental support and funding.

For more details on the Silicon Wafer market growth trajectory, including information on suppliers like Aymont, Ferrotec, GlobalWafers, Eswin, and more, go to: Silicon Wafers-NEW | TECHCET CA LLC

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

August 9, 2022

US CHIPS ACT Now Approved by President Biden – What’s Next?

Can we “build back better” the US chip industry? Or is it too little too late?

San Diego, CA, August 9, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— announced that today President Biden signed the long-awaited CHIPs Act into law. So, “what’s next” for the US semiconductor industry?

Pres. Biden signs CHIPS Act, from news feed from US News 8/9/2022

The US CHIPS Act will attempt to level the playing field by encouraging device makers, and their suppliers, to invest in the US. Although US companies have been industry leaders in chip design, chip fabrication, fab equipment, and advanced materials, Asia’s investments and government incentives have reduced the US share in chip manufacturing and materials manufacturing over the past several decades. These Asian investments, in combination with lower costs and ease of regulatory rules, have expanded the customer base and the manufacturing supply of materials and equipment in Asia.

Some key fab projects in the US are already underway, others have been announced, and more are potentially forthcoming. While this is welcome news for the US industry, these fab projects, especially leading-edge Foundry and Memory fabs (like Intel, TSMC and Micron) take 2 to 3 years to construct and ramp into high volume production. In contrast, existing leading-edge Foundry and Memory production is already in place in Asia and has continued to expand year over year. As a result, global material suppliers have been focused on Asia. Over the past few years, many suppliers announced both new plants and plant expansions in key semiconductor-producing locations like Korea, Taiwan, China, and Japan. And material suppliers, such as DuPont and EMD, followed with nearby facilities to support some of the most advanced fabrication processes. As a result of all this activity in Asia, some may ask, “Is the CHIPS Act too little too late?”

Many of the chip companies would have liked to see the CHIPS Act approved last year, but “better late than never” is the theme we are hearing. A myriad of global events, from the COVID pandemic to trade issues, to the Russian war, has forced each country to look at its own vulnerabilities. Many countries, including the US, realize the importance of having resident chip manufacturing and development, but building a new semiconductor device factory is an expense most companies do not shoulder without government support. The CHIPS Act grants and tax incentives will help to fuel this effort, but new Chip facilities alone will not solve the shortage problem.

Without materials, you cannot build chips. “Semiconductor manufacturing is a critical and strategic industry for the nation’s economy and its national security, and so are materials,” stated Lita Shon-Roy, President & CEO of TECHCET. While some investments for materials production have already been announced, the materials supply chain is expected to encounter strains as the new high-volume chip production begins to ramp up in the US. Significant investments in materials production and R&D will be needed to strengthen the materials supply chain with advanced leading-edge chemicals and materials. TECHCET has previously identified a critical dependency on imported high-purity chemicals for US-based chip fabrication. This is especially true as critical dependencies continue to exist for high-purity chemicals, silicon wafers, and other materials. Any funding and support through the US CHIPS Act for chemicals and materials produced in the US will greatly strengthen supply chains and reduce the risk of shortages and critical dependencies on imports.

For more details on the Impact of US Chip Expansions on chemicals and materials go to: https://techcet.com/product/impact-of-chip-expansion-on-us-chemical-supply-chain/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

July 26, 2022

Advanced Lithography Drives Extension and Ancillary Materials

Will growth slow enough to meet PFAS environmental challenges?

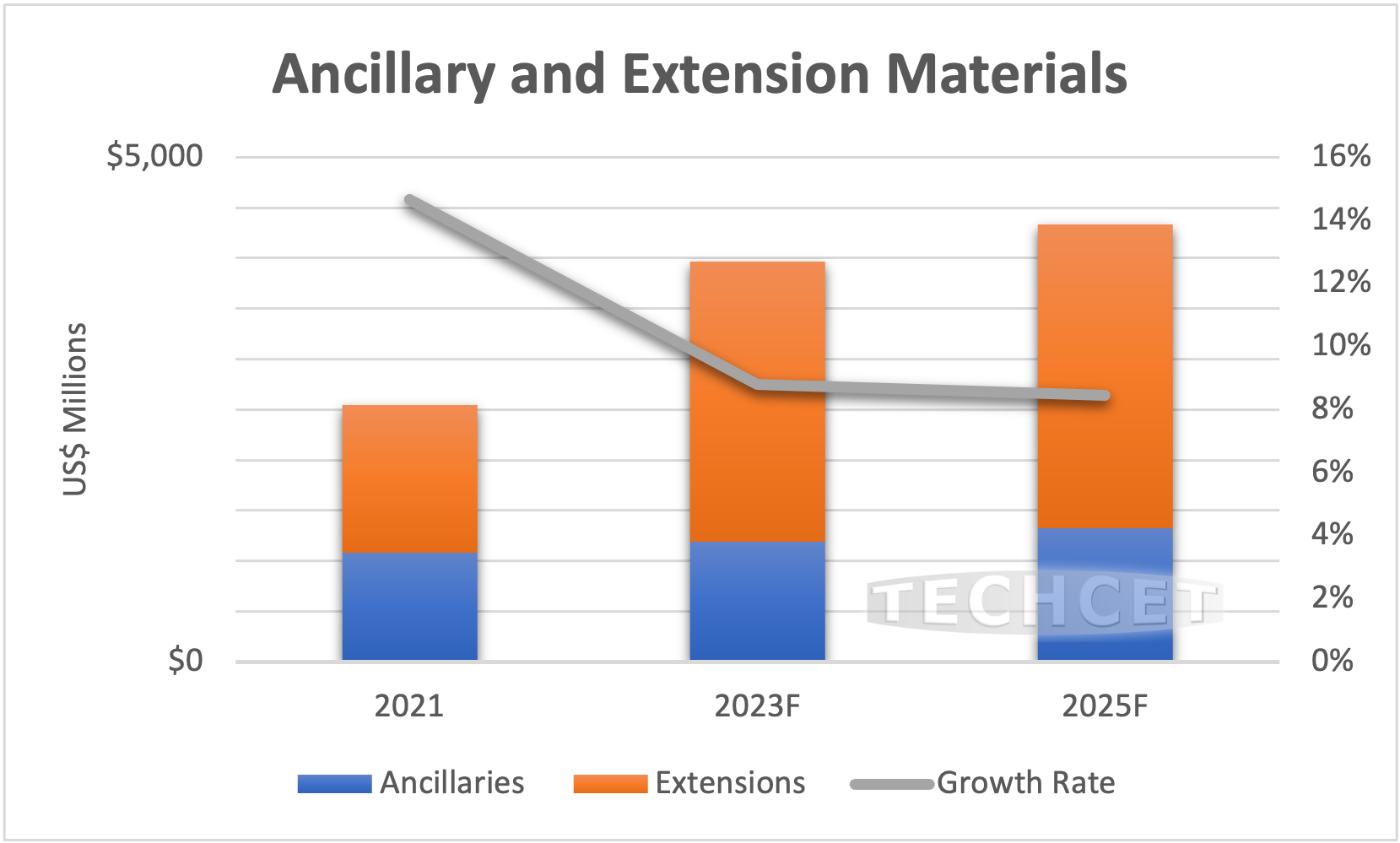

San Diego, CA, July 26, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— announced an updated outlook of the Lithography Extension and Ancillary Materials market segments. These advanced chemistries, which include developers, anti-reflective coatings, edge-bead removers, and others, are forecasted to grow by over 6% in 2022, and will approach a US$2.8 Billion market in 2023. As highlighted in TECHCET’s new Lithography Materials CMR™, total market revenues of the segment will grow by >5% CAGR through 2026 as EUV and KrF lithography applications continue to ramp in the semiconductor industry. However, growing environmental concerns related to PFAS (per-and polyfluoroalkyl substances) containing chemicals used in lithography materials may pose future production limitations.

The US$1.2 B Ancillary (organic developer, edge bead remover, and prewet) market segment is experiencing changes in material sets with the implementation of EUV lithography in high volume manufacturing. For example, organic developers are ramping as the developer of choice for Negative Tone EUV resists. As additional patterning levels migrate to EUV, this will reduce both 193i DUV photoresist and aqueous developer volume consumption at the critical layers; thus, aqueous developers should eventually see a decline as organic developer consumption grows.

The transition away from 193 nm immersion (multi-patterning) will drive other changes in the fab. For example, the Negative Tone resist can be processed without edge bead removal. Also, the implementation of a Dry Processed photoresist, if widely adopted, will not require a developer as a plasma removes the resist material.

Extension materials, which are specialty materials used to address reflections and adhesion problems during photoresist processing, make up a US$1.6 B market. This market is fragmented with a couple of companies that focus specifically on Bottom and Top side Antireflective Coatings (BARC/TARC), in addition to the photoresist suppliers providing both resists and ancillaries. Silicon based BARCs layer are consumed in high-resolution applications. Another fast-growing segment will be in KrF BARC as this application gets a boost from growing layer counts in 3D NAND Flash process fabrication.

Concerns relating to PFAS containing chemicals, which include some photoresists and ARCs, have been increasing over the past several years. Because of this, many chip companies are now pressing for alternatives in hopes of eliminating their use. Many of the large resist and ancillary companies have alternative offerings, although many end-users have not had the luxury of time to identify acceptable alternatives and make the switch. Recent announcements by the EPA highlight six PFAS materials included in the Regional Screening Level and Regional Removal Management Level lists (started in 2014 and updated it in May of 2022). These include: hexafluoropropylene oxide dimer acid and its ammonium salt (HFPO-DA – sometimes referred to as GenX chemicals), perfluorooctanesulfonic acid (PFOS), perfluorooctanoic acid (PFOA), perfluorononanoic acid (PFNA), perfluorohexanesulfonic acid (PFHxS), and , PFBS or perfluorobutanesulfonic acid. In particular, PFOS and PFOA are common materials found in ARCs and resist materials.

“For the suppliers of just Ancillary and Extension materials, and not photoresists, long-term relationships with customers and photoresist partners are key for finding acceptable alternatives in the midst of demand for higher resolution technology,” states Dan Tracy, senior analyst at TECHCET. As with photoresists, co-development work between supplier and chip company is required to complete the process of introducing alternative materials into existing production lines. A balance must be found between running production full-out to meet chip demand, and stopping the line to qualify for these environmentally-friendly alternatives.

For more details on the Electronics Litho Materials market information including suppliers Avantor, Dongjin, Fujifilm, JSR, Kempur, SEH, DuPont, and others go to: Litho Materials CMR-NEW | TECHCET

For more details on EPA Actions to Address PFAS use, go to: https://www.epa.gov/pfas/epa-actions-address-pfas

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

July 18, 2022

2022 Semiconductor Photoresists – Advanced Nodes Ramp

Growth continues strong through 2026

San Diego, CA, July 18, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— announced an updated outlook for the semiconductor-related Photoresist market. Growth is expected as revenues are predicted to increase by 7.5% in 2022 to reach almost US$2.3 billion. The 2021 to 2026 CAGR for total resists is forecasted to be 5.9%, with the fastest growing products being EUV and KrF type resist materials, as stated in TECHCET’s newly released 2022 CMR™ on Litho Materials (includes information on photoresists and ancillaries).

“The Lithography materials market is healthy and growing and is expected to stay on an upwards trajectory given the advancement in device technology and increased layer counts,” stated Dan Tracy, Ph.D., Techcet’s Sr. Director of Marketing Research. In particular, EUV photoresists have firmly ‘arrived’ and are now officially being used for high volume chip manufacturing by multiple chip makers. EUV photoresist will grow rapidly as new logic nodes continue to be introduced; advanced DRAM enters production with EUV, especially as more ASML scanners are placed into production.

Photoresists used for “old tech” (I-line, G-line, and KrF) are expected to surge due to the near-term chip supply constraints. KrF resists continue to find growth, especially as 3DNAND device production and layer count grows. ArF and ArFi both use similar polymer/solvent platforms that utilize an aqueous developer (0.263N tetramethyl Ammonium hydroxide – TMAH), and their demand is driven by multi-patterning applications.

In South Korea, Taiwan, and China, onshoring of photoresist production is a recurring theme, and domestic manufacturing of these materials is growing. Near-term issues impacting the photoresist market, as with other materials, are inflation, supply chain disruptions, and geopolitical events. All of these are contributing to price increases and product availability for the current year, and are expected to continue doing so into 2023.

It is also important to note that new suppliers surfacing in places like South Korea and China may lead to dynamic adjustments within the photoresist market landscape. These new suppliers are benefitting from government and chipmaker support within their respective countries.

For more details on the Electronics Litho Materials market information including suppliers Avantor, Dongjin, Fujifilm, JSR, Kempur, SEH, DuPont, and others go to: Litho Materials CMR-NEW | TECHCET

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

July 6, 2022

2022 Semiconductor Materials Outlook

Supply chain limited by Russia / US CHIPS Act a game changer

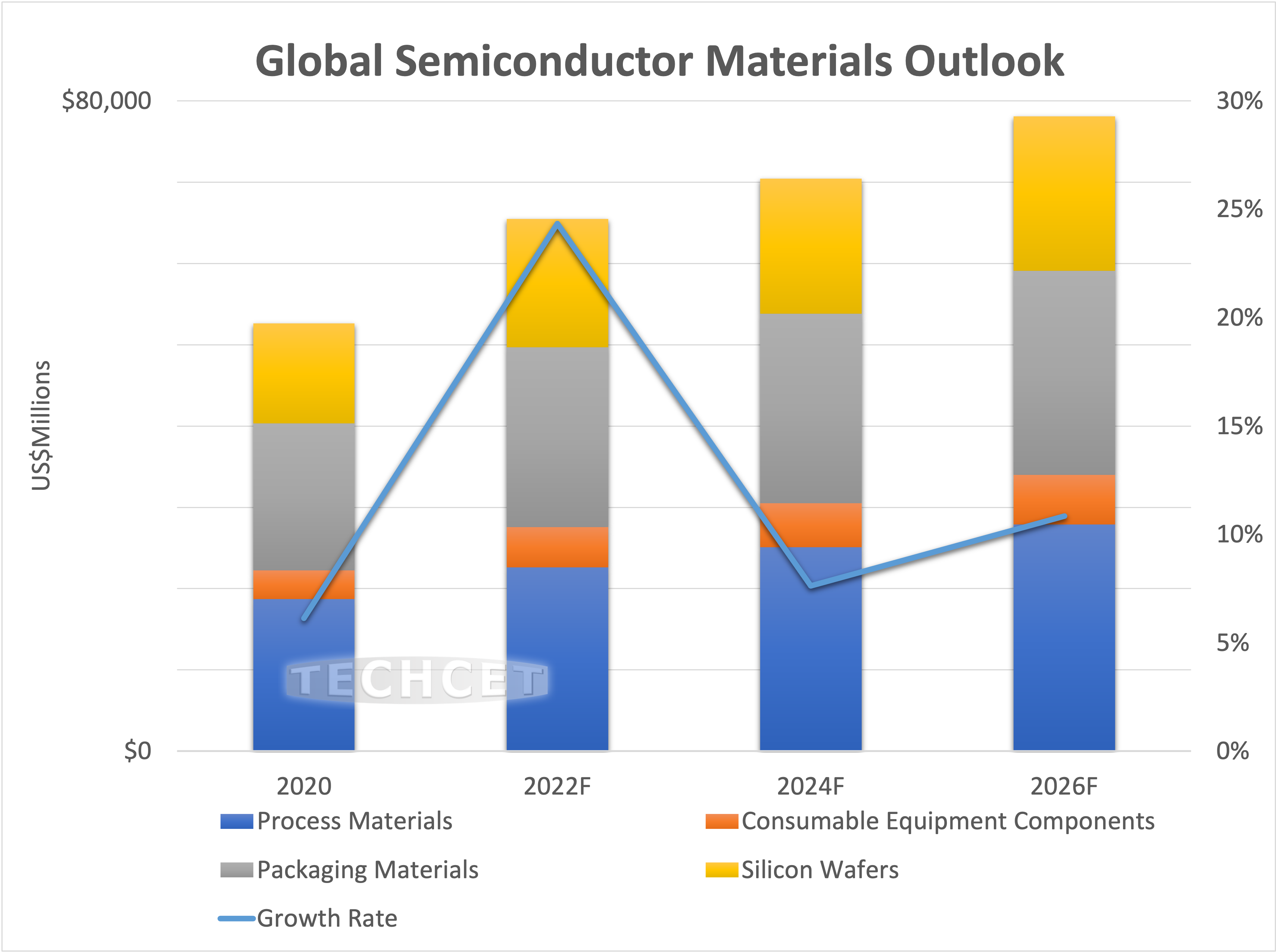

San Diego, CA, July 6, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— is forecasting semiconductor manufacturing materials to top US$65 B for 2022, a healthy 8% above 2021. “Semiconductor demand has remained strong through the first part of the year and average selling prices for materials are trending upwards,” cited Lita Shon-Roy, TECHCET’s President/CEO. In anticipation of slower market conditions, semiconductor materials market growth is currently forecasted to increase just over 2% in 2023 before further improving in 2024. “This is in keeping with cycles in demand and inventory volumes,” said Shon-Roy, as “per the latest TECHCET Critical Materials Reports™,” shown in the figure below.

While demand remains strong in 2022, a number of issues are impacting materials supply and pricing. The Russia/Ukraine region is a major part of the oil and natural gas supply chain, of which energy, specialty gases and helium are dependent. It was a region expected to play a significant role in the supply of helium this year, in addition to supporting neon and fluorocarbon production used for semiconductor manufacturing. Due to the turmoil in this area, alongside related economic sanctions against Russia, supply of these and other key gases have been curtailed, straining supply-chains around the world. Additionally, energy costs have steeply risen creating cost escalation of materials production worldwide.

In today’s business environment, surcharges for energy, logistics, and materials are increasing in costs across many materials segments. For silicon wafers, supply is limited as current production is constrained since no new green field production is available to ramp up for this year and into 2023. Hence, prices on wafers are rising.

For other material segments, from rare gases to sputtering targets, costs and prices are also rising due to price increases in raw materials, in addition to high energy and logistics prices. All of these are further exacerbated by supply-demand imbalances. Consequently, materials’ availability is becoming a limiting factor to semiconductor unit growth. (Note: upward trending ASPs will likely drive decent revenue growth for the year.)

Demand for semiconductors though the rest of the year, should remain strong. However, TECHCET sees the above trends contributing to inflation, and worries about another recession are now looking more likely. Whether this could result in a temporary dip in demand or prolonged recession impacting overall chip demand is not yet clear.

The game-changer for the US semiconductor market will be the CHIPS Act. Once fully approved by Congress, the CHIPS Act will buoy up the market allowing for further growth. However, the question remains, “Will there be set asides in the CHIPS Act for materials production and R&D?” This will be highly dependent on US policymakers and their interpretation of what is and is not needed to strengthen US’ position in semiconductor technology and manufacturing. Currently, a growing number of material companies are individually communicating to policymakers about the importance of CHIPS Act funding for US materials producers. The key to their message is that the cost of building a semiconductor gases and chemicals plant in the US is prohibitive. These materials are highly specialized and more costly to produce than industrial gases and chemicals. And the clincher is that the volume demands are 10X to >100X lower than industrial applications. Hence, the ROI on investing in a new US chemical production facility for semiconductor materials is so poor that many chemical companies will be unable to justify building it without subsidy. We hope through the continued efforts of individual material suppliers, TECHCET’s information on materials submitted to the US RFI, and SEMI’s work on the CHIPS Act, that the US Congress will indeed set aside monies in the CHIPS Act for building and expanding US materials production.

For more information, see TECHCET at SEMICON WEST, July 12-14, at the New York State Economic Development booth, 2051. Or go to TECHCET’s Critical Materials Reports™ and Market Briefings: https://techcet.com/product-category/critical-materials-reports/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.