- December 8, 2023- Semiconductor Materials Market – Better Things to Come in 2024 – Despite downturn in 2023, material demand and market growth are on the rise

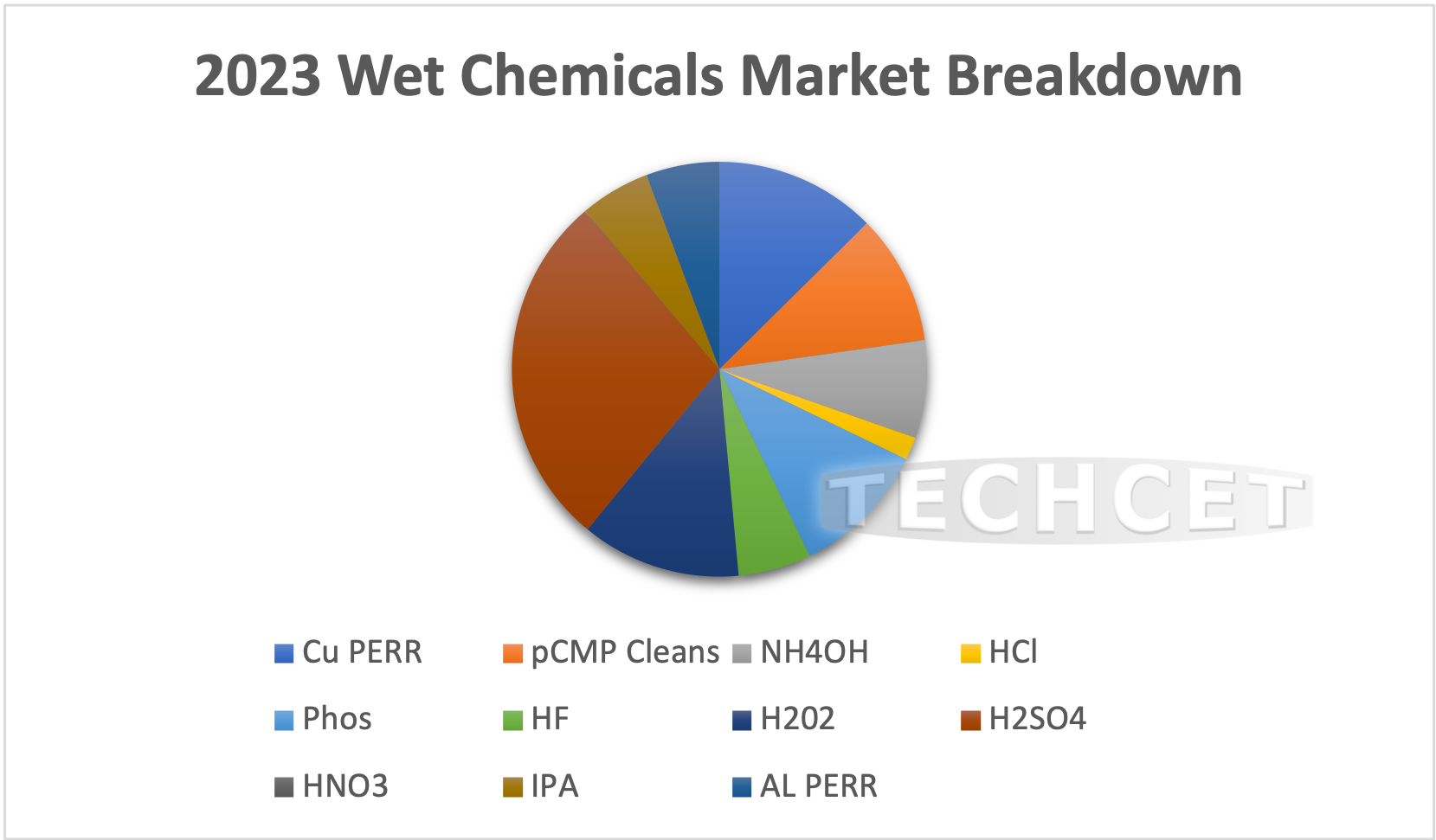

- December 4, 2023- Wet Chemicals Market to Make an Upward Turn in 2024 – Chemical consumption to increase for leading-edge tech and fab expansions

- November 22, 2023- Semiconductor Ceramic Parts Market to Rebound in 2024 – New investments in CVD SiC expected from equipment component suppliers

- November 7, 2023- 2023 CMC Seminar Unveils Semiconductor Industry Hurdles – Materials supply chains logistics, quality, and metrology complexities

- October 31, 2023- US Chip Expansions in Need of Significant Materials Support – Domestic chemical demand to leap through 2027, though supply is not prepared

- October 12, 2023- Growing Supply Chain Risks for Germanium and Gallium – How can the US stabilize Ge/Ga supply to support high semiconductor demand?

- September 27, 2023- Semiconductor Supply Chain Problems Running Rampant? – Solutions to mitigate future materials supply vulnerabilities

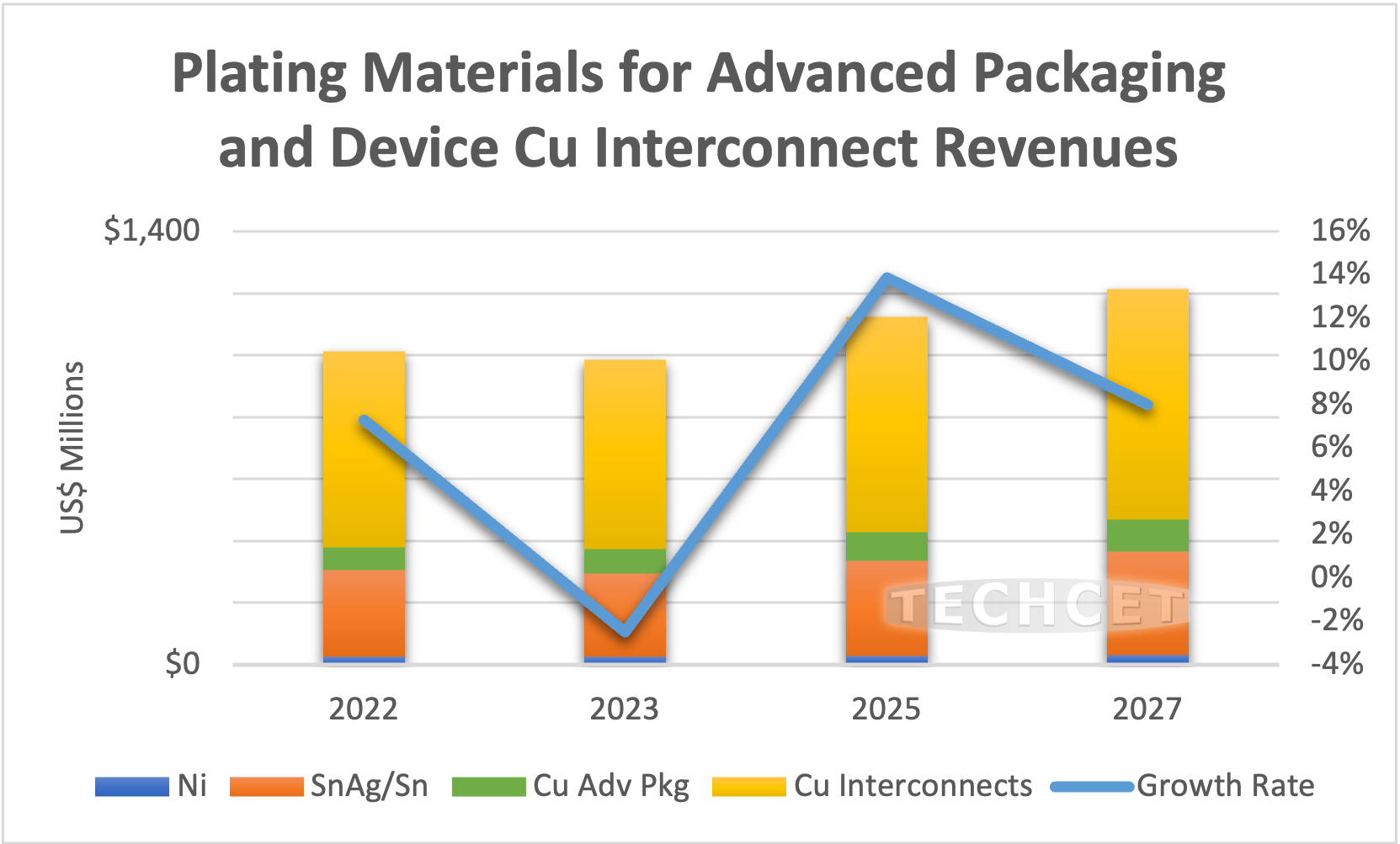

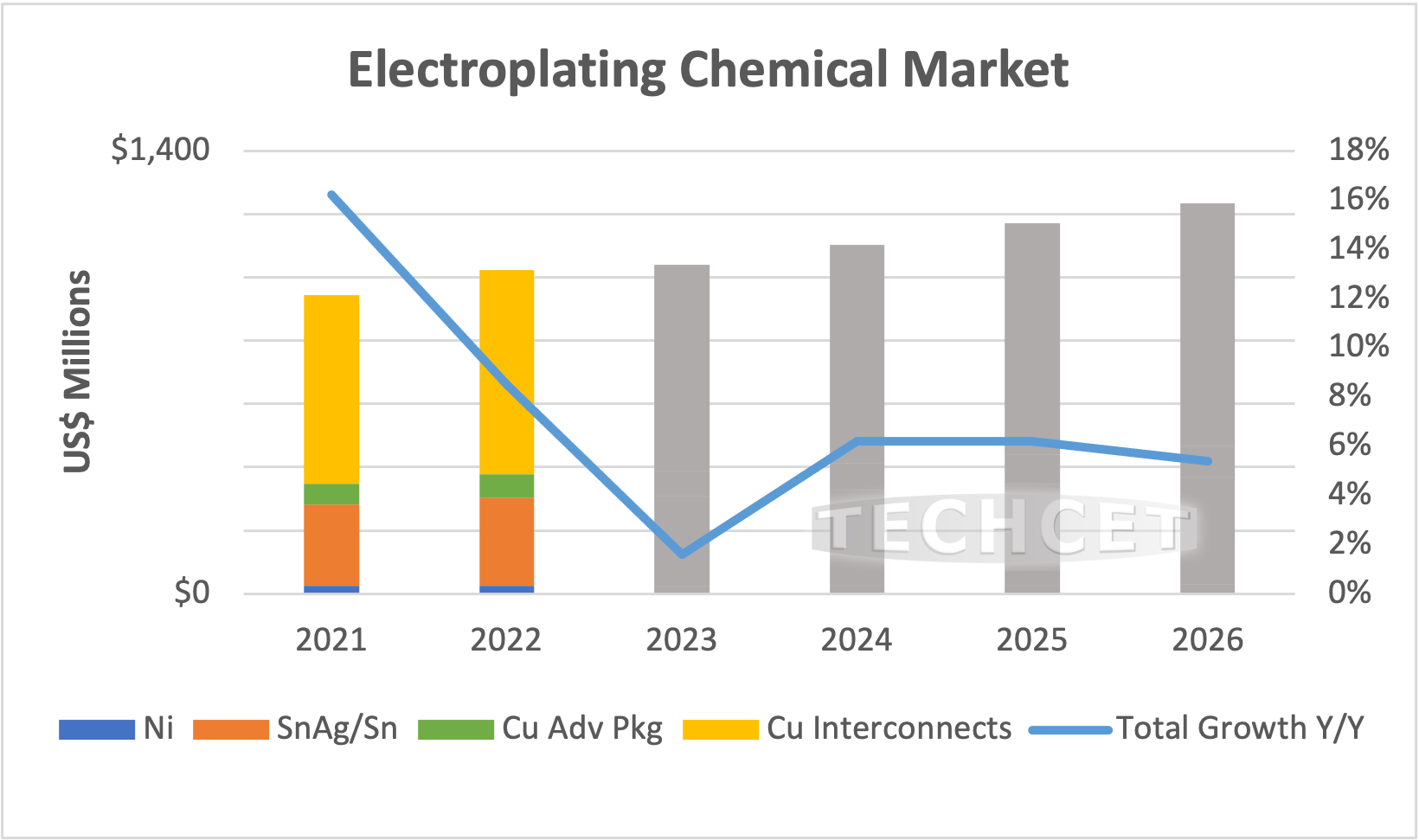

- August 31, 2023- Metal Plating Chemicals Revenues to Boost into 2024 – Growth driven by developments in leading edge logic and memory

- August 22, 2023- Silicon Fabricated Parts Market Forecasting High Growth – Increased layer technology and OLED growth driving demand for silicon parts

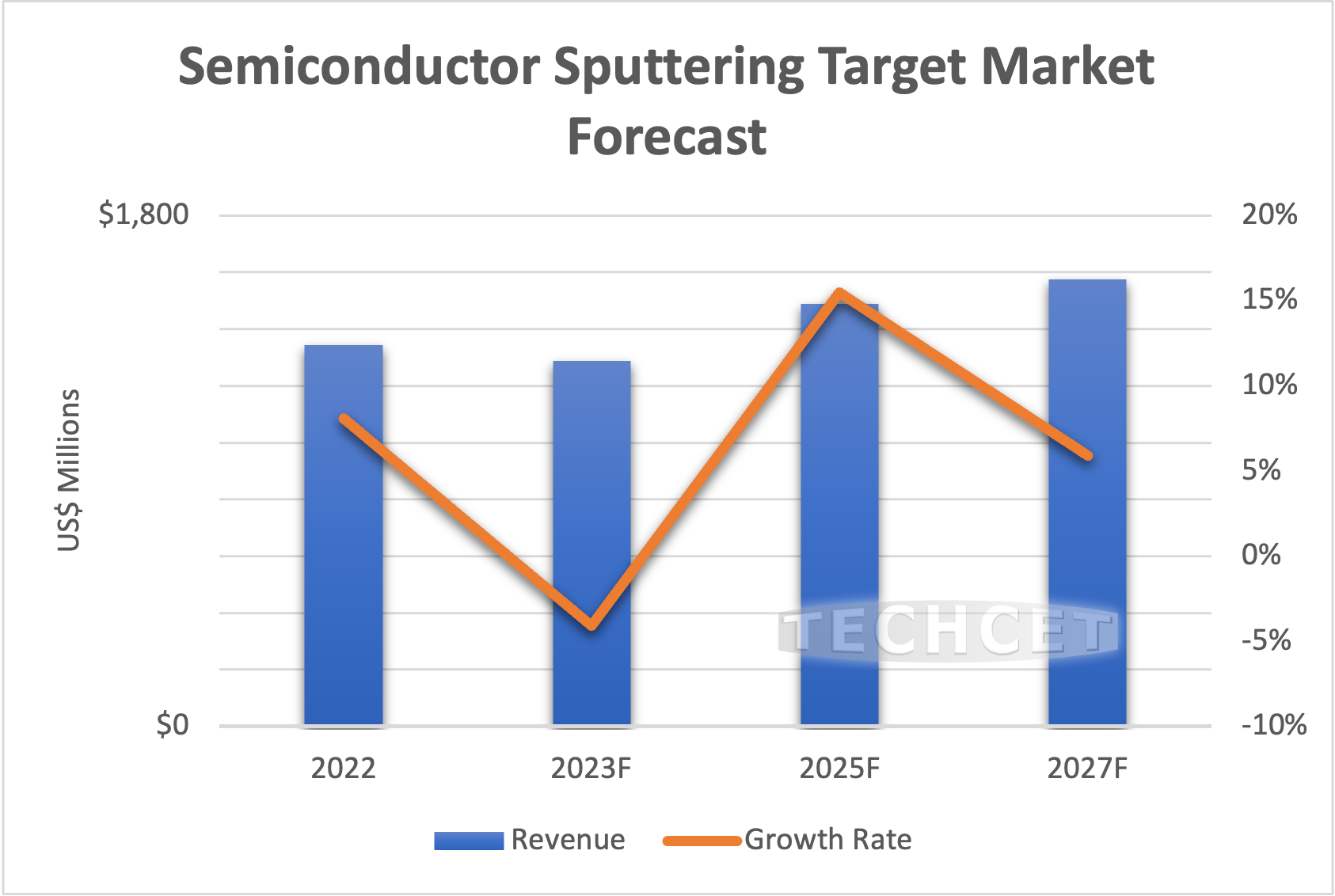

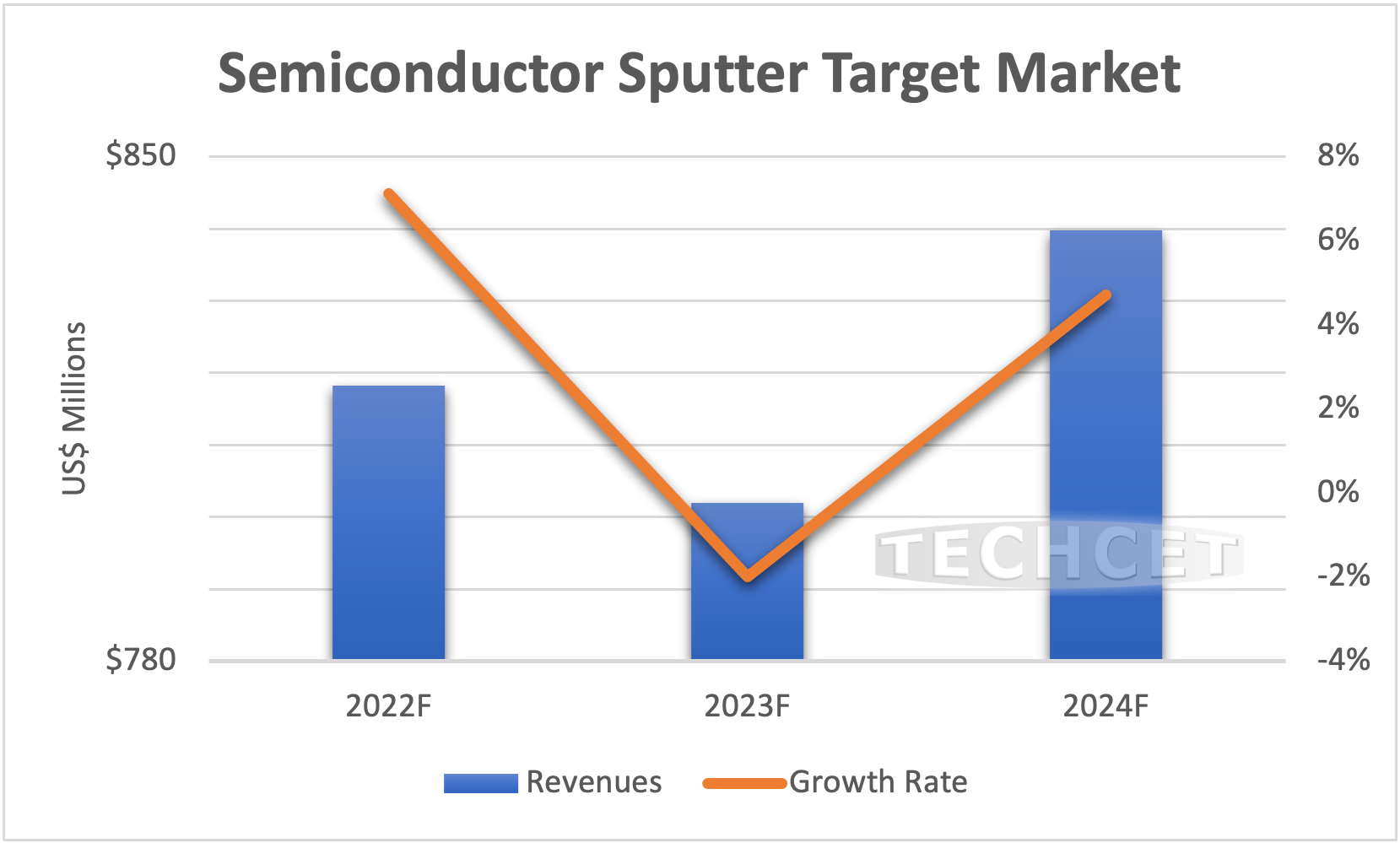

- August 10, 2023- Semiconductor Sputtering Targets & Metal Markets Status – Supply chain contraction will persist before rebounding in 2024

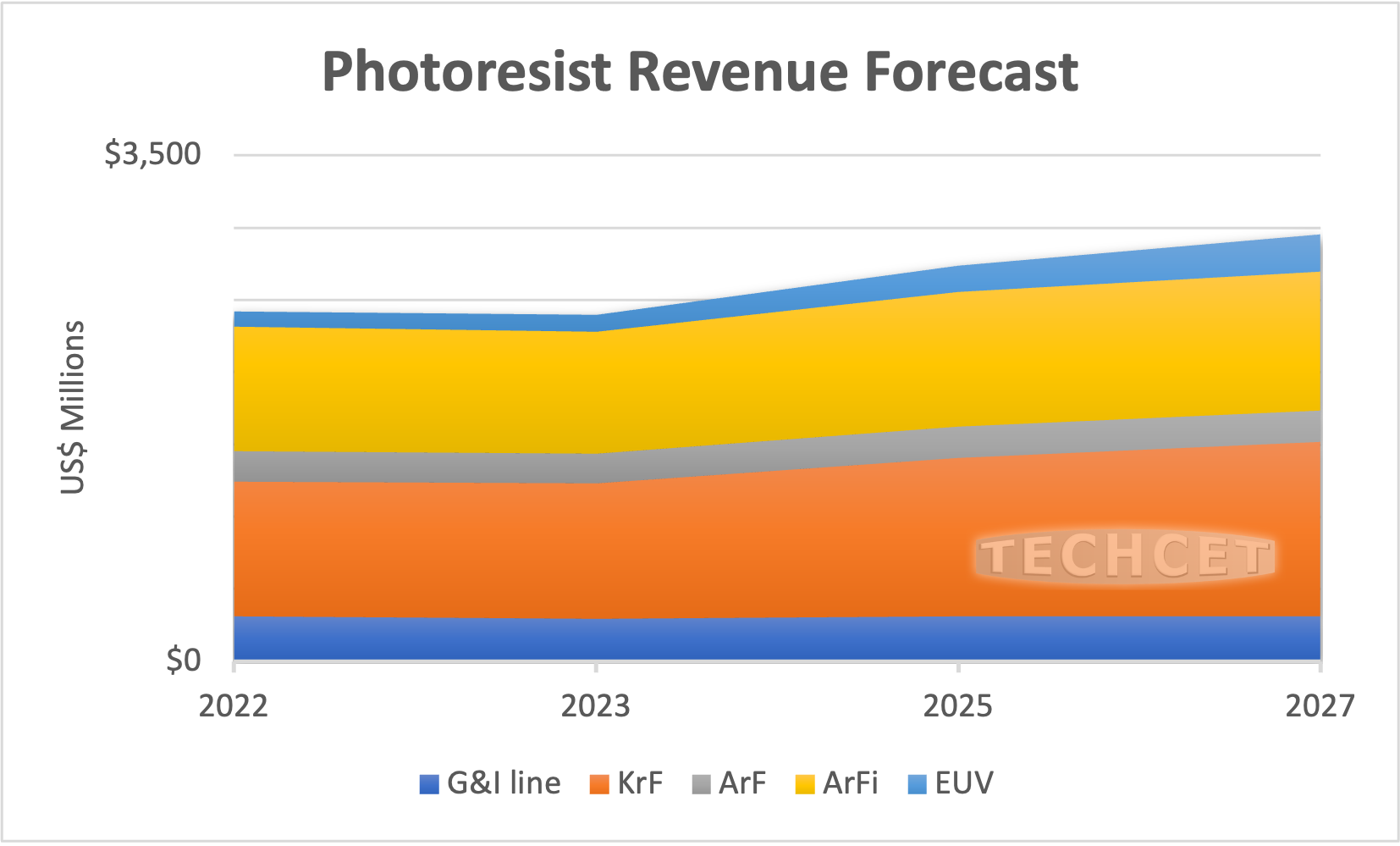

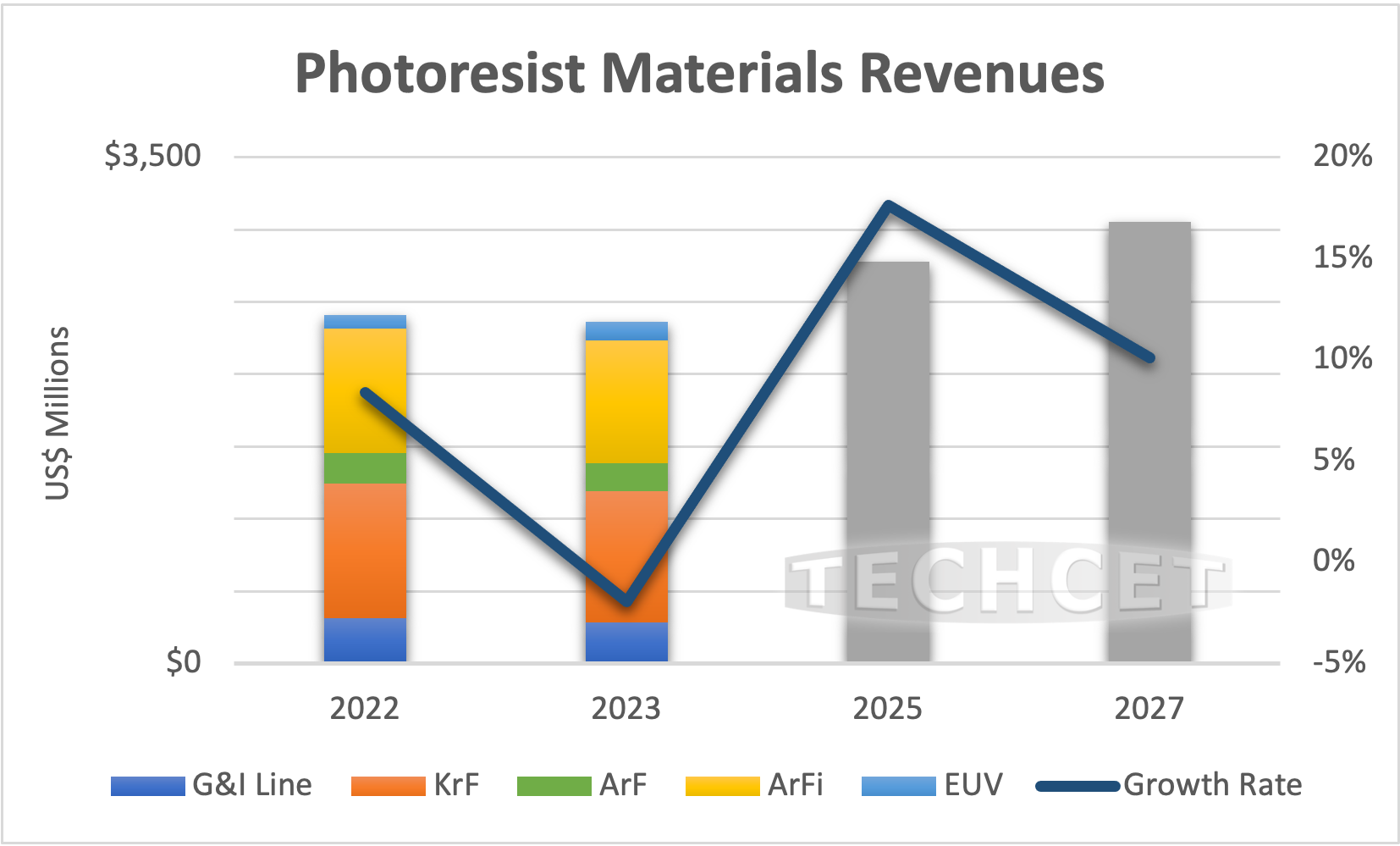

- August 3, 2023- 2024 Photoresist Market Forecasted to Rise – EUV and KrF Growing as Advanced Logic and Memory Increase

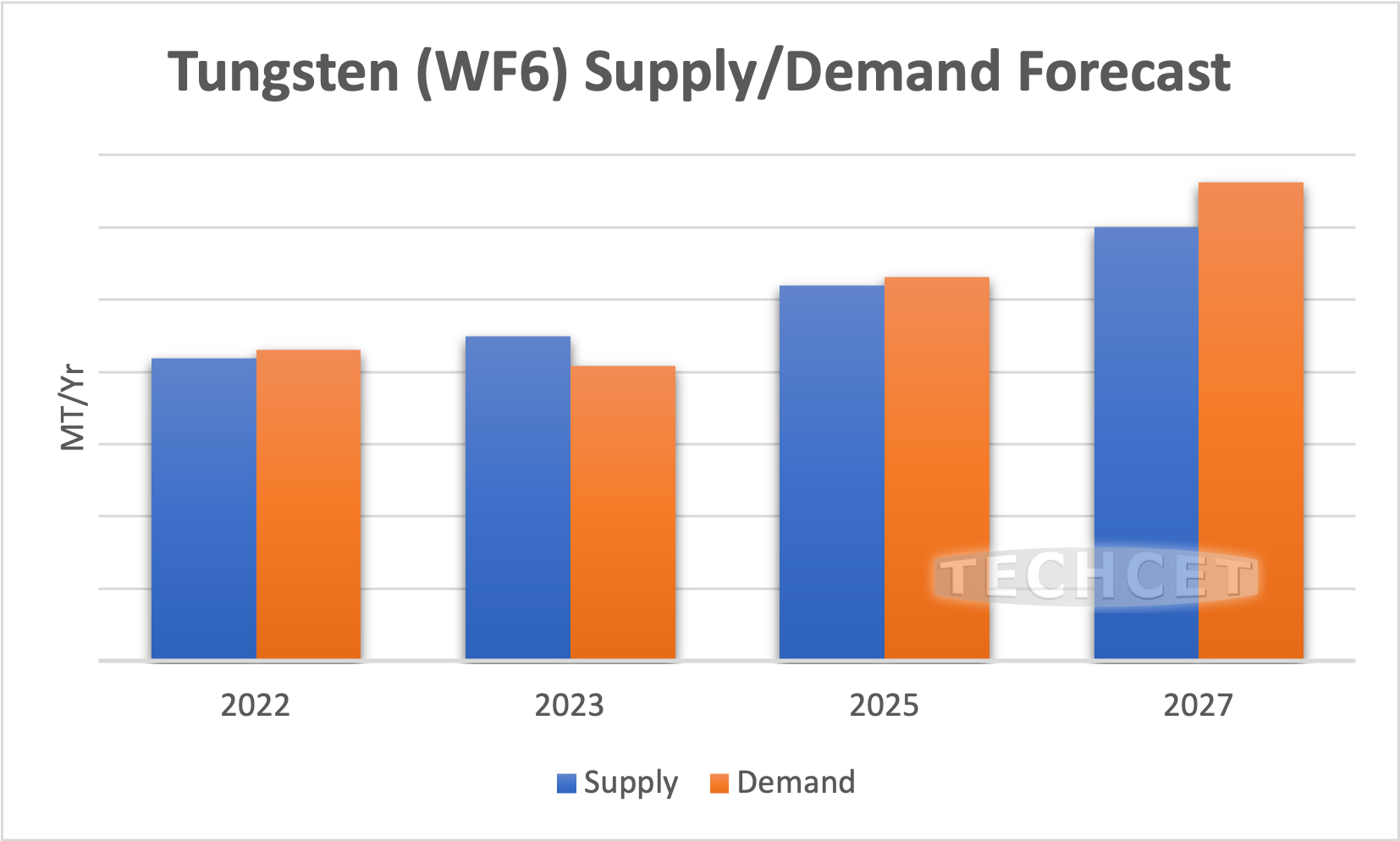

- July 26, 2023- Materials “Sweet-spot” – ALD/CVD Precursor Supply Chain – Mo may replace HVM applications, which could reduce future WF6 supply strains

- July 20, 2023- Silicon Wafers Supply Swinging Back to Positive for 2023 – Revenues for SOI Wafers remain stable, with high growth forecasted ahead

- July 12, 2023- 2023 Semiconductor Materials Market Slowing but Resilient – Material growth to resume in 2024 as industry recovers and fabs ramp up

- June 27, 2023-Semiconductor Metal Plating Chemicals Revenues Slowing in 2023- Increases in Interconnect Layers and Advanced Packaging Use to Revamp Growth

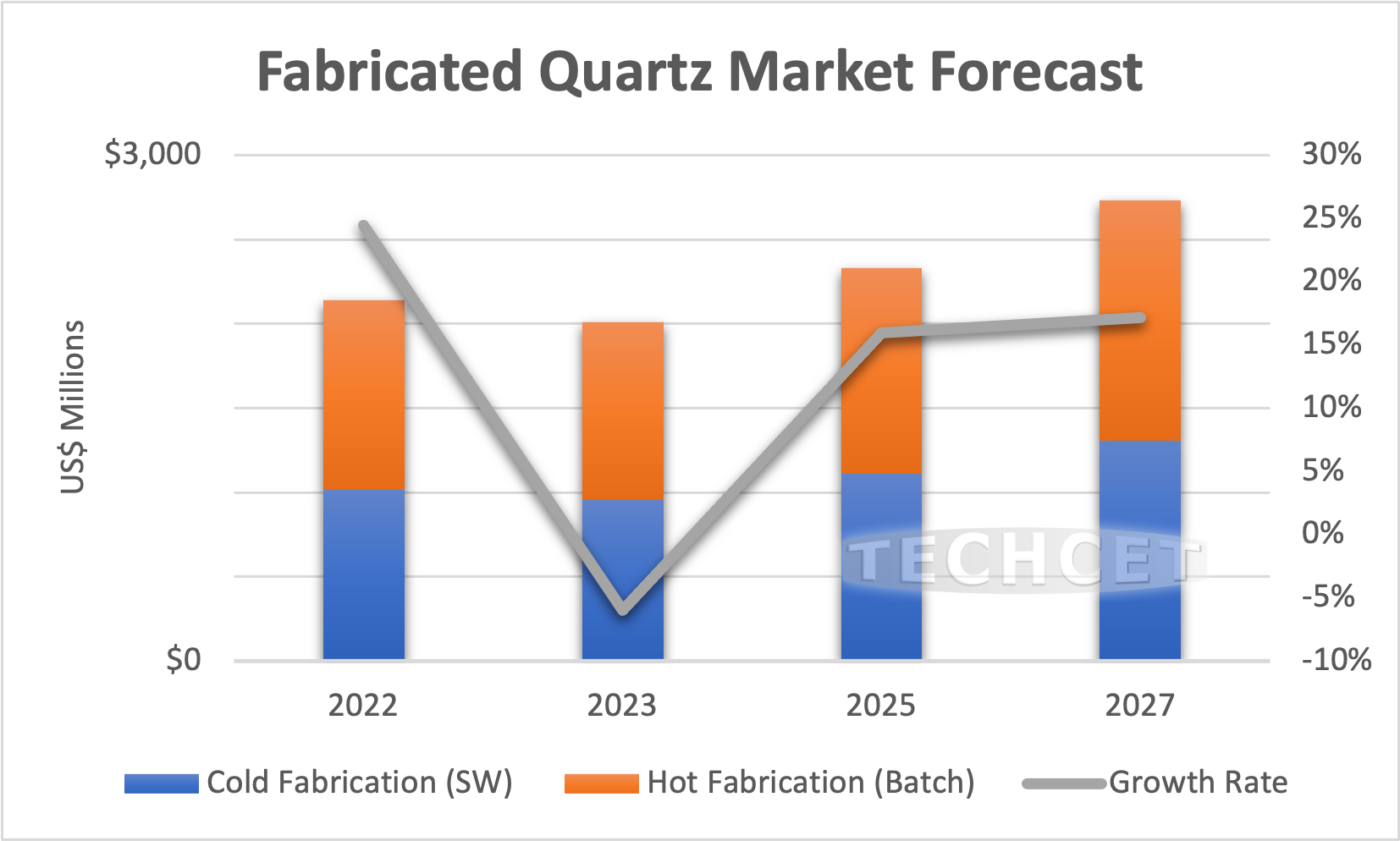

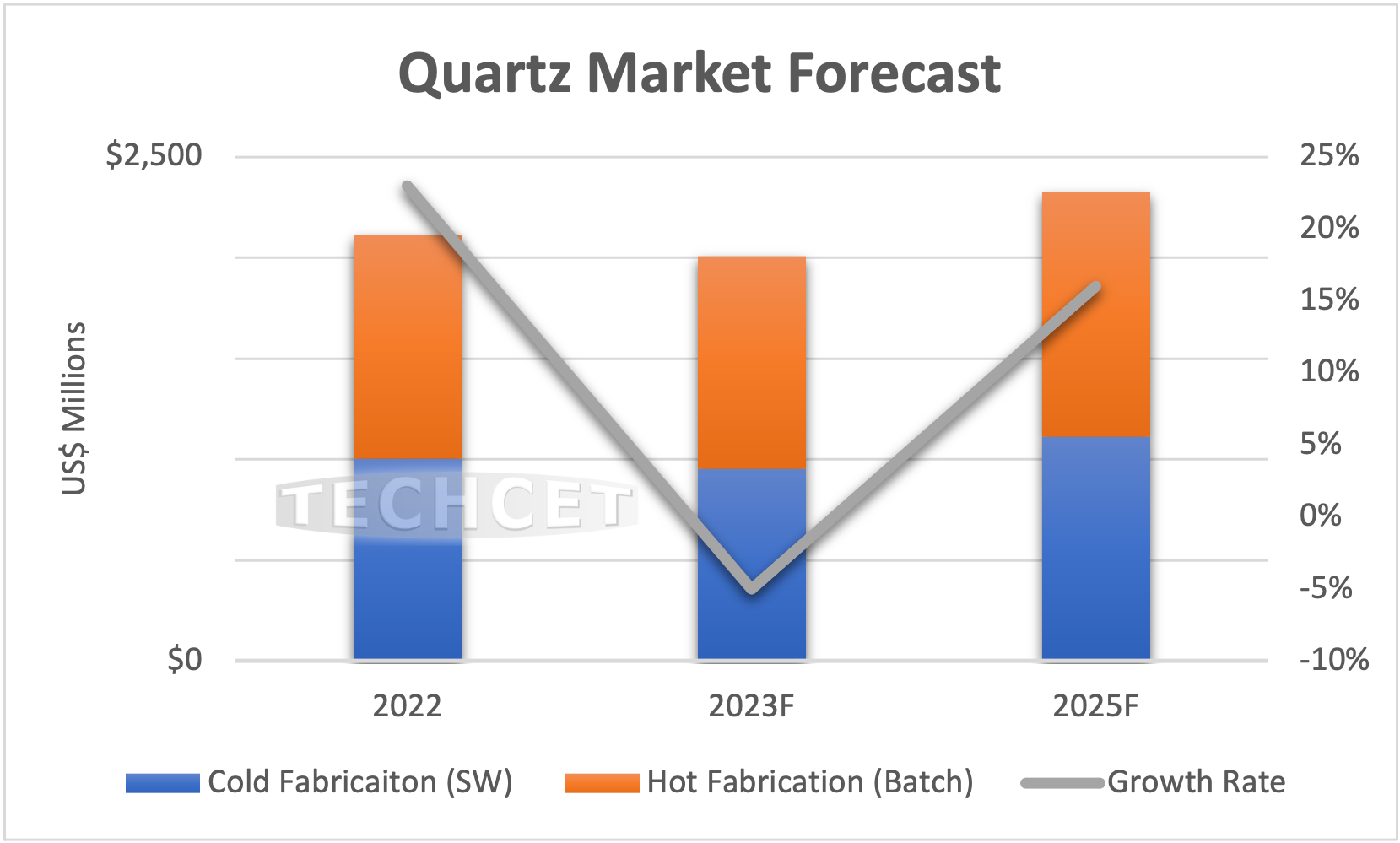

- June 15, 2023-Following All-Time Highs of 2022, Semiconductor Quartz Equipment Components Expected to be Down in 2023

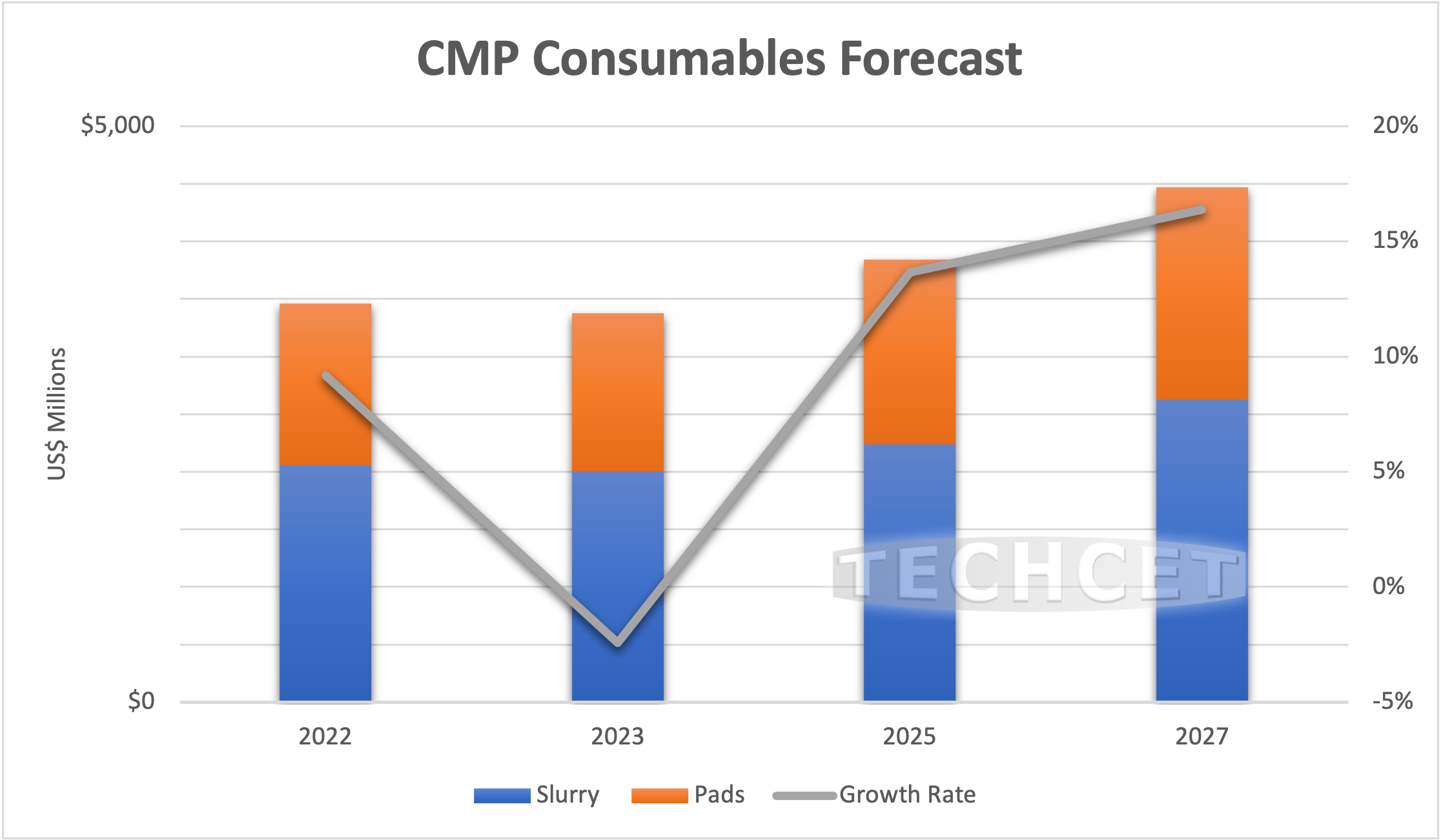

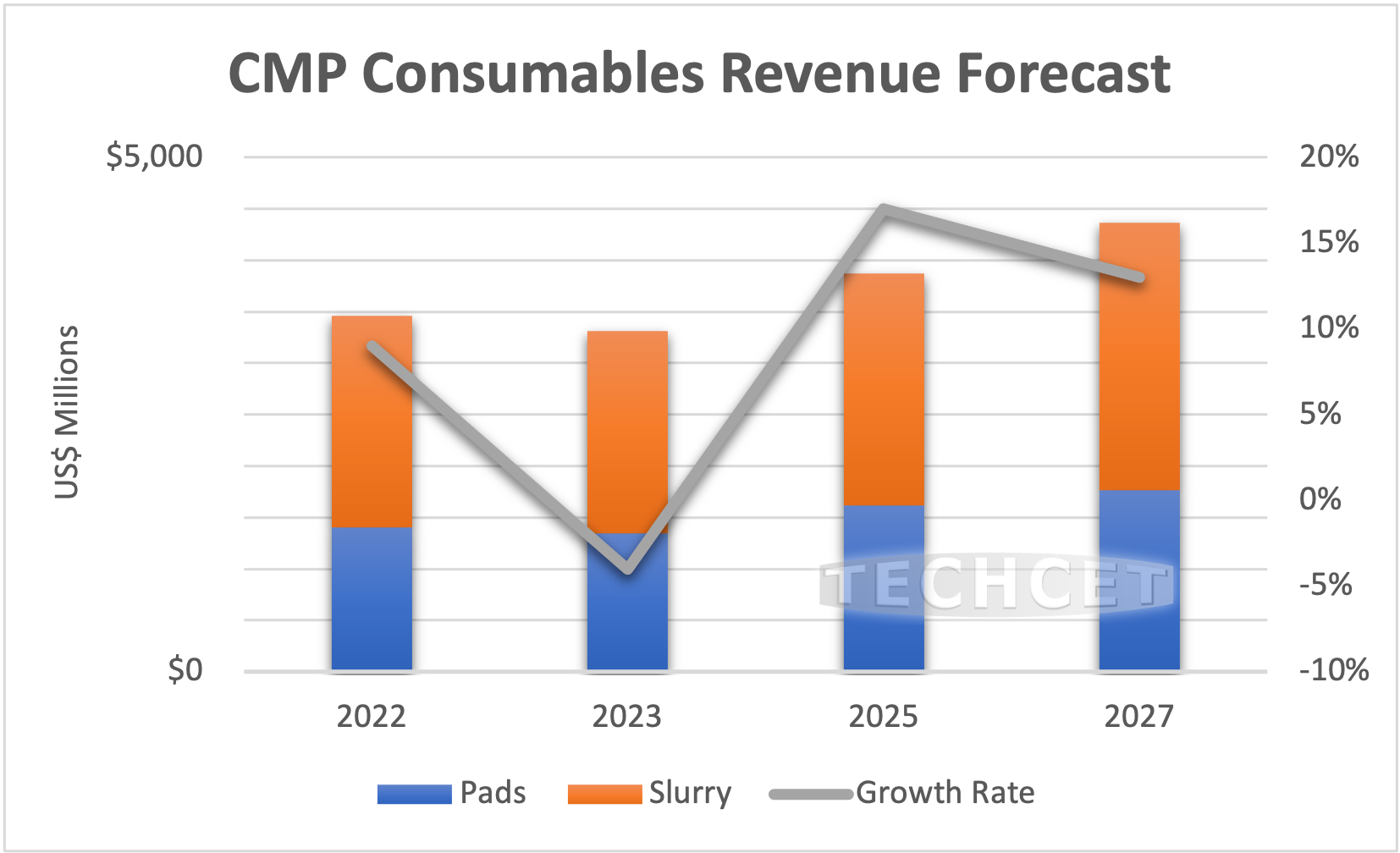

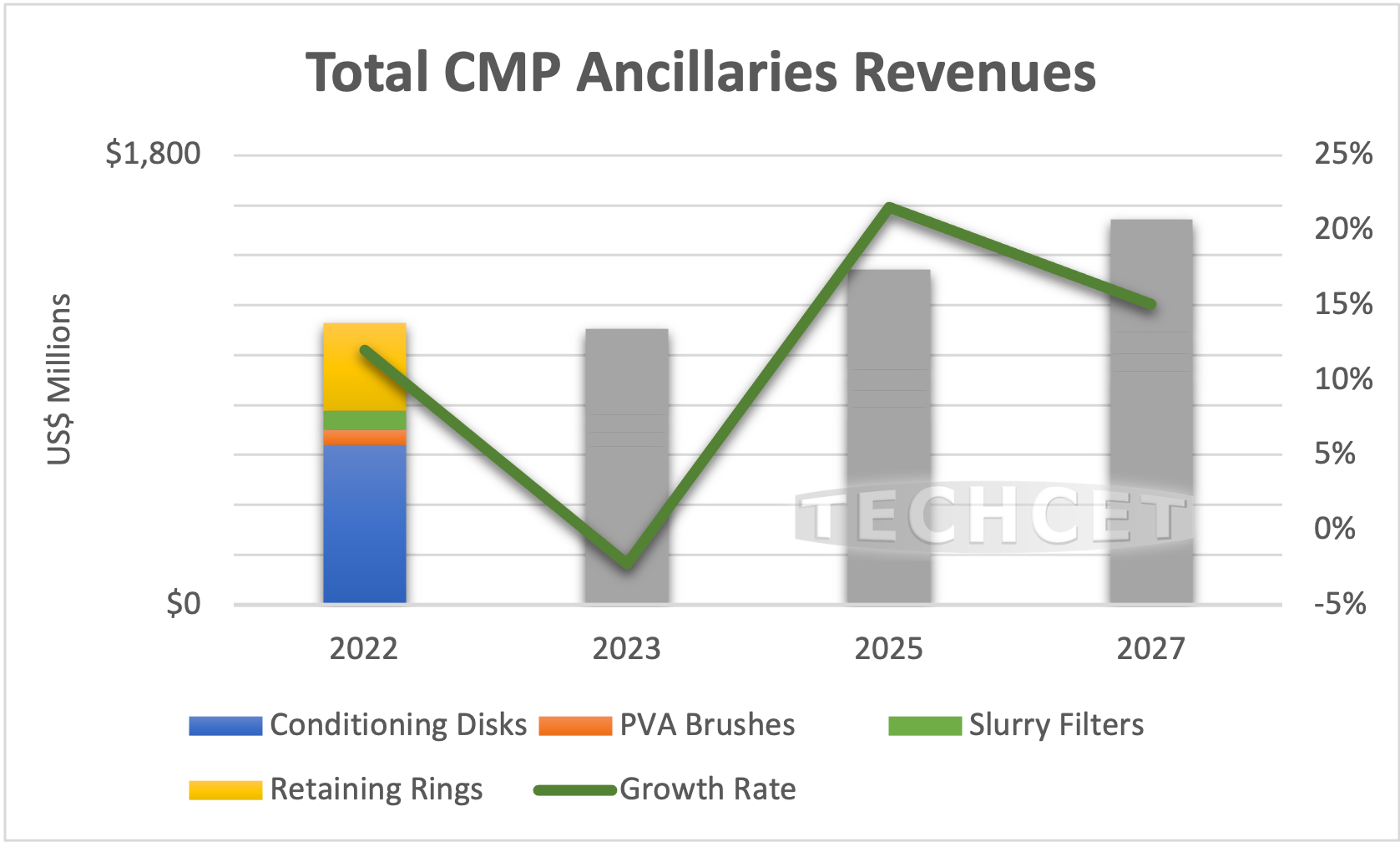

- June 6, 2023-CMP Consumables Facing Market Correction after Strong 2022- Advance logic developments drive new CMP consumables opportunities

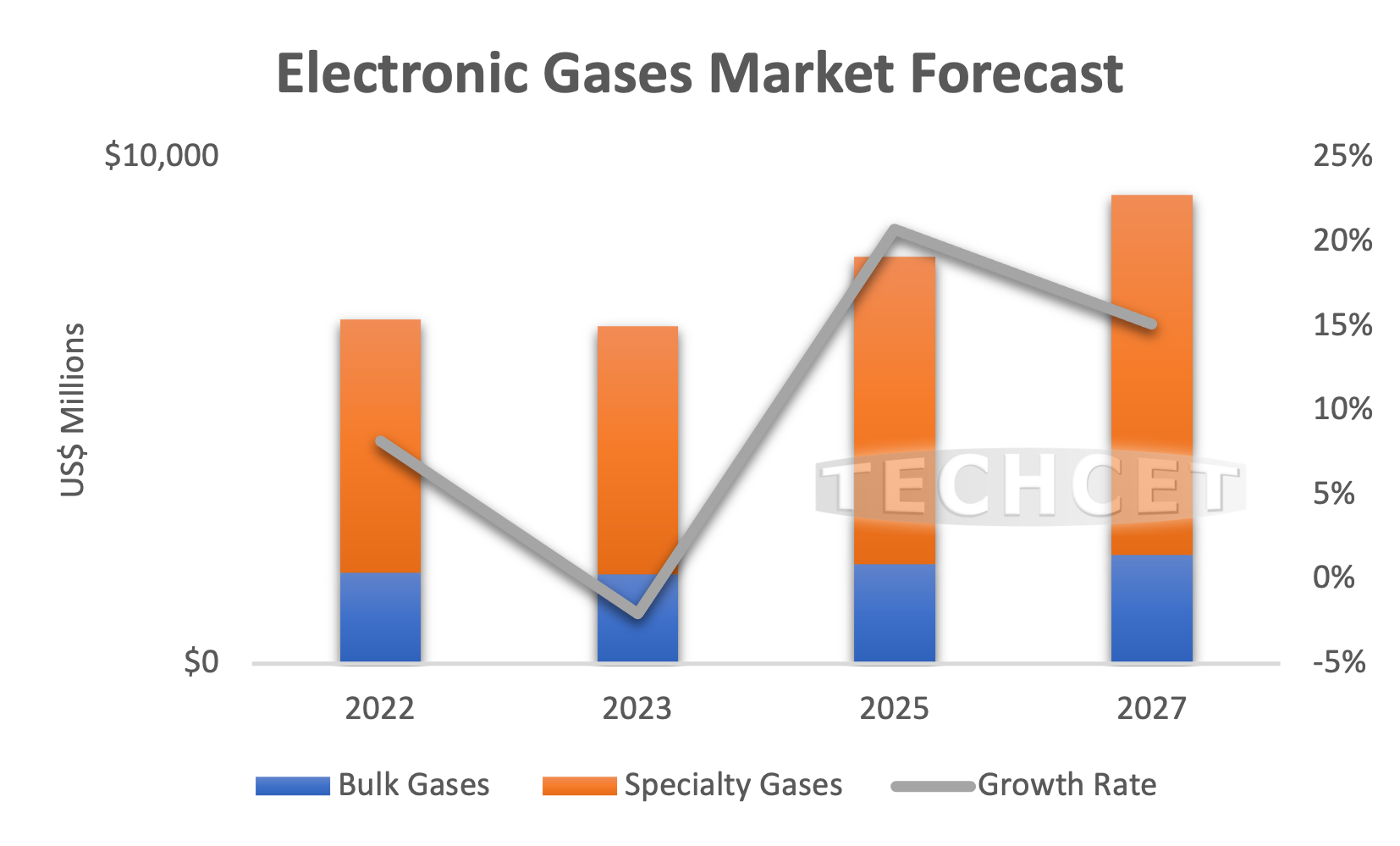

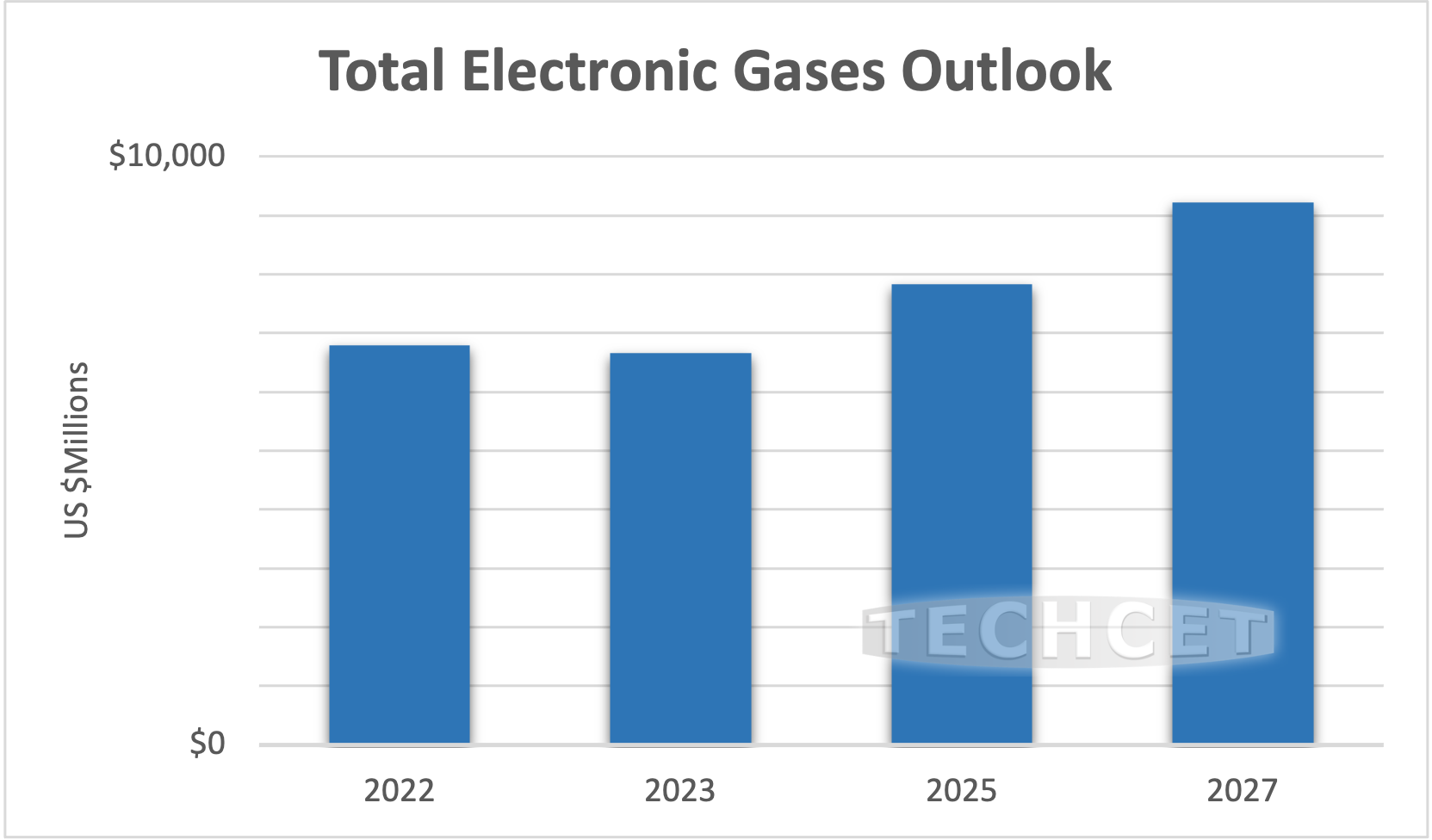

- June 1, 2023-Electronic Gases Demand to Increase as Semiconductor Fab Expansions Move Forward- Critical gases like B2H6 and WF6 may face supply constraints

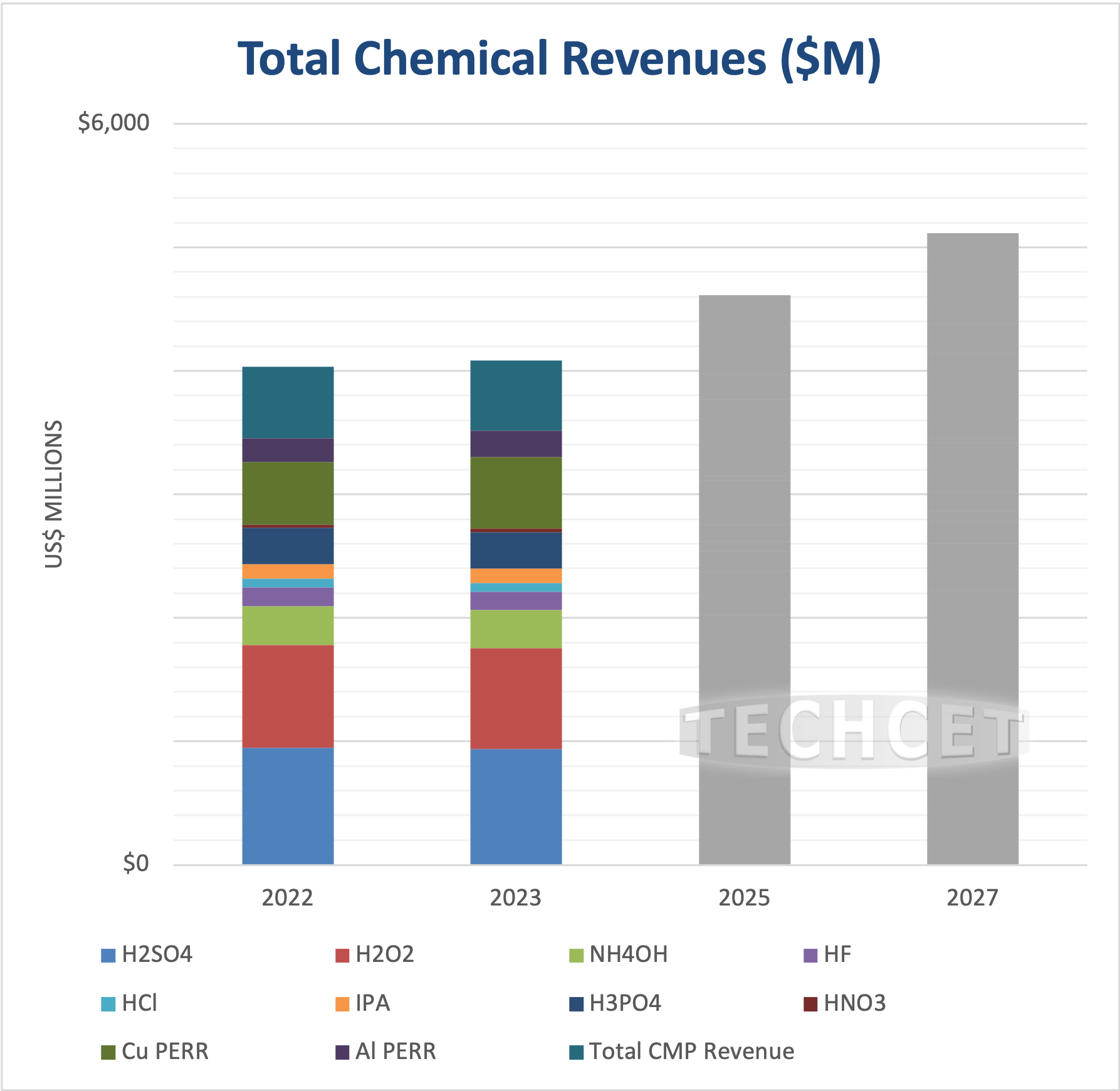

- May 24, 2023-Semiconductor Chemical Revenues Fall as Energy Prices Rise- Wet Chemical market decline follows wafer start slowdown

- May 16, 2023-ALD/CVD Precursors – Better Times Ahead – Market expected to rebound with memory pricing recovery

- May 9, 2023-US CHIPS Act- Silicon Carbide (SiC) Wafer Supply Gets Squeezed – Growing Demand Persists as Silicon Wafers Reach Its Limits

- April 13, 2023-US CHIPS Act- Opportunities and Issues for the US Semiconductor Industry

- March 30, 2023-New Global Semiconductor Packaging Materials Outlook – US$26 Billion market to approach US$30 Billion by 2027

- March 22, 2023-Electronic Gas Markets Show Minor Contraction on the Heels of Solid Growth

- March 7, 2023-Semiconductor Lithography Materials Trending Upwards – 2023 economic slowdown to cause a short-term dip on photoresists & ancillaries

- March 1, 2023-2023 CMC Conference to Host Intriguing Lineup of Speakers – Featuring talks on current trends, issues, and new technologies for the semiconductor materials supply chain

- February 28, 2023-Semiconductor Wet Chemicals 1H2023 Trending Down – Although 200+ new layer chip offerings are expected in 2023

- February 23, 2023-CMP Pads & Slurries to Slump with Overall Semiconductor Market in 2023 – Supply chain issues easing but still some delays for sub-assemblies and parts

- February 15, 2023-CMP Equipment “Ancillaries” Poised for Growth – Increases Driven by 3DFinFET and X-Stack 3DNAND

- February 6, 2023-8th Annual CMC Conference in Round Rock, Texas – Join chip fabricators and suppliers in discussing current trends and issues for the semiconductor materials supply chain

- January 31, 2023-Semiconductor Sputter Targets Forecasting Decline in 2023 – Suppliers will benefit from slowdown as tight supply will be alleviated

- January 24, 2023-Quartz Components Market Expecting Slight Decline in 2023 – Decline may vary in intensity depending on region and ongoing fab expansions

- January 10, 2023-Slowing Industry Conditions Temporarily Eases Supply Strain in 2023 for Silicon and SOI Wafers – Investments in increased capacity not expected to alleviate strain until 2024-2025

- January 4, 2023-2023 Semiconductor Plating for Device and Packaging Expecting Slowdown as Global Economic Conditions Weaken – New Technologies such as Ruthenium and Molybdenum in Barrier Layers May Also Replace Old Plating Standards

December 8, 2023

Semiconductor Materials Market – Better Things to Come in 2024

Despite downturn in 2023, material demand and market growth are on the rise

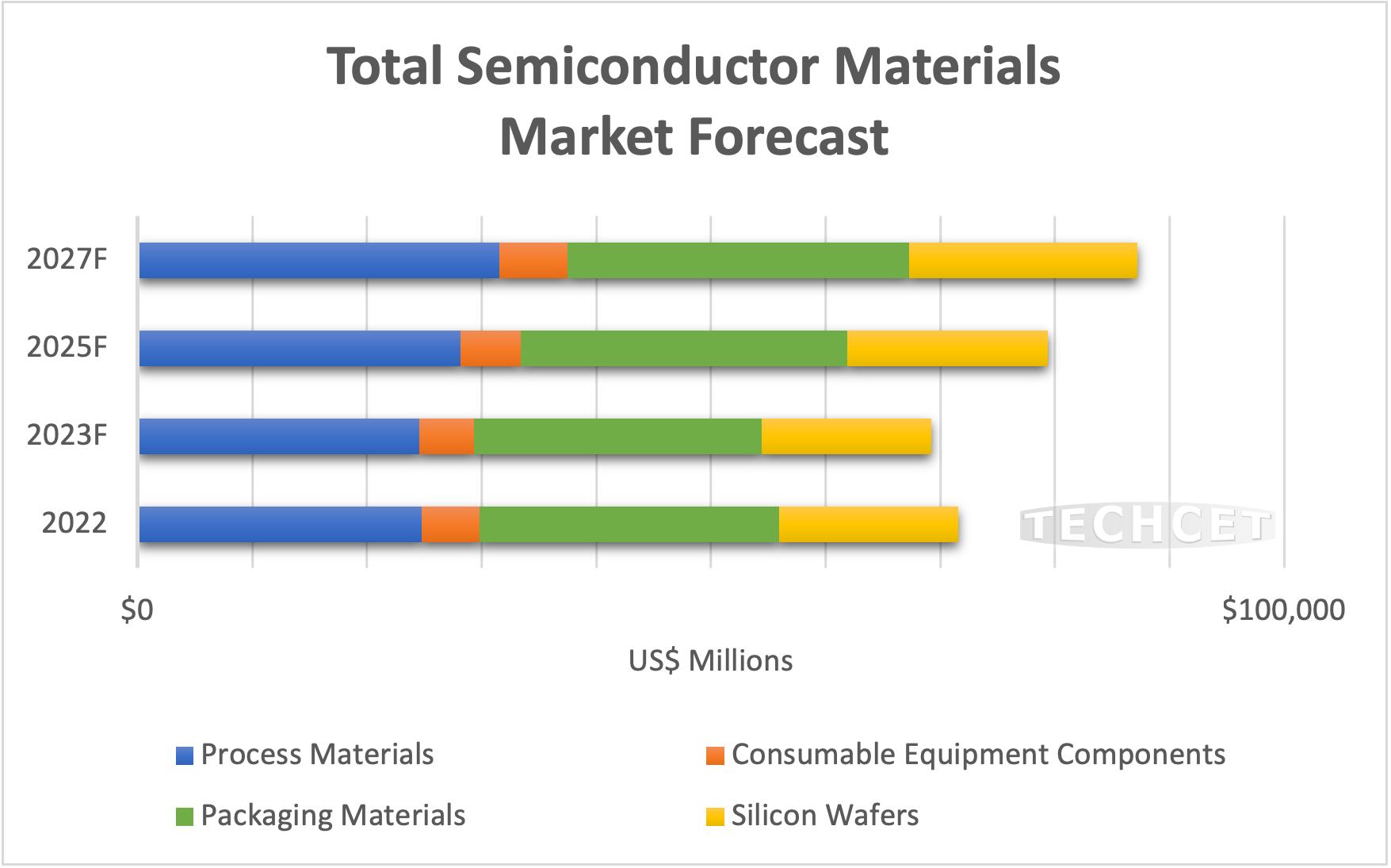

San Diego, CA, December 8, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — announced that the Total Semiconductor Materials market is forecasted to rebound with almost 7% growth in 2024 to reach US$74 billion. This upwards turnaround comes after a contraction of -3.3% in 2023 due to the overall semiconductor industry slowdown and decline in wafer starts. Looking ahead, the total semiconductor materials market is expected to grow at over a 5% CAGR from 2023 through 2027. By 2027, TECHCET anticipates the market to reach US$87 billion or more, with new global fab ramps contributing to a potentially higher market size.

Although the 2023 slowdown has eased supply constraints, tightness in supply is expected to resume in 2024 for 300 mm wafers, epitaxial wafers, some specialty gases, and perhaps copper alloy targets with the ramp of new fabs globally. The degree of supply tightening will be a function of material supplier expansion delays.

Strong demand growth could strain supply chains if material/chemical production capacity do not keep pace with fab expansions. TECHCET has been tracking high-purity chemical production availability in the US, and has identified several areas where imports will be necessary to support demand.

In addition to the global fab expansion, new device technologies will drive materials market growth as new materials and additional process steps are needed for Gate-All-Around Field Effect Transistors (GAA-FET), 3D DRAM, and 3D NAND as layer count approaches 5xxL. These materials include specialty gases for EPI silicon/silicon germanium, EUV photoresist and developers, CVD and ALD precursors, CMP consumables and cleaning chemicals (including highly selective nitride etch), and more.

Other lingering supply chain constraints and potential chokepoints could also cause issues as fabs expand capacity. For example, geopolitical issues between China and the US are beginning to strain germanium and gallium supply chains, while risks with rare earths supply are heightening due to China’s major stake on these materials.

Another concern in the US is on regulatory issues potentially limiting material supply expansions. Permitting around regulations can add time and costs to expansion projects. Additionally, government regulations for EHS hazards may regulate PFAS materials out of existence, forcing material suppliers to develop alternative replacements that will take time to develop and qualify.

For more details on segmented forecasting for the Semiconductor Materials Market, including ALD/CVD Precursors, Wet Chemicals & Specialty Cleans, CMP, Electronic Gases, Silicon Wafers, and more, go to: https://www.techcet.com

To discuss more on Wet Chemicals, come speak with Kevin McLaughlin, Ph.D., Senior Analyst at TECHCET, at the SEMICON Japan Semiconductor Materials Forum on Dec. 13th at 2:40PM in East Hall 8.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please email us here, call +1-480-332-8336, or go to www.techcet.com.

December 4, 2023

Wet Chemicals Market to Make an Upward Turn in 2024

Chemical consumption to increase for leading-edge tech and fab expansions

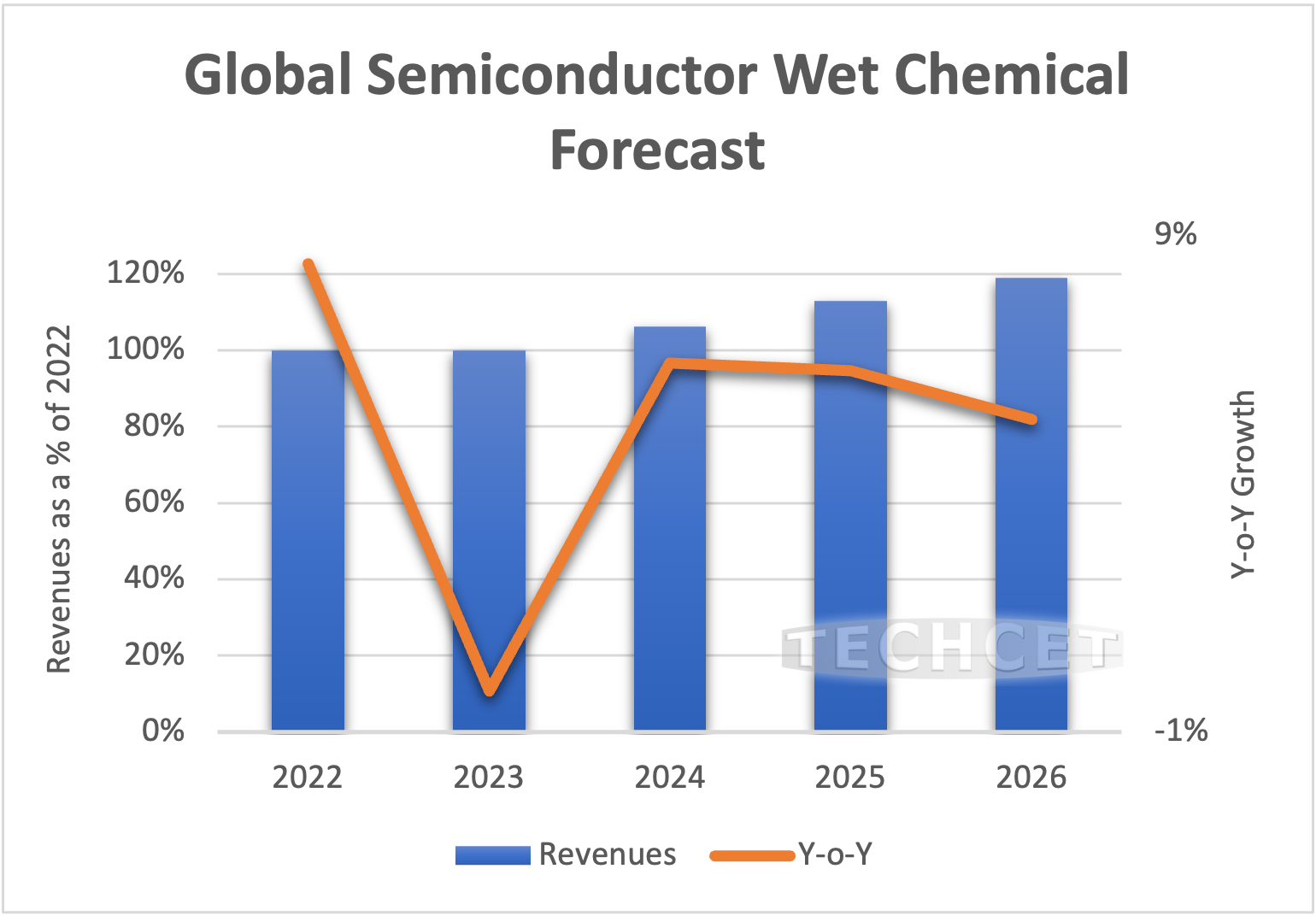

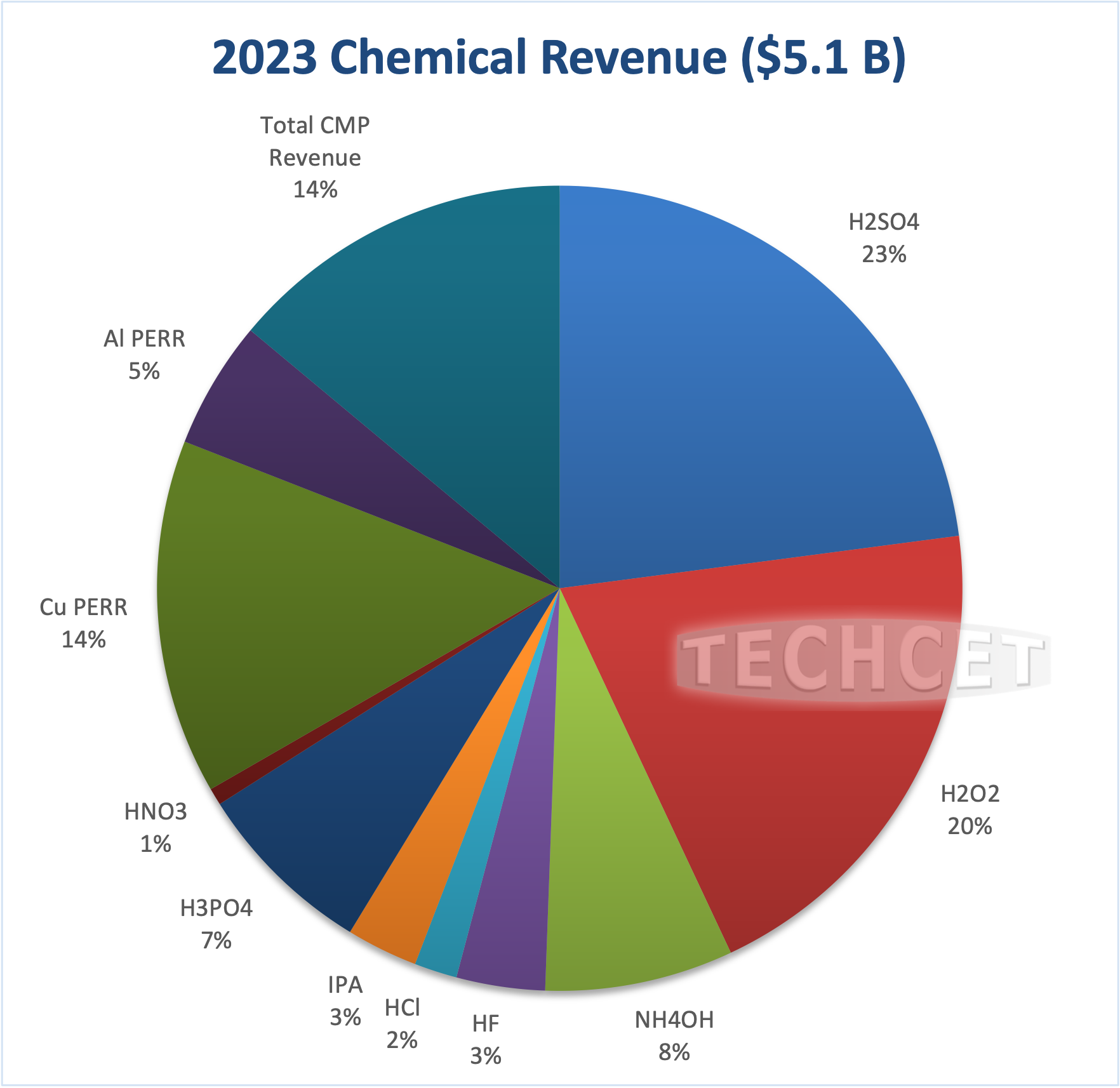

San Diego, CA, December 4, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — sees the semiconductor wet chemicals market contracting slightly in 2023, followed by a 6% rebound in 2024. The future ramp will be largely driven by growth in chemical consumption from leading-edge device technology, especially as expansion in 3DNAND layers ramp to 5xxL layer count. The continued expansion of global chip fab capacity will grow the wet chem market 6% YoY (2023-2027 CAGR). By 2027, TECHCET estimates the wet chemicals market segment to reach US$6.9 billion, as indicated in TECHCET’s 2023-2024 Critical Materials Report™ on Electronic Wet Chemicals.

From the device perspective, increased process steps and demanding yield requirements will drive growth and consumption of wet chemicals since cleaning steps are critical for achieving high yields. For example, as the layer count increases in 3DNAND, Highly Selective Nitride etch (HSNE) formulation is expected to see strong growth since it is an important driver in phosphoric acid consumption.

Dynamics in the wet chemicals market have changed over the past couple of years given logistic challenges, energy costs, and geopolitical events. As a result of geopolitical events and global fab expansions, a regional supply base catered to the requirements of Integrated Device Manufacturers (IDM’s) is becoming increasingly necessary to be competitive in the wet chemicals market. There is concern that specific chemical supply chains may face economic problems connected with inflation, the Russia-Ukraine situation, and raw material sources from China.

In addition, energy costs are changing in several regions, which heightens risks for material costs. Today, higher energy costs have contributed to upwards pricing pressures for materials. Prior to 2020, prices were seldom adjusted. However, the market saw significant changes to pricing in 2021 and 2022 with no ease in pricing in 2023. Given concerns about increased costs from energy and regionalization, TECHCET expects a continued pushback from suppliers on requests to return to pre-pandemic prices.

For more details on the Semiconductor Wet Chemicals market segments and growth trajectory, including profiles on AUECC, Avantor, BASF, Chemtrade, and more, go to: https://techcet.com/product/specialty-cleaning-chemicals/

To discuss more on Wet Chemicals, come speak with Kevin McLaughlin, Ph.D., Senior Analyst at TECHCET, at the SEMICON Japan Semiconductor Materials Forum on Dec. 13th at 2:40PM in East Hall 8.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please email us here, call +1-480-332-8336, or go to www.techcet.com.

November 22, 2023

Semiconductor Ceramic Parts Market to Rebound in 2024

New investments in CVD SiC expected from equipment component suppliers

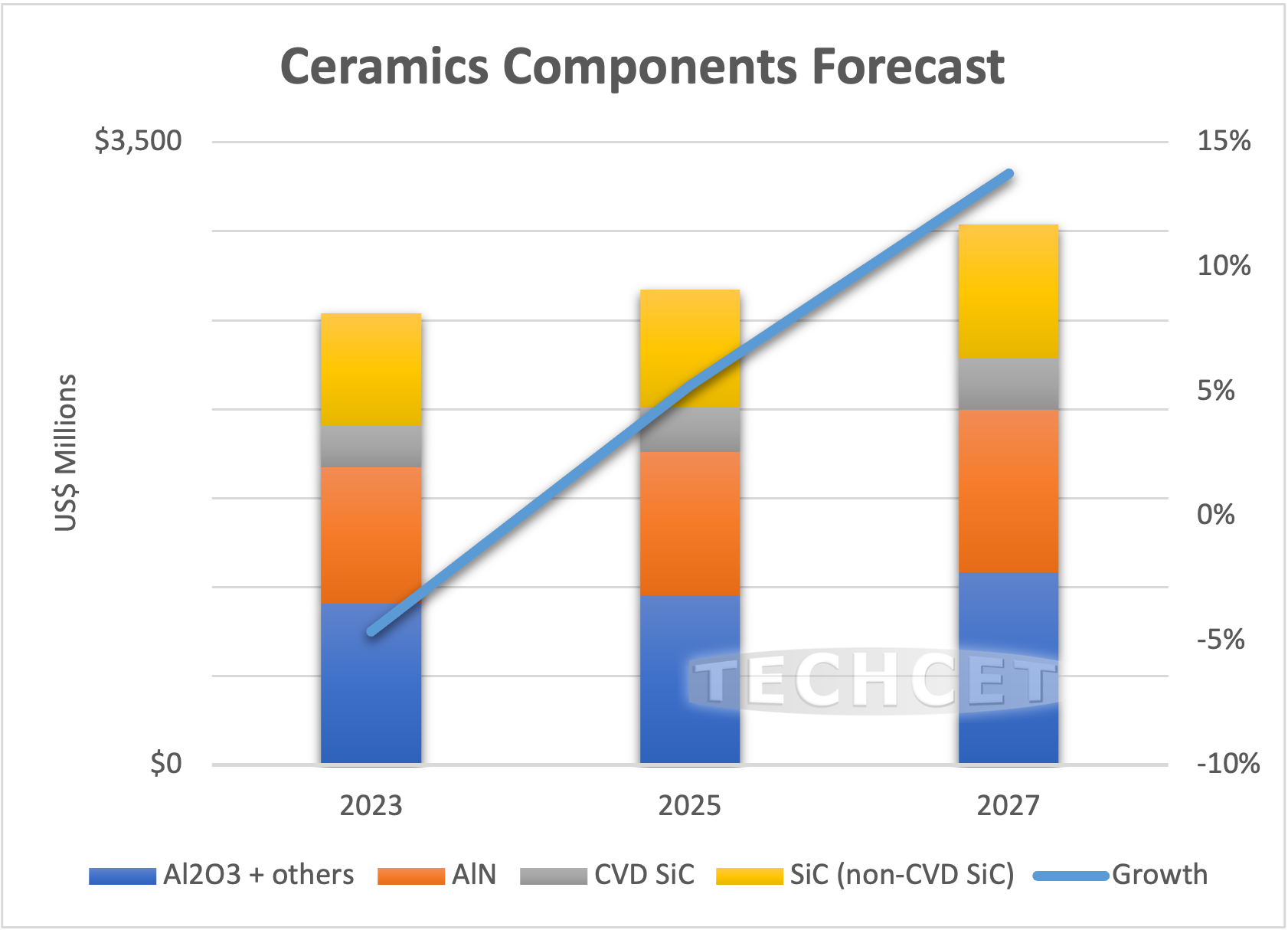

San Diego, CA, November 22, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — has announced that the consumable ceramic equipment parts market will contract by -5% in 2023 to US$2.5 billion. Ceramic fabricated parts, including alumina (Al2O3), aluminum nitride (AlN), silicon carbide (SiC), and chemical vapor deposition SiC (CVD- SiC), are consumed as components in semiconductor process equipment, meaning that market trends are directly tied to fab wafer production and semiconductor equipment sales. The ceramic fabricated parts market will grow on the order of 2% to 5% in 2024, and will top over US$3 billion by 2027, as indicated in the graph below from TECHCET’s newly released Critical Materials Market Report on Ceramics™.

Previous backlogs from 2020-2022 in the Ceramic Parts Market have gradually cleared given the industry slowdown, which is allowing some fabricators time to work on efficiency improvement projects. Long lead-times for large SiC components previously stretched to over 1 year, though they have shortened slightly.

Semiconductor equipment makers using CVD SiC will continue for the foreseeable future, driving growth of CVD SiC used for advanced semiconductor capital equipment applications. New investments in growing CVD SiC capacity are finally beginning to appear after previous supply shortages. The 2023 lead-time in CVD SiC has improved, so this is a good sign for this segment of the industry, which TECHCET expects to see strong growth in. Given the expense and expertise needed, it is difficult for new players to enter the CVD SiC market. However, large silicon and quartz suppliers are expected to enter this market segment over the next several years.

Both the SiC and AlN markets will continue to exhibit stronger growth than alumina and other ceramic materials due to contributions to increasing productivity, reduced defects, and process requirements for next-generation thermal processes.

200 mm component market demand is still ongoing and well supported by small ceramics grind shops/fabricators. With that said, there are indications that ceramic fabricators in China are suffering more than their overseas competitors in 2023. This is due to the economic situation in China, the US/China geopolitical situation, and US customers buying less components from Chinese sources. In some cases, there could be a much greater revenue drop in 2023 for some of those suppliers.

For more details on the Semiconductor Ceramic Fabricated Parts market segments and growth trajectory, including profiles on 3M, Applied Ceramics, Ferrotec, Resonac, and more, go to: https://techcet.com/product/ceramics/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

November 7, 2023

2023 CMC Seminar Unveils Semiconductor Industry Hurdles

Materials supply chains logistics, quality, and metrology complexities

San Diego, CA, November 7, 2023: The 2023 Critical Materials Council (CMC) Seminar in Taichung, Taiwan centered on, “Future-Proofing the Supply Chain,” as introduced by keynote speaker Donghui Lu, Corporate VP at Micron Taiwan. Mr.Lu’s presentation touched upon the risks and inefficiencies in global semiconductor materials sourcing and ultimately called for the tightening of the supply chain through three key actions: co-locate, invest, and expand. Lita Shon-Roy, President and CEO at TECHCET, built upon Lu’s points by highlighting key material supply “chokepoints,” and adding government support, improved trade relations, and more as solutions to alleviating them.

Chris Wright, EVP, Chief Operations Officer, Rinchem speaking on” The Future of Global vs. Local Movement of Chemicals and Gases”

Alongside Lu and Shon-Roy were other thoughtful speakers presenting on logistics, quality, and metrology challenges within the local and global semiconductor materials supply chain. Cheng Ting-Fang, Chief Tech Correspondent at Nikkei Asia, unveiled the mystery of the PFAS supply chain, showing the existence of a PFAS village in Suzhou, China, and the growing industry reliance on this key supply source. New methods for smart data collaboration to sustain and improve materials quality were presented by Chris Han-Adebekun, VP of Business Development at Athinia, and Vish Srinivsian, Sr. Director of Supplier Programs at Micron. Furthermore, invited Taiwanese and US government officials participated in a panel discussion on future policy direction for the growth of the global semiconductor industry.

The Seminar was attended by suppliers and major chip fabrication companies from Asia, the US, and Europe. CMC members also participated in interactive private group meetings earlier that week at Micron’s facility in Taichung, where they discussed the impact of geopolitics on the semiconductor materials supply chains. TECHCET was highly satisfied with the engagement and insight brought to these events and is looking forward to the next set of CMC Member Meetings on April 9-10 and the CMC Conference on April 10-11, 2024, in Chandler, AZ.

For more details on CMC events, go to: https://cmcfabs.org/. If you are interested in accessing this year’s Seminar presentations, go to: https://techcet.com/product/2023-cmc-seminar-presentations/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

October 31, 2023

US Chip Expansions in Need of Significant Materials Support

Domestic chemical demand to leap through 2027, though supply is not prepared

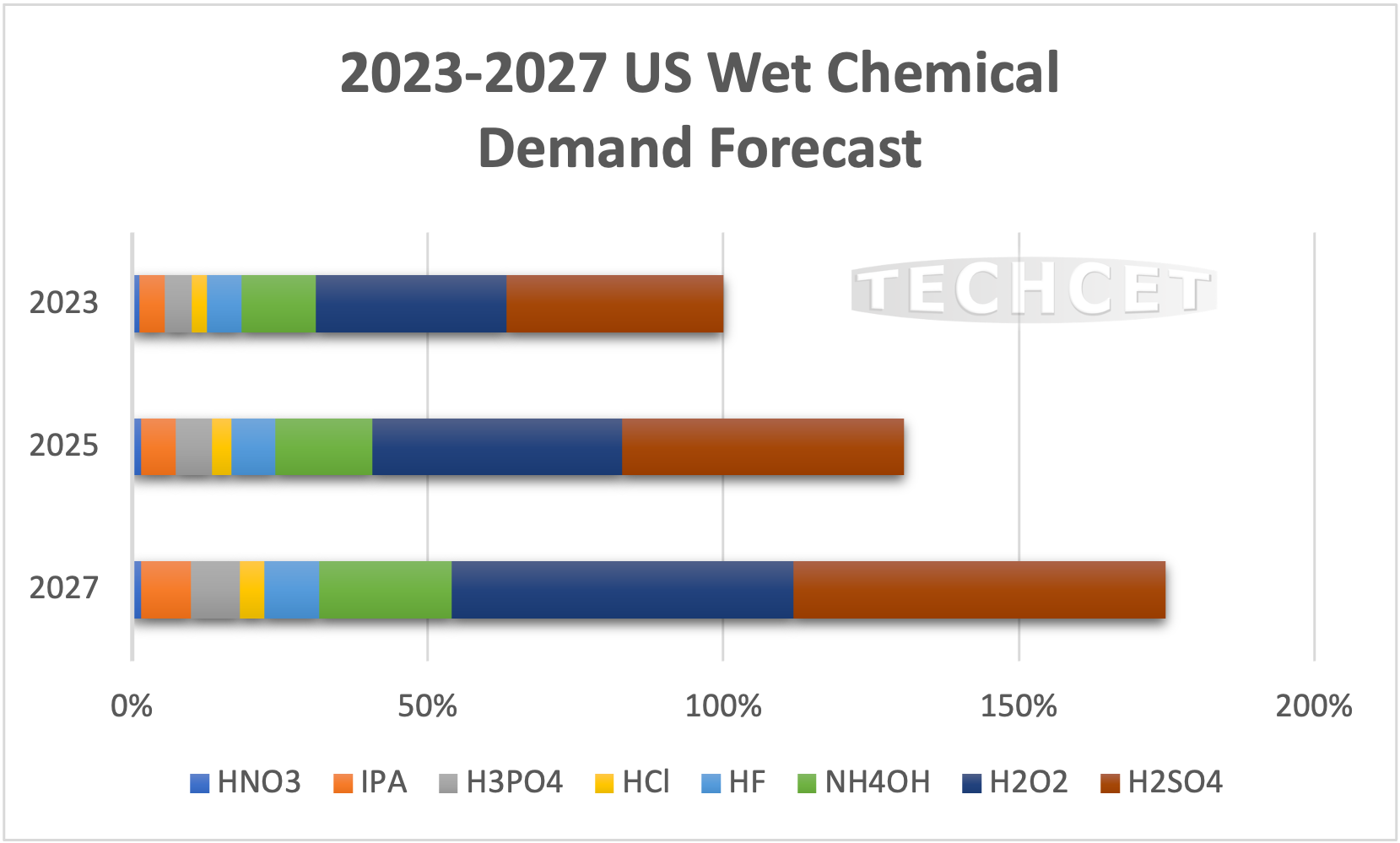

San Diego, CA, October 31, 2023: TECHCET — the electronic materials advisory firm providing market and supply-chain information — is forecasting US demand for the bulk chemical sector to increase by a combined 75% by 2027. The anticipated demand jump is due to announced fab expansions coming on-line and increasing wafer start capacities. Over the next 4 years, TECHCET is expecting domestic wafer start capacity to potentially jump to 46M in 2027, a 35% increase from the 34M wafer starts expected in 2023. As these wafer start numbers increase, material demands will escalate creating a gap in the supply needed to support the industry, as demonstrated in TECHCET’s Special Report on The Impact of Chip Expansions on US Chemical Supply Chains.

While the movement to more advanced devices will have a strong impact on US material requirements, recent announcements indicate that legacy (mature) node manufacturing will also drive domestic materials demand. Advanced node device manufacturing (14nm and smaller nodes) will drive an increase in high purity requirements, in addition to volume growth.

Over the 2023-2027 forecast period, domestic chemical production capacity is expected to increase slightly, but not enough to cover all chemical needs. Building a chemical plant to support semiconductor quality chemicals typically takes 2-3 years to come online, so there may be shortages experienced as soon as 2024 if new capacity is not running. Currently, imports cover a significant portion of the overall US wet chemical demand, especially for ultra-high purity (UHP) quality wet chemicals. If domestic supply is not ramped to support expansions, this reliance on imports will grow, creating vulnerabilities and ancillary issues for the domestic semiconductor supply chain.

H2SO4, IPA, HCl, HF, HNO3, and H3PO4 will all need boosts in domestic supply in order to meet demand from new fabs. Kanto/Chemtrade ha announced plans to expand on H2SO4, however, the timing of plant build and production is yet uncertain. Currently, UHP material is largely supported by qualified suppliers in Taiwan. Details on anticipated gaps in supply and volume requirements by purity grade can be found in TECHCET’s report on the “Impact of Chip Expansions on the US Wet Chemical Supply Chain” here: https://techcet.com/product/impact-of-chip-expansion-on-us-chemical-supply-chain-2/.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

Back to top

October 12, 2023

Growing Supply Chain Risks for Germanium and Gallium

How can the US stabilize Ge/Ga supply to support high semiconductor demand?

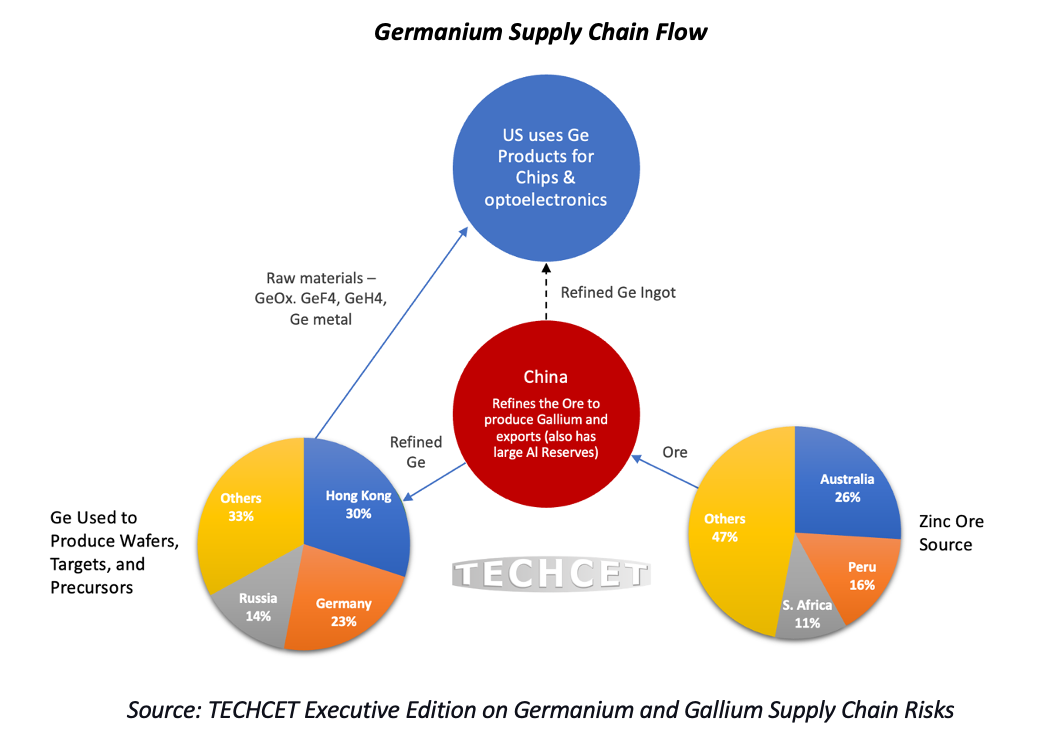

San Diego, CA, October 12, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — has uncovered a significant supply chain risk for germanium and gallium for the global semiconductor market. Both germanium and gallium are critical metals essential to producing RF and sensor devices, 5G, IT communications, and automotive applications. China is the world’s leading producer of refined germanium and gallium, which has increased risk for the US semiconductor supply chain. Global supply risks have been further amplified by recent announcements from China regarding export permit requirements for both metals, as explained in TECHCET’s new Report on Germanium and Gallium Supply Chain Risks. TECHCET’s new Report on Germanium and Gallium Supply Chain Risks.

While there are other reserves and capacities for germanium and gallium outside China, producing viable material would require significant investment and time. Any reduction in gallium supply from China over the next 1-3 years poses an issue for the US. China primarily dominates the refining resources required to produce these materials, and the ore emanates from other non-US sources, as shown in the Figure above on germanium.

Ramping up production and capacity for germanium and gallium within the US would help to stabilize the supply of these much-needed metals. However, mineral and chemical companies within the US face various hurdles in justifying the investment in new capacity for these materials. For example, chemical companies in China benefit from support through free or tax-free land, government money, and loans for building plants. US chemical companies do not have these benefits and are burdened with more expensive labor and power costs than offshore alternatives. This results in less willingness for companies to independently expand capacity within the US, indicating a high need for government support or improved trade relations with outside sources.

In the short term, improved trade relations are tantamount to a continued supply of these critical materials. Since building a refining or mining operation requires several years to become productive, it may be wise for the US to cultivate better trade relations with China to ensure current supply needs, while also developing other supply sources from allied nations or domestically within the US. Operating parallel paths would help reduce risk in the short term while working on a longer-term solution to minimize risks to the overall US chip manufacturing supply chain.

For more details on Germanium and Gallium supply chain dependencies and risks, go to: https://techcet.com/product/germanium-and-gallium-supply-chain-risk-executive-edition-single-user-license/.

To discuss more on the supply chains for germanium, gallium, and other semiconductor materials, come talk to TECHCET at the CMC Seminar in Taichung, Taiwan on October 25th. For more information and to register, go to: https://cmcfabs.org/2023-cmc-seminar/.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

September 27, 2023

Semiconductor Supply Chain Problems Running Rampant?

Solutions to mitigate future materials supply vulnerabilities

By Lita Shon-Roy, MS/MBA, and Sachi Brown, TECHCET CA

Over the past 2 to 3 years, the semiconductor industry has faced extreme pressure to meet growing consumer demand for an abundance of everyday electronic products like cars, smartphones, and computers. This pressure has only been amplified by various supply chain issues stemming from the raw material sources that are essential to building semiconductors. These material dependencies are easy to overlook since they reside in the sub-tier of the semiconductor market, hidden from direct view of what is sold to chip fabricators and consumers. TECHCET, a leading materials supply chain analysis firm, has consistently worked to uncover many of these dependencies, such as for fluorspar, neon, and helium. These materials play an essential role in the supply chain lifeline to the semiconductor industry and require expertise to identify, qualify, and track for the efficient forward movement of the market.

With recent chip shortages, various producers around the world have announced plans to invest in chip expansions that total more than US$500B over the next five years. For the US alone, this equates to an increase of >45% in semiconductor wafer starts by 2026. While this sounds hopeful for resolving chip deficiencies, it still does not address one key weakness: material shortages. As the industry expands, the risk of complications to the semiconductor supply chain grows, elevating the importance for material supply chain tracking and analysis.

Sulfuric acid is one example of an essential material that would put the semiconductor supply chain at risk if its supply is not properly managed. Fortunately, TECHCET has identified a >50% increase in demand for US sulfuric acid by 2026 to help key chip fabs prepare for expansions. TECHCET consistently provides key metrics related to supply and demand to the Critical Materials Council (CMC), a consortium formed in the mid-1990’s made up of chip fabricators and material suppliers. The Council also provides feedback to TECHCET to direct their ongoing supply chain analysis work. Identifying materials-related disruptions, dependencies, and weaknesses within the supply-chain, are all key elements of TECHCET’s focus and benefits to the CMC subscriber members.

In recent years, material shortages from the Russia-Ukraine conflict and COVID-19 have proven to be high stress points for chip fabricators and material suppliers. For example, neon gas faced shortages at the onset of the Russia-Ukraine war, threatening the stability of semiconductor production and causing high anxiety among chip fabs. At the time, it was unknown how much the US and Asia relied on Ukraine for neon supply. TECHCET managed to uncover various dependencies on Ukrainian neon from different regions around the world, helping major chip companies re-evaluate and better stabilize their supply chains. During the COVID pandemic, sporadic and extreme ocean freight roadblocks also contributed to slowdowns in chip manufacturing. In response to these disruptions, CMC subscriber companies met with logistics and shipping port officials to improve mitigation strategies for further supply interruptions.

CMC member subscribers also gain insight into supply chain challenges from the CMC Seminar. The next one will be hosted in Taiwan (October 25) and will focus on current problems in the materials supply chain and future quality requirements. This event is one of several that brings conversation on supply issues to the forefront. These events connect the entire semiconductor ecosystem by providing essential information on critical materials needed by decision makers at chip fabricators, suppliers, and government. The current CMC chip fab subscribers include more than a dozen of the world’s largest chip makers. (Reference: https://cmcfabs.org)

Given the massive impact semiconductors have in our digital global society, there is a growing and persistent need to manage the coming supply-chain issues, especially with expectations for chip volume to sharply ramp come 2025-2026. Looking into the future, TECHCET and the CMC will continue to facilitate coordination among key players in the materials and chip industry to navigate what lies ahead.

For more information on TECHCET: https://techcet.com or https://cmcfabs.org/2023-cmc-seminar/.

Lita Shon-Roy is President/CEO of TECHCET CA LLC, an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries.

Sachi Brown is the Marketing Specialist of TECHCET CA LLC, in charge of marketing communications.

August 31, 2023

Metal Plating Chemicals Revenues to Boost into 2024

Growth driven by developments in leading edge logic and memory

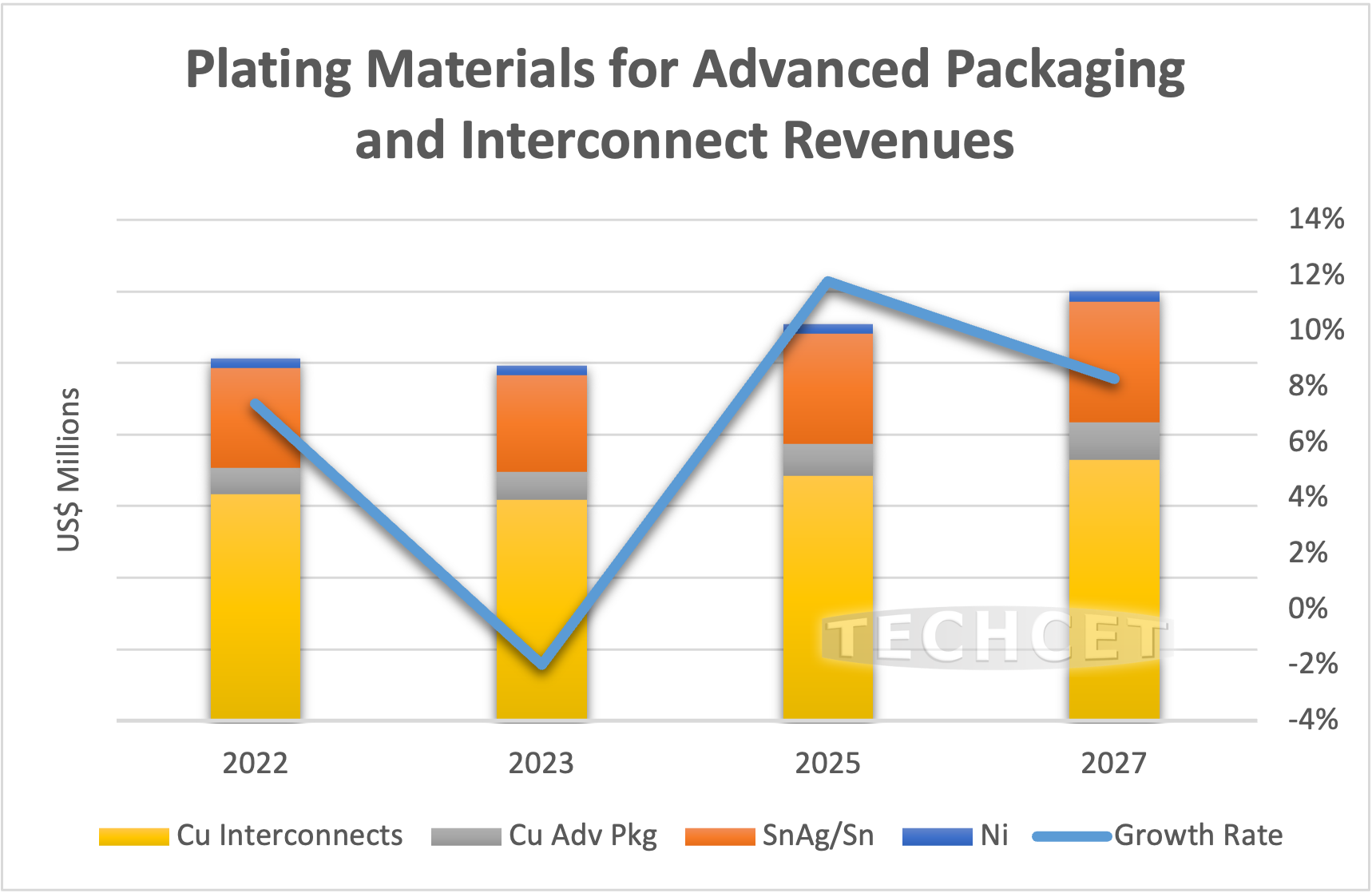

San Diego, CA, August 31, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — reports that revenues for the Semiconductor Metal Plating Chemicals market will rise to USD $1,047M in 2024, a 5.6% increase from the forecasted USD $992M for 2023. The largest revenues for 2024 are forecasted for copper plating chemicals used for device-level interconnect and advanced packaging wiring, as explained in TECHCET’s newly released Metal Chemicals Critical Materials Report™. The 5-year CAGR’s for 2022-2027 are expected to remain on an upward track, with 3.5% growth for advanced packaging and 3% for copper device interconnects.

“Increased usage of advanced packaging, redistribution layers, and copper pillar structures are all factors contributing to the growth of the metal chemicals market segment,” states Dr. Karey Holland, Chief Strategist at TECHCET. Leading-edge logic and memory wafers are beginning to grow at a faster pace than legacy nodes, influencing a higher need for advanced packaging and increased metal layers. The fastest growing segment of advanced packaging is for fan-out wafer-level packaging (FOWLP), which will help boost growth in RDL plating applications.

TECHCET is not currently expecting new players in plating chemicals, however it would not be surprising if new players spring up in China to support their own domestic market. The introduction of Ru or Mo to displace the Ta & Co barrier layer at the GAA nodes is possible. Ru or Mo (ALD or CVD, not plating) will also possibly fill the interconnects & vias between M0 to M3 metal layers for Advanced Logic.

A potential risk factor for the metal chemicals market is increased lead times and price increases for electronic chemicals. Fabs and plating chemical suppliers are not reporting any difficulty obtaining metals for semiconductor plating in 2023, however shortages may occur in the future. Geopolitical tensions with China, for instance, may hinder availability of tin that is mined there. Similarly, nickel imported from Russia and Ukraine may face supply constraints.

For more details on the Semiconductor Metal Plating Chemicals market & supply chains, including profiles on companies such as BASF, Dupont, JX Nippon, Chang Chun Group, and more, go to: https://techcet.com/product/metal-chemicals-for-fe-advanced-packaging/.

To discuss more on the supply-chains for metal chemicals and other semiconductor materials, come talk to TECHCET at the CMC Seminar in Taichung, Taiwan on October 25th. For more information and to register, go to: https://cmcfabs.org/2023-cmc-seminar/.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription services, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

August 22, 2023

Silicon Fabricated Parts Market Forecasting High Growth

Increased layer technology and OLED growth driving demand for silicon parts

San Diego, CA, August 22, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — is forecasting revenues for Silicon Fabricated Parts to decrease by 5% in 2023, reaching a total of US$856 million. This slowdown is due to overall downtrends within the semiconductor industry, alongside lower numbers of wafer starts. TECHCET is forecasting a sharp rebound of near 11% for the Silicon Parts market in 2024, as explained in the newly released Silicon Parts Critical Materials Report™.

Silicon parts purchases from OEMs for new etch and deposition tools grew in 2022 to make up about 50% of all sales. This increase in OEM purchases was due to higher demand for equipment. OEM tool sales are expected to ease over the next 2 years as demand from chip fabs for spare parts increases.

Over the past decade, global polysilicon production capacity has ramped significantly, from 30,000 or so metric tons in the 2000s, to almost 700,000 metric tons currently. However, demand for silicon parts continues to grow steadily, requiring even more additional capacity needs. Beyond 2023, supply tightness for silicon parts is currently expected as etch and deposition steps increase for 3DNAND and leading-edge logic devices. Additionally, strong growth in the OLED market may cause supply chain problems for silicon parts equipment. Semiconductor equipment companies may consider buying parts in advance to alleviate future supply chain bottlenecks.

Higher pricing and lead time issues may also occur without silicon parts capacity increasing. As long-term purchase agreements expire, the price of raw materials has gone up for major suppliers. Additionally, inflation, logistics, and labor shortages will all play a role in the silicon parts segment going forward.

For more details on the Semiconductor Silicon Parts market & supply chains, including profiles on companies such as FerroTec, Coorstek, Tosoh, Mitsubishi Materials, Sungrim, HANA Materials, and more, go to: https://techcet.com/product/silicon-equipment-components-research-report/.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription services, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

August 10, 2023

Semiconductor Sputtering Targets & Metal Markets Status

Supply chain contraction will persist before rebounding in 2024

San Diego, CA, August 10, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — states that the Semiconductor Sputtering Target market will contract to US$1.29 billion in 2023 due to the industry-wide slowdown and lower wafer starts. This decline comes after a strong year in 2022, which grew 8% over 2021 to reach US$1.34 billion. TECHCET is forecasting increased wafer starts in 2024, which will grow the targets market to US$1.39 billion, as described in TECHCET’s new Sputtering Targets Critical Materials Report™.

.

.“The metal ore supply chain for targets is reported to be stable, though it must adapt to higher costs for metal and other process materials,” states Dan Tracy, Sr. Director at TECHCET. In addition, higher energy costs globally continue to impact the mining, smelting, and refining segments of metal supply chains. Many key metals and raw materials also have a critical reliance on sources in China, which has resulted in geopolitical concerns when it comes to supply chain management and planning for metals. With the expected ramp of new fabs in the US, target suppliers are expressing interest in alternative high-purity metal sources from within the US.

In the mid and longer term, “green energy” and “zero emission” objectives will greatly increase demand for Copper, Silver, Tungsten, Cobalt, and other metals. New mines will need to come online to meet this forecasted metal demand, with timelines being 10 years or more for mining exploration to production. Given restrictions and regulations for mining in the West, new mines will likely be located and developed in nations with less stringent mining regulations. This could thwart efforts in the semiconductor supply chain to achieve sustainability targets. Recycle, reclaim, and reuse will also be critical components of future metal supply chains to meet goals for sustainability and zero-emissions.

On the application side for targets, multiple processing layers associated with advanced node logic devices and 3D memory will accelerate PVD target demand with upper layers. Alternative interconnect metallization is expected for 7 nm and below, with increased use of non-PVD (ex. CVD/ALD) for M4 and below. Though, 3D interconnect techniques at advanced logic nodes will result in metallization requirements for back-side Power Distribution Network. This network delivers power by Through Silicon Vias (TSV) to buried power rails based on copper metallization. Growth will also rise for power devices, including SiC device technology, leading to demand for Al, Ti, and backside metallization target applications.

For more details on the Semiconductor Sputtering Target markets & supply chains, including profiles on companies such as Honeywell Electronics Materials, Grikin, JX Metals Corporation, KFMI, Linde, Materion, Tosoh SMD, and more, go to: https://techcet.com/product/sputter-targets/.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription services, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

August 3, 2023

2024 Photoresist Market Forecasted to Rise

EUV and KrF Growing as Advanced Logic and Memory Increase

San Diego, CA, August 3, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — is expected to rebound in 2024, growing 7% to total US$2.57B, following 2023’s slight downturn of -0.9%. Moving forward, the market is expected to stay strong with a 5-year CAGR of 4.1% for 2022-2027, as explained in TECHCET’s new Lithography Materials Critical Materials Report™. “The fastest-growing photoresist products are EUV and KrF, as both are being used with the introduction of new technologies such as advanced logic and memory,” said Karey Holland, Ph.D., TECHCET’s Chief Strategist.

Photoresist materials used for “legacy” nodes (such as I, G, and KrF/248nm) will also support continued growth of the market. EUV volumes are ramping as companies such as Samsung, TSMC, and Intel shift some processes from ArF and ArFi (193nm & 193nm immersion 193i) to a combination of EUV and 193i. Micron and SK Hynix are expected to follow suit.

.

.Increased use of negative tone EUV is driving new trends such as negative tone solvent development and increased pre-wet of the wafers before photoresist application. The growth of EUV negative tone photoresist is also expected to decrease the usage of aqueous developer and edge bead use.

Smaller photoresist companies that support TSMC in Taiwan and Samsung in South Korea are gaining a foothold in local markets due to fab expansions and export restrictions from other international suppliers. Photoresist companies headquartered in Japan currently hold a significant 75-90% share of the photoresist market, though the Japanese government (prior to March 2023) restricted the export of certain photoresist supplies to South Korea and China. While some of these restrictions have been dropped, these geopolitical trade disruptions have pushed along the onshoring of local material suppliers in China, Taiwan, and South Korea.

For more details on the Lithography Materials market trends, supply-chain issues, and supplier profiles on JSR, Shin-Etsu, BASF, Avantor, Brewer Science, Dupont, Eastman, Fujifilm, SACHEM, TOK, Sumitomo and more, go to:

https://techcet.com/product/photoresists-and-photoresist-ancillaries/.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription services, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

July 26, 2023

Materials “Sweet-spot” – ALD/CVD Precursor Supply Chain

Mo may replace HVM applications, which could reduce future WF6 supply strains

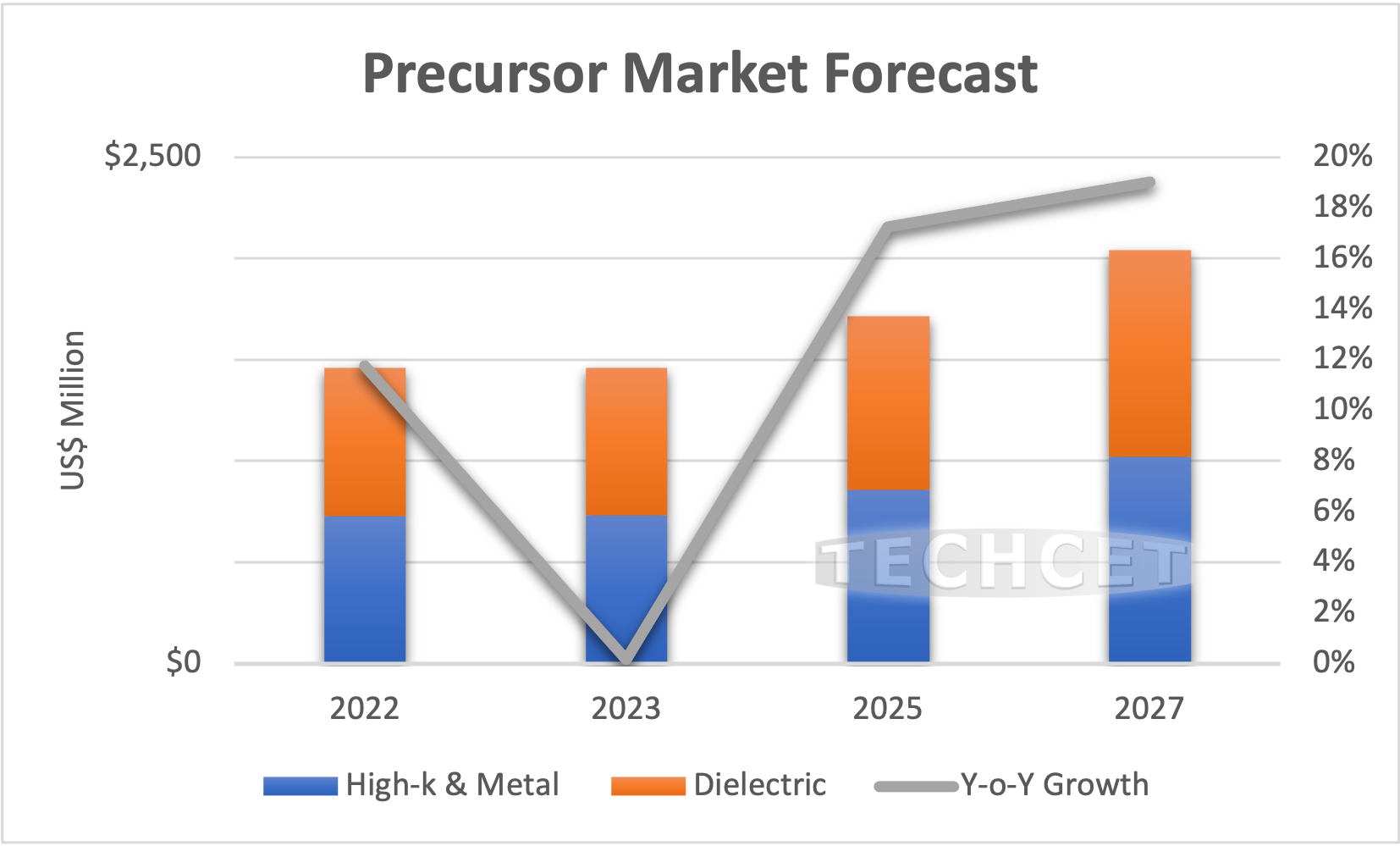

San Diego, CA, July 26, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — has announced that Semiconductor Precursor revenues are continuing to see high growth, with 5-year CAGR’s of 7% for metal, 5% for high-k, and 8% for dielectrics. Growth is influenced by the increasing interest and need for new materials for ALD and CVD processes. Device producers continue to look for new manufacturing solutions designed to improve cost and performance, and ALD/CVD solutions are at the forefront of such efforts.

Tungsten (from WF6 precursor) usage is highly driven by vertical scaling of 3DNAND and increased wafer start numbers in all segments. WF6 supply/demand is expected to stay in balance through 2023. However, TECHCET is anticipating supply of WF6 to become constrained by 2025 with threat of shortage in 2026 (as shown below). Possible shortages could be mitigated if molybdenum (Mo) solid precursors start replacing WF6 and transition from R&D to HVM. Implementation of Mo is still uncertain as fabs will need to see cost and performance equal to, or better than WF6, as indicated in TECHCET’s new ALD/CVD Precursors Critical Materials Report™.

.

.Other critical areas of technology change for improved devices include new materials for transistors such as high-κ gate dielectrics, metal gate electrodes, strain/stress epi of the channel and channel materials, memory cells and high-κ capacitors, interconnect wiring, barriers, seed layers, capping, insulators, and photolithography (with associated patterning techniques). Emerging challenges are driven by continued dimensional scaling addressed with materials (e.g., Hf, Zr, La, Co, Ru, Mo), and processes (e.g., ALD and plasma-assisted methods. For more details on ALD/CVD Precursor market trends, supply-chain issues, and supplier profiles on Adeka, Air Liquide, Entegris, EMD Electronics, Matheson Gases, Linde, Nanmat, Yoke, SK Materials, and more, go to: https://techcet.com/product-category/ald-cvd-precursors/.

To discuss materials including ALD/CVD Precursors, talk to us at the ALD 2023 Conference in Bellevue, Washington on July 23-26. Karey Holland, Chief Strategist at TECHCET, will be there to talk materials. Please email us if you are interested in setting up a time to meet.

New reports are out now for ALD/CVD Precursors, Gases, CMP Consumables and Ancillaries, Photoresist, Silicon Wafers, Wet Chemicals, and Quartz Equipment Components. To learn more, go to: https://techcet.com/product-category/critical-materials-reports/.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription services, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

July 20, 2023

Silicon Wafers Supply Swinging Back to Positive for 2023

Revenues for SOI Wafers remain stable, with high growth forecasted ahead

San Diego, CA, July 20, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — is forecasting a -7% decline for Total Silicon Wafer shipments for the 2023 year due to overall slowdowns in the semiconductor industry. These slowdowns in combination with wafer inventory build has reduced strains on wafer supply/demand in 2023 and allowed for a net positive supply-demand balance. In 2024, total wafer shipments are expected to rebound and grow about 8%, as highlighted in TECHCET’s newly released Critical Materials Report™ on Silicon Wafers.

Previous supply/demand imbalance for 300 mm wafers has been corrected given reduced wafer demand in 2023. Suppliers report high inventory levels, given the industry slowdown.

Through the forecast years, both epitaxial and SOI wafers expect strong growth. 300 mm epi is becoming more critical in advanced logic applications, and shipments are forecasted to grow at a CAGR of 6% through the 2027 forecast period.

All of the top five wafer suppliers (SEH, Sumco, GlobalWafers, Siltronic, and SK Siltron) have announced new greenfield expansion plans, which will lead to ramps in capacity beginning in 2024 and into 2025. However, it is known that some of the expansion projects are being pushed out in the current market environment. Depending on market conditions and the status of Long-term Agreements (LTA), suppliers are expected to ramp capacity in additional phases post-2025 as well. China suppliers also continue to invest to establish a position in the 200 mm and 300 mm wafer segments.

In the longer term, TECHCET is forecasting supply/demand imbalance to stabilize in 2024 and tighten once again in 2025. Into 2026, TECHCET is anticipating another slowdown and subsequent reduction in supply tightness as the natural course of inventory builds. For more details on Silicon Wafers market trends, supply-chain issues and supplier profiles like Eswin, GlobalWafers, Sumco, Siltronic, SEH and more, go to: https://techcet.com/product/silicon-wafers/.

New reports are out now for ALD/CVD Precursors, Gases, CMP Consumables and Ancillaries, Photoresist, Silicon Wafers, Wet Chemicals, and Quartz Equipment Components. To learn more, go to: https://techcet.com/product-category/critical-materials-reports/.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

July 12, 2023

2023 Semiconductor Materials Market Slowing but Resilient

Material growth to resume in 2024 as industry recovers and fabs ramp up

San Diego, CA, July 12, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — announced that the Total Semiconductor Materials market will contract by at least -3% in 2023 given the industry wide slowdown and reported higher levels of inventory in the materials supply chain. This year’s decline will result in revenues for Semiconductor Materials to total US$69.6 billion, down from the US$71.7 reported in 2022. However, leading-edge logic and automotive/power device production will limit the overall decline in materials revenues for 2023.

.

.TECHCET is forecasting a strong recovery in the market in 2024, with total material revenues increasing 8% to almost US$75 billion. CAGR growth over the next 5 years is forecasted to be 4%, which will result in the market reaching US$88 billion by 2027.

The 2023 slowdown has corrected material supply constraints across the supply chain. Though, demand for materials will strengthen as the industry recovers and new fabs ramp up globally. Tightness in supply is expected to resume for 300 mm wafers, epitaxial wafers, some specialty gases, and possibly copper alloy targets. The degree of any supply shortages will be a function of material supplier expansion delays. Some expansion projects have been pushed out given the current slow market environment.

Strong market demand in 2024 and beyond will be driven by advanced photoresist and ancillary chemistries for EUV related processing (20% CAGR) and for 3D NAND fabrication (>5% CAGR). Advanced precursor volumes and revenues will soar for new capacitor and interconnect structures in advanced logic and next generation memory. TECHCET also expects the Specialty Gas market to grow by >7% CAGR through the 2027 forecast period.

To find out more: see TECHCET at SEMICON West at NY CREATES Booth (North Hall 5845) from July 11-13. Lita Shon-Roy, Diane Scott, Dan Tracy, and Kevin McLaughlin will all be there to share market insights and industry updates. Or visit our website:https://techcet.com/product-category/critical-materials-reports/. New reports are out now for ALD/CVD Precursors, Gases, CMP Consumables and Ancillaries, Photoresist, Silicon Wafers, Wet Chemicals, and Quartz Equipment Components.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

June 27, 2023

Semiconductor Metal Plating Chemicals Revenues Slowing in 2023

Increases in Interconnect Layers and Advanced Packaging Use to Revamp Growth

San Diego, CA, June 27, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — is estimating that the market for Semiconductor Metal Plating Chemicals will reach US$987M in 2023, a 2% decrease from 2022. The decrease in the 2023 forecast is due to lower expectations for the amount of overall wafer starts. Additionally, the decline may be influenced by the overbuying of materials in 2020-2021 and subsequent inventory corrections within the market. The largest revenue within the 2023 metal plating chemicals segment is forecasted for copper, with $373M for copper advanced packaging wiring, and $614M for interconnect copper plating. Despite the current slowdown, the overall 2022-2027 CAGR is expected to be a positive 3.7% for advanced packaging and 3.3% for interconnect metal chemicals, as highlighted in TECHCET’s new Quarterly Update to the Metal Chemicals Critical Material Report™.

.

.Current economic environments will likely cause overall semiconductor device production to be reduced until at least the end of 2Q 2023. However, demand for more devices used for electric cars, faster charging stations, stronger data storage, and more applications, are expected to produce higher density and lower power devices in the coming years. Simultaneously, the US Chips Act and similar investments by Europe and China will push these developments along. This will drive increases in metal interconnect layers and advanced packaging use, which should revamp growth in the metal chemical plating market.

TECHCET is following new technologies for metal deposition, such as the introduction of Ruthenium (Ru) or Molybdenum (Mo) (or Vanadium (V) or Iridium (Ir)) to possibly displace the Tantalum (Ta) & Cobalt (Co) barrier layers at the smallest interconnect dimensions for the GAA nodes. Ru or Mo (ALD or CVD, not plating) will possibly fill the interconnects & vias between M0 to M2 metal layers for Advanced Logic. Possible wafer backside connections to the backside power rail will add Copper (Cu) plating to possibly match or exceed the Cu plating lost at the M8-M14 layers.

For more details on Metal Deposition market trends, supply-chain issues and supplier profiles like Dupont, Chang Chun Group, JX Nippon, Moses Lake Industries, MacDermid and more, go to: https://techcet.com/product/metal-chemicals-for-fe-advanced-packaging/ or https://techcet.com/product/sputter-targets/.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

June 15, 2023

Following All-Time Highs of 2022, Semiconductor Quartz Equipment Components Expected to be Down in 2023

San Diego, CA, June 15, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — announced it expects a slight downturn in the Quartz components market, following an all-time high in 2022. Fabricated quartz equipment components revenues reached an estimated US$2.14 billion in 2022, growing 24.5%, above 2021. The huge growth in components was a result of continued demand in new OEM equipment in 1H2022. However, by Q4 2022 and into H1 2023, the industry began down shifting their investments. Luckily, previous 2022 purchases and backlogs are expected to buoy up the components market for the first half of 2023. “Orders in Q1 2023 declined QoQ, and as we move into 2H2023, the components market is expected to slow,” stated Lita Shon-Roy, TECHCET’s President/CEO. Most of the orders from 2022 will have been shipped by 2H2023 and new orders will be down YoY, resulting in an overall -6% decline for 2023, as shown in TECHCET’s newly released Quartz Equipment Components Critical Materials Report™. Despite this decline, new fab expansions are expected to revamp growth in the future, as seen from the 5% CAGR for 2022-2027.

.

.The goal of most fabricators during the 2021-2022 time frame was to simply keep making as much quartz product as possible with existing production facilities. “Solving production and logistic issues, hiring and training new personnel, and acquiring new production equipment were all pathways that quartz fabricators used to incrementally push up their capacity,” Lita Shon-Roy stated. Now in Q2 2023, the industry has shifted gears from full scale production to planning for fewer purchase orders for the remainder of the year. Though the industry is slowing this year, quartz demand is still expected to ramp in 2024 for newly advanced process nodes, OEM needs, and legacy requirements.

For more details on the Quartz Equipment Components market trends, supply-chain issues and supplier profiles like Tosoh Quartz, FerroTec, Maruwa, Shin-Etsu, Heraeus, QSIL, Feilihua, DSTechno, Kumkang Wonik and more, go to: https://techcet.com/product/quartz-equipment-components/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

June 6, 2023

CMP Consumables Facing Market Correction after Strong 2022

Advance logic developments drive new CMP consumables opportunities

San Diego, CA, June 6, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — is forecasting a -2.4% reduction in the 2023 CMP Consumables market composed of pads and slurry following strong performance in 2022. This slight drop is the result of an oversupply in DRAM and general corrections within the market. Despite the drop, the CMP Consumables market is expecting an overall upward 5-year CAGR of 5.2%, as mentioned in the the newly released CMP Consumables Critical Materials Report™. During this period, CMP Consumables for copper, tungsten, and oxides will continue to represent most of the market. The largest growth rate in demand over the next 5 years is expected for new metals (Co, Mo, and Ru) pads and slurry combined.

.

.Developments in new methodologies like GAA/Nanosheet, ForkSheet in logic are driving a new set of challenges for thinner layers and better thickness control. Additionally, new BEOL materials, such as cobalt, ruthenium, molybdenum are being evaluated to replace W and some minimum dimension Cu interconnects levels. Because of this, new CMP consumables are required to process these materials.

Device makers are continuing to look for ways to reduce consumables costs. In the current market climate with high inflation rates and the high degree of customization, there is little chance that prices will go down. Possible supply chain disruptions due to geopolitical events in China and Russia could also cause delays and price increases as suppliers work to qualify alternate sources of supply for raw materials that they were importing from these countries. Despite these hurdles, there could be an upside for CMP consumable suppliers as “local” equipment suppliers gain traction since they will need to develop process recipes, which could result in an increase in consumables demand.

For more details on the CMP Consumables market segment and growth trajectory, including profiles on suppliers like 3M Company, Anji Micro, Asahi Glass, Ace Nanochem, JSR, Fujifilm, EMD Electronics, DuPont and more, go to:

https://techcet.com/product/cmp-slurry-and-pads-only/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

June 1, 2023

Electronic Gases Demand to Increase as Semiconductor Fab Expansions Move Forward

Critical gases like B2H6 and WF6 may face supply constraints

San Diego, CA, June 1, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — is forecasting an upward 5-year CAGR of 6.4% for the electronic gas market, as indicated in the newly released Electronic Gases Critical Materials Report™. This positive forecast in electronic gases is primarily due to expansions within the semiconductor industry, with leading-edge logic and 3DNAND applications being the most impactful to growth. As ongoing fab expansions come online in the next few years, additional supply of gases will be necessary to accommodate demand, hence upping market performance for gases. In the US, there are currently six major chipmakers planning to build new fabs: GlobalFoundries, Intel, Samsung, TSMC, Texas Instruments, and Micron Technology.

.

.Supply constraints for electronic gases may appear as demand increases are expected to outpace supply. For example, diborane (B2H6) and tungsten hexafluoride (WF6) are both critical for manufacturing various types of semiconductor devices such as logic IC, DRAM, 3DNAND memory, flash memory, and more. Because of their critical role, they are expected to see rapid demand increase as fabs ramp up. Some Asian suppliers are now taking the opportunity to fill these supply gaps within the US market.

Disruptions in gas supply from current sources have also heightened the need to bring new gas suppliers into the market. Ukrainian suppliers of crude neon, for example, are currently no longer functional due to the Russia War, and may be out permanently. This has placed a severe constraint on the neon supply chain that will not be alleviated until new supply sources comes online in other regions.

“Helium supply is also at high risk. The US BLM transferring ownership of helium stores and equipment may interrupt supply as equipment may need to be taken offline for maintenance and upgrades,” states Jonas Sundqvist, Senior Analyst at TECHCET. Unfortunately, there has been little to no new helium capacity built over the past year, with the exception of Russia, to make up for future demand growth and any supply chain disruptions. Russia’s capacity continues to be questionable given the war. Additionally, TECHCET is currently anticipating potential shortages for Xe, Kr, NF3, and WF6 over the next few years unless additional capacity is brought on line.

For more details on the Electronic Gases market segment and growth trajectory, including profiles on suppliers like Adeka, Air Liquide, Entegris, Linde, TNSC, and more, go to: https://techcet.com/product/gases/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

May 24, 2023

Semiconductor Chemical Revenues Fall as Energy Prices Rise

Wet Chemical market decline follows wafer start slowdown

San Diego, CA, May 24, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — is forecasting 2023 semiconductor wet chemical revenues to hit $5.2B, a 2% decrease from 2022. This forecast follows wafer start trends, which are also expected to decline by about 3% in 2023. The slowdown is also attributable to rising energy prices and instability from the Russia-Ukraine war, as highlighted in TECHCET’s newly published Wet Chemicals Critical Materials Report™. The strongest of the wet chemicals segments is from phosphoric acid, due to growth in the 3DNAND market. The overall market is forecasted to rebound in 2024, with the 2022-2027 CAGR being 3.9%, as shown in the graph below.

.

.

“2023 is teaching us that a holistic approach to the chemical supply chain is required to stay competitive,” states Dan Tracy, Sr. Director at TECHCET. Tracy added, “to be successful in the wet chemicals market, one must be actively involved in all stages of the supply chain.” For example, shortages due to refinery shutdowns affects the cost and availability of multiple chemicals such as IPA and sulfuric acid. Additionally, shortages of fluorspar affect the availability and cost of HF and BOE.

Chemical price increases have occurred due to higher pricing and restrictions of natural gas and petroleum used for power in chemical manufacturing. For example, costs of European electronic chemicals have increased due to rises in the cost of natural gas. Although these natural gas costs have come down from its highs of 2022, chemical prices still remain higher than before the Russia war. Similar trends have been observed in other chemical manufacturing regions over the past two years.

For more details on the Wet Chemicals market segment and growth trajectory, including profiles on suppliers like BASF, Chemtrade, Dupont, Eastman, Fujifilm, and more, go to: https://techcet.com/product/specialty-cleaning-chemicals/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

May 16, 2023

ALD/CVD Precursors – Better Times Ahead

Market expected to rebound with memory pricing recovery

San Diego, CA, May 16, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — is forecasting semiconductor precursor revenues, both for high-ƙ metal dielectrics and low-ƙ dielectrics, to increase in the 2nd half of 2023, rebounding from the current 0% growth rate. The current market flattening is due to reduced memory pricing in production (DRAM and 3DNAND), as explained in TECHCET’s ALD/CVD Precursors Critical Materials Reports™. In 2027, TECHCET expects the revenues of both the high-ƙ and low-ƙ dielectric precursors to rebound significantly, reaching ~19% growth, as shown in the graph below.

The market is forecasted to also rebound from the current wafer start downturn in 2024. With expansions in 2nm and 3nm logic devices, logic wafer starts below 45nm can reach >7% CAGR in 2027. Additionally, logic growth using more mask layers will drive the demand for metal and dielectric precursors related to patterning and low-k. DRAM is also undergoing a transition to EUV (ALD/CVD hardmasks). Continued scaling of 3DNAND by all global fabricators to above 352-368 layers (using four stacks) continues to move even higher, with expectations of >500 layers by 2030. This also continues to drive the need for dielectric stack deposition, high aspect ratio etch (RIE), and deposition (ALD).

Full implementation of High-k/Metal Gate is driving demand for hafnium precursors as well. This has led to continued supply chain issues for hafnium, especially from major surges in aerospace industry demand. While many other strategic metals and rare earths used for semiconductor production primarily rely on China, hafnium does not. “China currently produces hafnium to satisfy its own demand, and demand from the West is met by production from France, the US, and ongoing expansion in Australian mining operations in the New South Wales Dubbo project,” says Jonas Sundqvist, Senior Technology Analyst at TECHCET.

For more details on the Precursor market segment and growth trajectory, including profiles on suppliers like Adeka, Air Liquide, Entegris, Hansol Chemical, and more, go to: https://techcet.com/product-category/ald-cvd-precursors/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

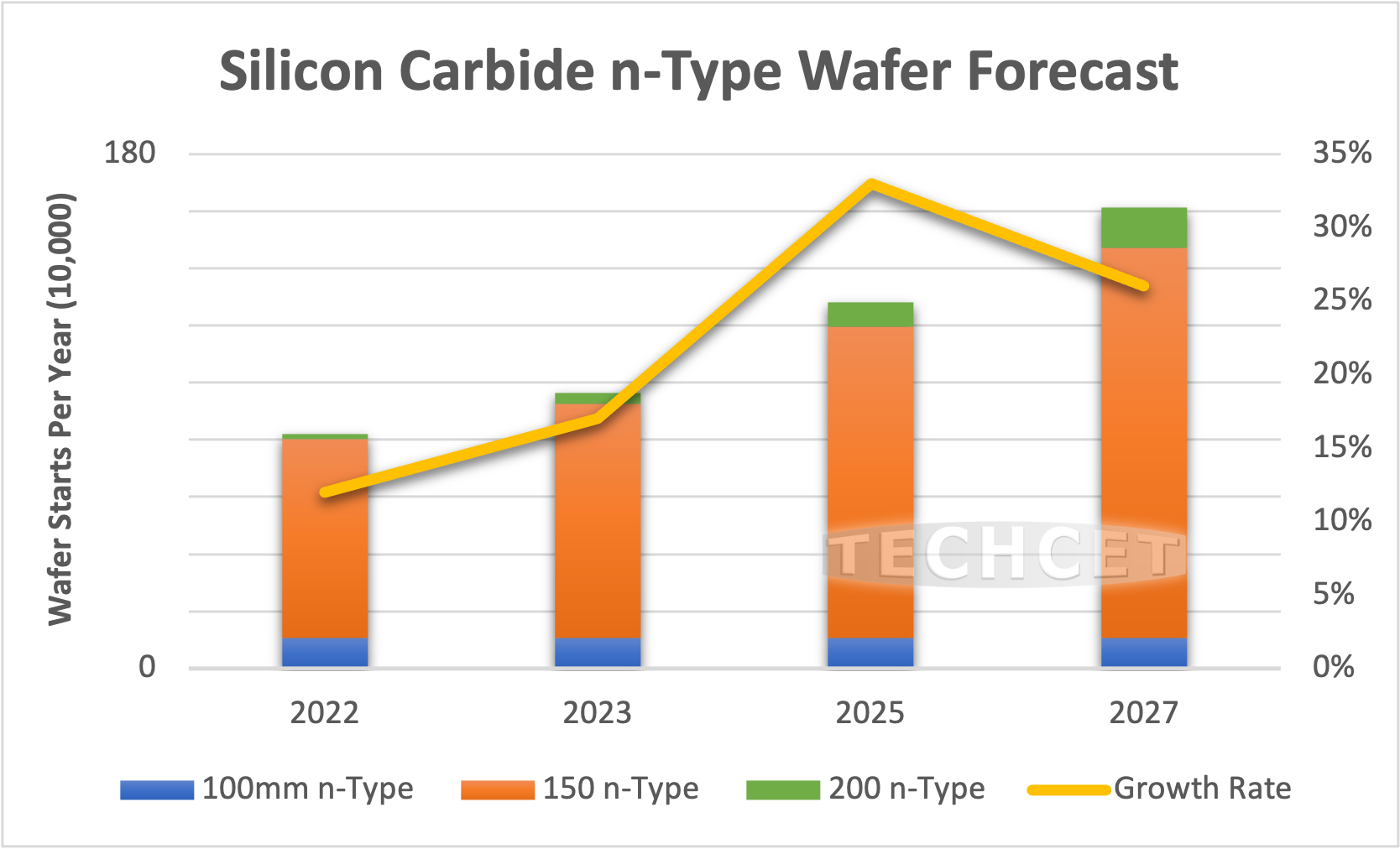

May 9, 2023

Silicon Carbide (SiC) Wafer Supply Gets Squeezed

Growing Demand Persists as Silicon Wafers Reach Its Limits

San Diego, CA, May 9, 2023: TECHCET— the electronic materials advisory firm providing business and technology information on semiconductor supply chains —is forecasting continued strong growth for silicon carbide (SiC) wafer through 2023, despite the slowdown in the general global economy and other semiconductor materials markets. In 2022, the SiC N-type Wafer Output Market grew ~15% over 2021, totaling 884k wafers (150 mm equivalent), as highlighted in TECHCET’s new Silicon Carbide Wafers Materials Report. This market is expected to grow even further in 2023, reaching 1072k wafers (just over 1 million 150 mm equivalent) growing ~22% over 2022, as shown below. The overall 2022-2027 CAGR is estimated to be approximately 17%.

High demand for SiC wafers comes as a result of silicon-based power devices approaching its physical limits, particularly for high-speed or high-power applications. Wide bandgap semiconductors represent the most promising of the current alternatives, and SiC is at the forefront in terms of both materials properties and supply chain maturity. Additionally, demand from electric vehicles, charging infrastructure, green energy production, and more efficient power devices in general is pushing demand higher for SiC.

While SiC is growing increasingly popular, chemical properties of the material have made it difficult to process boules into actual wafers. This has led to undersupply in the SiC wafer market. In an effort to increase boule supply over the past several years, a significant number of companies entered into or announced major expansions in SiC boule growth capacity, but very few companies have actually entered the wafering services market.

Some of this gap is being addressed by the vertically integrated SiC device companies, such as Wolfspeed, ON Semiconductor, and ST Microelectronics, who are able to balance their own production capacities internally. Other companies are attempting to address the gap by offering process services, such as X-trinsic and Halo Industries.

For more details on the Silicon Carbide (SiC) Wafer market segment and growth trajectory, go to: https://techcet.com/product/silicon-carbide-wafers/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

April 13, 2023

US CHIPS Act- Opportunities and Issues for the US Semiconductor Industry

By Dan Tracy, Sr. Director, TECHCET

San Diego, CA, April 13, 2023: Countries around the world view semiconductor manufacturing as vital for economic growth and national security, as devices power all aspects and sectors of the global economy. Across the globe, politicians, government officials, and semiconductor industry leaders deem to revitalize local semiconductor manufacturing through government-initiated programs and subsidies to strengthen or re-shore domestic semiconductor manufacturing. Some examples are shown in the table below.

| Country/Region | Government Initiative |

| United States | US Chip Act: US$52B program, plus local and state programs |

| Europe | European Chips Act: proposed €43B. Proposed though not finalized |

| Japan | $2.8B; up to 1/3 for chips (power, controllers, analog); up to ½ for raw materials |

| South Korea | Korean Chips Act: financial, regulatory, and tax incentives totaling 340 T Won (~US$259B) |

| China | US$1.4T pledged for over 5-10 years |

For the US, the current CHIPS Act is reminiscent of initiatives in the late 1980s to launch SEMATECH, a partnership between the government and a number of US chipmakers, to counter the growing dominance to device makers in Japan. The SEMATECH initiative was successful in re-establishing the prominence of the US domestic chip making industry; however, globalization and outsourcing/foundry opportunities resulted in strong industry investments across Asia since SEMATECH was launched.

As such, it is estimated that the US chip fabrication global share declined from about 37% in 1990 to about 10% to 12% by 2020. While the share has declined, US semiconductor production still entails 2.3 million Wafer Starts per Month capacity (200 mm equivalent) spread over 27 300 mm production lines; roughly 40 200 mm production lines; and numerous specialty lines producing MEMs/sensors and optoelectronic components.

So, while there is a sizeable chip manufacturing base in the US, politicians and industry leaders seek to revitalize and restore the prominence of chip fabrication in the US given the declining market share and strategic importance of the industry. Plans for such have been in the works since 2019, under the name CHIPS for America Act, and have garnered, for the most part, bipartisan political support. The lawmaking process does involve back-and-forth and negotiations, so took some time for the legislative process to produce a final bill.

The US CHIPS Act signed into law by President Biden in August 2022. The signed CHIPS Act includes $39 billion in tax benefits and other incentives for companies, including non-US headquartered companies, to build new chip manufacturing plants in the US. The CHIPS Act is a 5-year funding program that includes the following:

- For fiscal year 2022, US$19 billion has been allocated, “including the US$2 billion for legacy chip production funding. US$5 billion each year from FY23 through FY26.”

- “Also US$11 billion appropriated over 5 years for R&D and workforce development programs, and US$2 billion appropriated for on-shore, university-based prototyping, lab-to-fab transition of semiconductor technologies, etc.”

Of interest and concern to companies receiving CHIPS Act support is Section 103 of the legislation, which “stipulates that recipients of Federal incentive funds are prohibited from expanding or building new manufacturing capacity for “certain advanced semiconductors in specific countries that present a national security threat to the United States.” This stipulation has raised concerns and issues concerning possible recipients that currently have manufacturing in China. This is a subject of on-going negotiation between companies and governments with US officials.

With all of that stated, various US government departments and agencies worked on implementing a plan and have rolled out the programming for companies to apply for funding support. The first phase of funding occurred in February of this year and is targeted for device makers. The second phase is expected to roll out by May and will be open to supply chain participants, such as semiconductor material suppliers.

The implementation of the CHIPS Act has generated considerable interest across the industry and has spurred numerous investment announcements over the past couple of years and has already resulted in construction and other activities to move projects forward. The below map highlights some of the major fab announcements and locations across the US. Projects include new fabs being built by TSMC and Intel in Arizona. Intel has longer term plans for fabs in Ohio. In addition, Texas Instruments is constructing a new fab in Texas and announced plans for a new one in Utah. Samsung will also invest in Texas. Micron has plans for new fabs in Idaho and New York.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

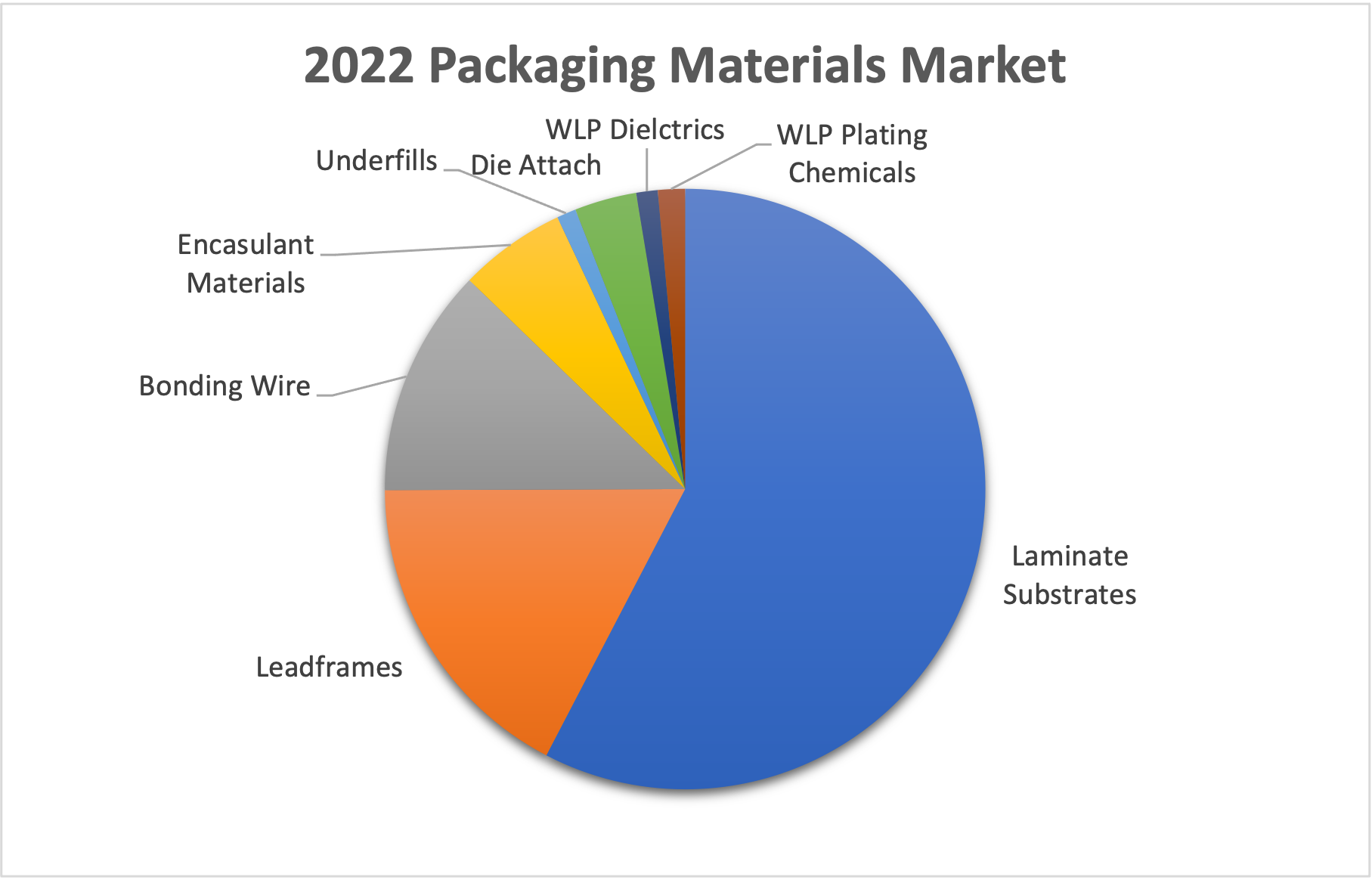

March 30, 2023

New Global Semiconductor Packaging Materials Outlook – US$26 Billion market to approach US$30 Billion by 2027

San Diego, CA, March 30, 2023: TECHCET and TechSearch International, Inc. recently announced that the market for Semiconductor Packaging Materials totaled US$26.1 billion in revenues for 2022, and is forecasted to approach US$30 billion in 2027. For 2023, packaging materials are expected to decline about -0.6% given the forecasted slowdown in the overall semiconductor industry. Recovery is expected in the second half of 2023, pointing to growth in 2024 that should increase packaging revenues by 5% that year, as indicated in the recently completed 10th edition of the Global Semiconductor Packaging Materials Outlook (GSPMO).

The GSPMO Report is a comprehensive market research study covering key segments of the semiconductor packaging materials market. Available for purchase exclusively through SEMI, this materials report includes a comprehensive look at the market size and growth trends of key packaging materials including substrates, lead frames, bonding wire, encapsulation materials, underfill materials, die attach, solder balls, wafer level package dielectrics, and wafer-level plating chemicals.

Beginning in 2020 through the pandemic, packaging materials experienced strong unit and revenue growth. Changes in end market demand coupled with strained supply chains and logistic constraints boosted pricing for materials across the supply chain. Higher raw material costs, rising energy prices, and soaring logistics costs pushed material suppliers to raise prices, which were passed on to customers. In addition, many material segments were constrained in terms of available production capacity. Being squeezed on rising costs, numerous suppliers limited their capacity related investments. Additionally, as demand rose during the pandemic, supply chain and logistics constrained how rapidly suppliers could expand capacity as available manufacturing equipment was also limited.