Consumables Industry Feeling a Swell in Demand

CMP Slurry and Pad Market Forecasted 13% Growth for 2021

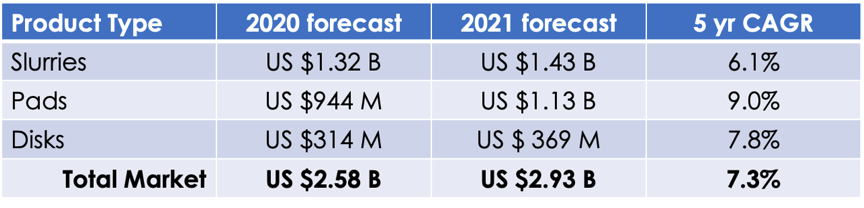

San Diego, CA, January 6, 2022: TECHCET—the electronic materials advisory firm — announced that CMP consumables demand is surging upward as device makers continue to push up production, and equipment suppliers scramble to build their backlog. “Shipments of CMP pads and slurries are at a 10-year high,” states Lita Shon-Roy, President of TECHCET.

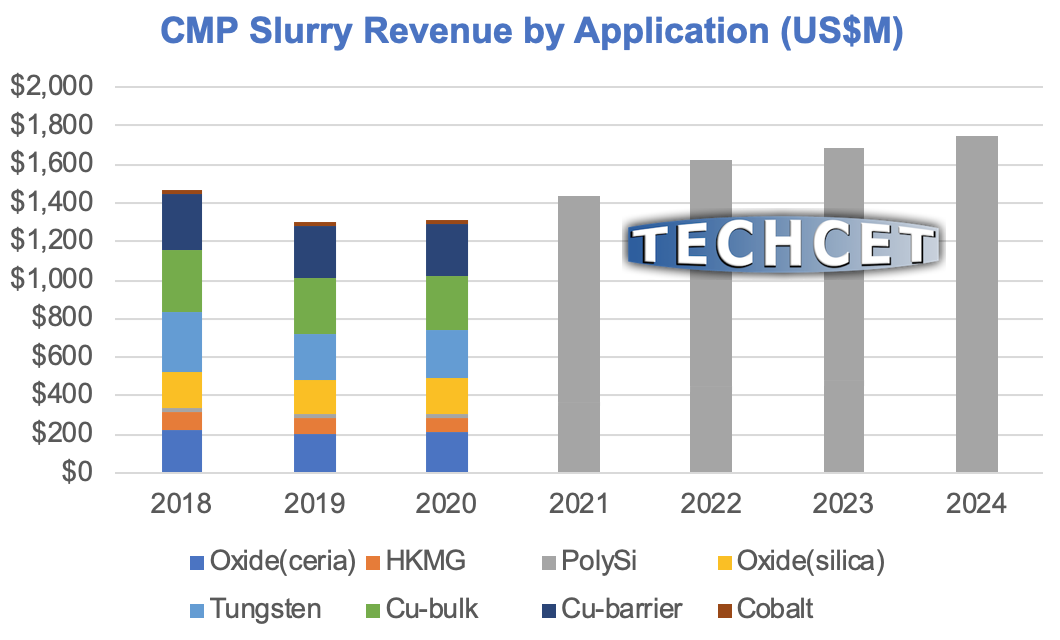

The 2021 revenue forecast for the CMP slurry market is a TAM US$1.89 B growing 13% over 2020, with a 5-yr CAGR 8.8%; from TECHCET’s analysis of CMP Pads & Slurry markets. The strongest segments are Cobalt and PolySi slurry, while the Cu, Tungsten, and Oxide segments hold the largest revenue. Under normal market conditions prices are being driven down by competition and pressure from device makers persists in attempts to reduce costs. However, during this high growth period, we expect prices to hold steady or increase slightly. Slurries for advanced products will support higher prices because they are not as readily available.

The 2021 revenue forecast for the CMP pad market is a TAM of US$1.15B, also growing 13% year over year. A 6.2% CAGR is expected (2020 to 2025); lower growth than the slurry market due to increased pad life and price competition from China. The largest growth segments include Cobalt and PolySi pads, while oxide, tungsten, and Cu bulk pads make up the majority of the revenues. Due to the strength of the major shareholders like DuPont and Cabot in the pad market, pad prices will hold firm. However, if the new entrants in China are starting to gain position in their local market, which will lead to price competition in China. As for other process materials, shipping costs of CMP consumables have dramatically increased, which will be passed on to the customer.

Supply Chain Concerns:

- Transportation delays, huge price increases for overseas shipments, warehousing challenges are all resulting in higher costs and quality issues for some slurries.

- Equipment suppliers are seeing long-lead times on sub-components and some process materials which are slowing down the expansion plans of device makers.

- Higher than expected materials demand is making the supply-chain tight and may ultimately result in shortages

- Increasing dependencies on Asian suppliers of chemicals pose a greater risk of supply-interruption given ongoing logistics problems caused by persistent COVID19 and variants.

For more information about the CMP Slurry and Pad market, check out TECHCET’s report on CMP Slurry, Pads & Conditioners:

hhttps://techcet.com/product/cmp-slurry-and-pads-only/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm focused on process materials supply-chains, electronic materials business, and materials market analysis for the semiconductor, display, solar/PV, and LED industries. Since 2000, the company has been responsible for producing the Critical Material Reports™, covering silicon wafers, semiconductor gases, wet chemicals, CMP consumables, Photoresists, and ALD/CVD Precursors. The Critical Materials Council (CMC) of semiconductor fabricators is a business service offered by TECHCET, and includes materials supplier Associate Members. For additional information about reports, market briefings, CMC membership, or custom consulting please contact [email protected], +1-480-332-8336, or go to www.techcet.com.

ALD/CVD Market Accelerates Due to New Fab Expansions

Will ALD/CVD Precursor Demand Outgrow Wafer Starts?

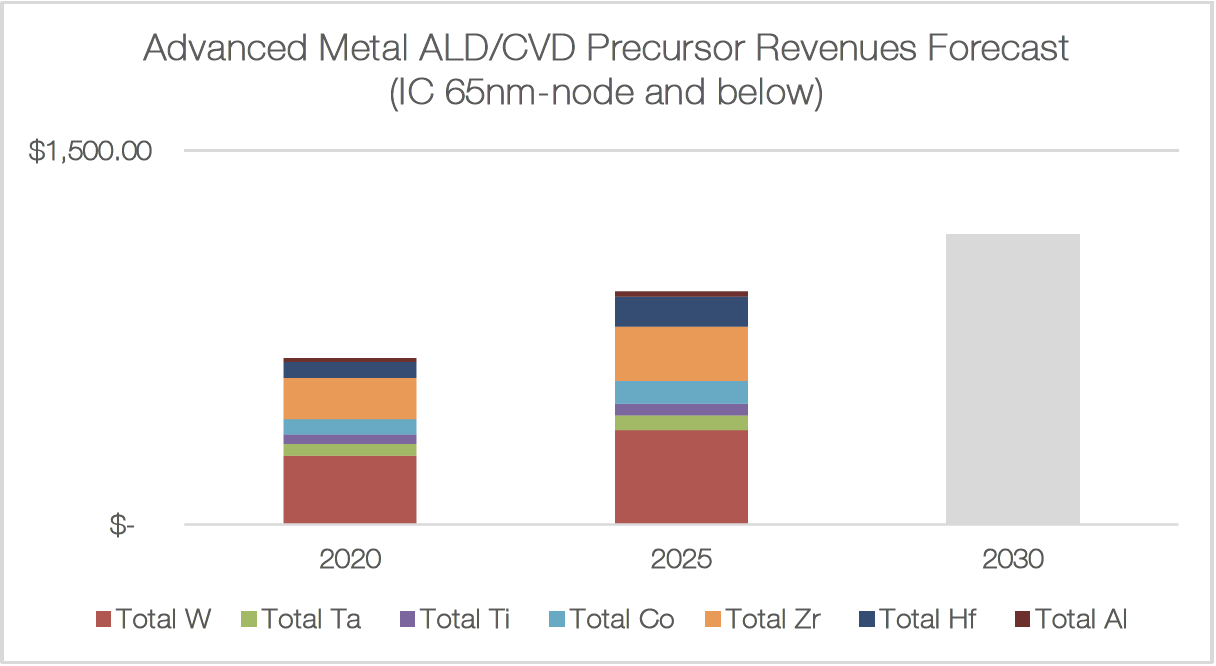

San Diego, CA, December 20 2021: TECHCET—the electronic materials advisory firm — announced that the ALD/CVD markets will accelerate in growth due to the many new fab expansions in leading-edge Logic and Memory. As a result, the high-K and Metal Precursor markets are expected to have high growth for Hf, Co, and Tungsten precursors. The expected market is forecasted to increase 17%, reaching US$713 Million. By 2025, the market will reach US$1,050 Million. The dielectric precursor market segment will also experience high growth for the same reasons. This segment will grow 20% in 2021 to reach US$650 Million, and by 2025, is forecasted to be US$875 Million, as indicated in TECHCET’s Critical Materials Reports on ALD/CVD Precursors.

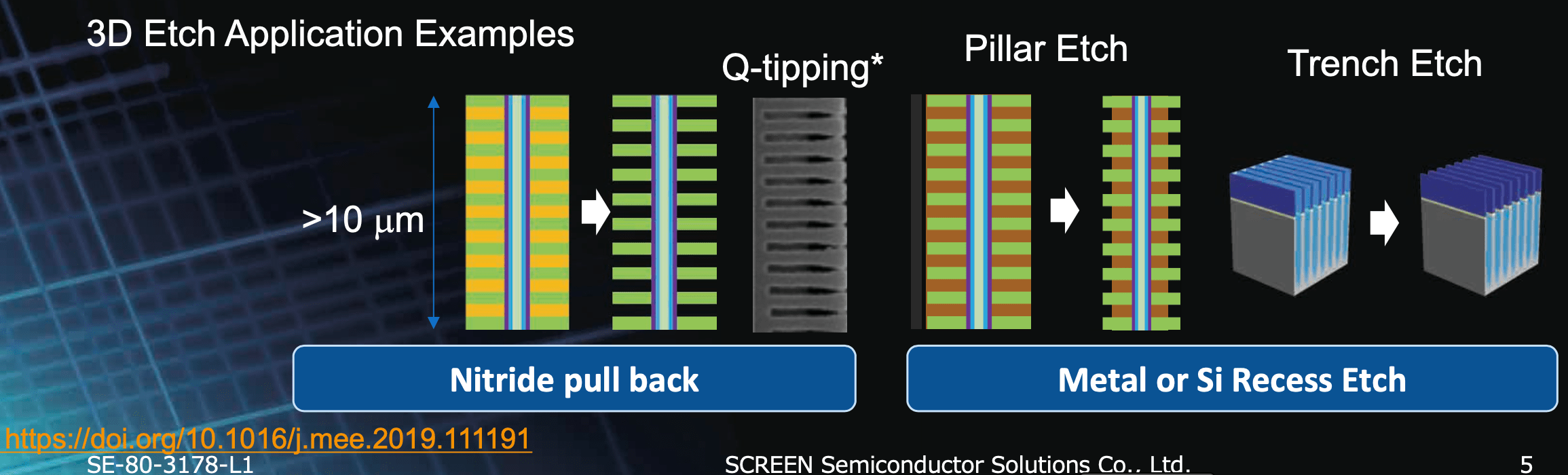

The disruptive change in NAND Flash scaling reaches upward as layered stacks have increased the demand for several CVD and ALD processes:

- PECVD dielectric stack, 32 to 192L

- Tungsten (WF6) gates

- Contacts get deeper, and stacked modules are implemented

- Multiple ALD processes within the ONO/MG stack

CVD/ALD precursor demand outgrows wafers starts because multiple new processes are added node by node for patterning and 3D-stacked scaling and replacing other deposition techniques such as PVD, Spin-on-Dielectrics, and Plating.

The industry is also getting geared up for the planar DRAM transition to 3D-DRAM, which may, just like NAND, be a growth driver for PECVD, ALD, and Etch. However, 3D implementation is on the horizon, and until then, many more nodes of continued classical DRAM scaling are being executed according to industry roadmaps. GAA-FETs will increase opportunities for Epi Si/SiGe multi-stacks. CEA-Leti has demonstrated a 7 Si/SiGe level stack and may use double exposure EUV. Current 3D-NAND scaling is good to go for 5 -years.

For more information about the ALD/CVD market, check out TECHCET’s CMRs on ALD/ High-K Metal and Dielectric precursors reports:

ALD/ High K Metal Precursors: https://techcet.com/product/high-kald-precursors/

Dielectric Precursors: https://techcet.com/product/dielectric-precursors/

To see all press releases: CLICK HERE

2021 Silicon Parts Demand Outstrips Supply as Market Grows >30%

Parts Revenues Expected to Exceed US $900M

San Diego, CA, November 19, 2021: TECHCET—the electronic materials advisory firm — announced silicon parts demand is outpacing supply given pandemic-induced needs for increased safety stocks and high chip production. Even if the pandemic subsides next year, the supply tightness is expected to continue beyond 2022 as parts will be needed to support growing 3DNAND and leading-edge logic device production.

Top Concerns About Supply Availability

- Silicon Parts capacity is likely to remain below demand for the next year as equipment and ingot materials needed to increase volumes are experiencing long lead-times 2-3X normal.

- Strong growth in 3DNAND and advanced logic devices is expected to drive healthy parts revenue growth through 2025, growing 8.7% per year (CAGR 2020-2025)

- The OLED market, which also depends upon silicon parts, is experiencing strong growth adding to the supply availability issues

As identified in TECHCET’s latest Critical Materials Report™ on Silicon Equipment Components, these concerns about supply availability are revealing opportunities for smaller and potentially new fabricators. IDMs are increasingly receptive to engaging with smaller suppliers in hopes of alleviating supply-chain shortages.

Opportunities for Fabricators of Si and SiC Parts

- The upturn in equipment components sales stimulates opportunities for smaller fabricators, “Mom & Pop” shops, that can cater to requests from larger fabricators or IDMs that own the parts designs. This is most prevalent in Asia.

- The shorter lifetime and potentially lower cost of ownership of silicon parts compared with CVD SiC parts are essential factors that will continue to stimulate a transition away from silicon to CVD SiC. Additionally, because SiC is not dependent on the silicon ingot supply-chain, CVD SiC may also have better availability over the next few years.

2021 is estimated to be up 33% to total $911M in 2021, an unprecedented 2nd year of high growth.

For more information on the silicon parts market, check out our new Critical Materials Report™ on silicon parts: https://techcet.com/product/silicon-equipment-components-research-report/ which includes detailed profiles on Applied Ceramics, CoorsTek, Daewon, DS Techno, FerroTec, Global Wafers, HANA Materials, Hayward , Quartz Materials/ Sungrim, Sanwa, Schunk Xycarb, Silfex, SKC Solmics, Techno Quartz, WorldEx/ WCQ, and others.

To see all press releases: CLICK HERE

TECHCET’S 2022 CMC CONFERENCE ANNOUNCES CALL FOR PAPERS

TECHCET announces a call for papers for the upcoming 2022 CMC conference – “Mission Critical Materials Keeping Pace with Chip Supply & Demand”. The Conference will focus on challenges of materials and manufacturing of semiconductor devices – those materials issues most critical for today and those needed to be solved for the future.

TECHCET is looking to find the best original work from all areas of the semiconductor industry pertinent to materials. To submit a paper for consideration, please send a 1-page abstract focusing on critical materials supply dynamics to Jonas Sundqvist at [email protected]. The call for papers deadline is January 15, 2022.

The conference is currently being planned to be in person in Phoenix, Arizona from April 28-29, 2022, however, it is subject to change based on COVID-19 guidelines and may become virtual if the situation arises.

The Critical Materials Council (CMC) Conference is a 2-day event providing actionable information on materials and supply-chains for current and future semiconductor manufacturing. Unlike other conferences, the CMC Conference provides practical information addressing “How-to” not just “What.” Solutions to process challenges and materials-related issues are a key focus for the CMC conference presenters. Equally important focal points include business and supply-chain trends and materials needed for emerging technologies.

2022 CMC Conference welcomes submissions to cater to our 4 Sessions:

- Global Issues & Trends Impacting Materials

- Immediate Challenges of Materials and Manufacturing

- Emerging Materials in R&D and Pilot Fabrication

- Heterogenous Integration& Advanced Packaging Materials

Material areas of consideration include front end and back end process materials and equipment components, including: wafers & substrates, electronic gases, chemicals, CMP consumables, sputter targets, precursors, metal chemicals, photoresist and other lithography materials; packaging materials; and equipment components, with emphasis on quartz, SiC, and ceramics.

For more information on our 2022 CMC Conference: CLICK HERE

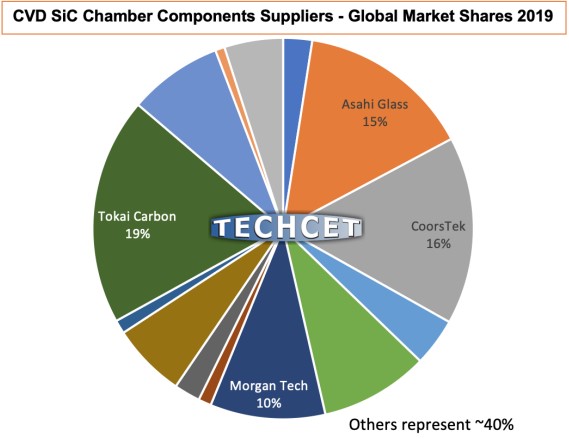

Ceramics/SiC Market Expected to Reach US $2.00B

Will Aluminum Nitride & SiC Markets Continue to Grow?

San Diego, CA, October 25, 2021: TECHCET—the electronic materials advisory firm — announced that the 2021 worldwide ceramics parts market for fabricated ceramic parts is expected to reach US$2.00B, growing 37+% from 2020, driven by semiconductor production growth and spending on new fab equipment. The market will experience a 13% CAGR from 2020 to 2025, which aligns with forecasted fab construction projects and fab expansions globally. Ceramic demand looks very positive; however, ceramic material production capacity is challenged to meet volume requirements for newly advanced process nodes in the midst of strong growth from all device segments.

Currently, the industry is grappling with a chip shortage situation caused by two factors:

- Ongoing demand for chips that support computing and mobile applications that arose during the COVID19 pandemic

- The resurgence of the automotive market that had gone dormant during the first 6 months of 2020 when the COVID19 pandemic began

As indicated in TECHCET’s newly released “Critical Materials Report™ on Ceramic Equipment Components,” automotive chip applications are a key driver of 200 mm chip production and subsequently 200 mm parts fabrication. High growth in this area is requiring 200 mm parts fabricators to increase production volumes at a surprising rate, suspected to be even higher than 300 mm this year. 150 mm fabrication, although older technology, has more available capacity than 200 mm. Parts fabricators are consequently increasing instead of decreasing 150mm parts production.

Aluminum nitride, AlN, has become a highly popular ceramic material for heater applications and heated wafer chucks. With increased usage in new systems, AlN consumption is expected to increase over the next several years. Being that it is produced by less than a handful of suppliers, AlN purchasers will always have a difficult time with lead-times with the OEM equipment market heats up again.

High purity, high density (low porosity) homogeneous materials such as AlN, SiC, CVD SiC, and polysilicon will flourish in new etch, PECVD, ALD, and thermal processing applications, where low defect and high thermal uniformity performance is critical. Over the next 5 years, the AlN and SiC markets will continue to exhibit stronger growth than Alumina and other ceramic materials due to needs for increased productivity, evolving intellectual property rights, reduced defects and process requirements for next-generation thermal processes.

Companies that participate in ceramics and SiC market segments include: Ferrotec, Coorstek, SK Solmics, Hana Materials, Morgan, Kyocera, Asahi Glass, Tokuyama, NGK, Maruwa, and Watlow.

For more information on the ceramics market, check out our Critical Materials Report™ on ceramics/ SIC:

https://techcet.com/product/ceramics/

To see all press releases: CLICK HERE

Chip Demand Riding High but for How Long?

Materials Capacity Constraints on the rise with possible correction in 2023

San Diego, CA, October 11, 2021: TECHCET warns of possible bull-whip effect from the 2020-2021 steep chip growth. A key factor that may ease any sudden inventory correction is limited materials capacity. All materials from wafers to wet chemicals are seeing signs of strain as lead-times are steadily increasing. Leadtime push outs result from the supply-demand imbalances and logistic bottlenecks caused by the still lingering effects from the COVID19 pandemic in 2020.

As shown below, from TECHCET’s proprietary Wafer Start Forecast, leading-edge device wafer starts are growing in excess of 12% in 2021. This, combined with the legacy devices, drives robust growth rates and adds to the supply-demand strain. Wafer suppliers and other process materials companies are challenged to meet demand from chip fabricators worldwide. TECHCET is hearing complaints of lead-time increases from nearly every material market segment, including wafers, targets, wet chemicals, and equipment consumables, among others. Lead-times of equipment consumables (parts) are at an all-time high, increasing 50% to 100% in most cases; some delivery lead-times are exceeding 9 months as opposed to 1-2 months, as stated in TECHCET’s recent Critical Materials Reports™ on Ceramics and Silicon Parts.

Over the past 15-20 years, materials suppliers have been hesitant to invest in additional capacity, especially in those regions of the world (US and Europe) that are losing chip production share relative to Asia. Past experience with unpredictable swings in the semiconductor market has lead some materials companies to over-invest, not aware of the downturn; the result is having to operate at a loss or close their doors. Looking at history, lower or negative growth dips tend to occur every 3-5 years. Hence, suppliers have experienced these cycles at least 4 times over the past 2 decades. As a result, suppliers have been very hesitant to invest. This behavior will likely limit overall growth throughout the value chain.

“As chip-making capacity grows, inventories will start to build; this type of behavior typically results in a slower growth by year 3,” stated Lita Shon-Roy, TECHCET’s President & CEO. “We normally don’t see more than two years of strong consecutive wafer start growth, and it is not clear whether this will result in a hard correction by 2023 or a soft landing. The bull-whip effect happens when a large swell in demand pulls on the supply-chain. Like a traffic jam, everyone speeds up just to get halted somewhere along the Highway. And as capacity is finally put online, the market corrects itself, demand drops, and supply shoots past demand.” Shon-Roy expects to see this occur sometime in 2H2023 or early 2024, cautioning that the economy will play a role in whether we come to a screeching halt or if the slow-down will be gradual enough for suppliers to adjust production levels to match demand.

Despite these cycles, the semiconductor market is expected to maintain strength over the next 5 years with CAGRs well above 5% YoY in spite of the challenges that COVID19 has brought to the world. As a result, growth investment in semiconductor production and materials is strong and is expected to continue in upcoming years.

For more information on critical materials, see TECHCET’s Critical Materials Reports ™:

https://techcet.com/shop/

“How long will it last?” Heightened Demand for Plating in Advanced Packaging & Front-End (FE)/Damascene Chemicals

Healthy growth through 2022, but softening expected in 2023

San Diego, CA, September 23, 2021: TECHCET—the electronic materials advisory firm providing business and technology information— announced a heightened need for plating chemistries consumed in advanced packaging & FE/damascene driven by huge growth in chips in all sectors. This includes plating chemicals for copper (Cu), nickel (Ni), tin (Sn), and silver (Ag). Total copper plating chemicals are expected to grow 14.2% in 2021 to total $662M, with advanced packaging rising almost double that of damascene. Advanced packaging applications include Cu pillar, Redistribution Layer (RDL), and Through Silicon Via (TSV).

Advanced logic is the main driver of growth for plating materials. Used for damascene, copper plating chemicals volume demand increases with each new logic generation. Although CVD or PVD Cobalt (Co) and Ruthenium (Ru) are starting to be used in M0-M4 layers, overall growth in advanced logic and the number of layers pushes up Cu plating revenues for advanced logic applications. Advanced logic nodes (<16nm) wafer starts are forecasted to increase 14.4% CAGR (2020-2025); however, the number of damascene steps required for all leading-edge device wafer starts is expected to increase by more than 50% annually.

https://techcet.com/product/metal-chemicals-for-fe-advanced-packaging/

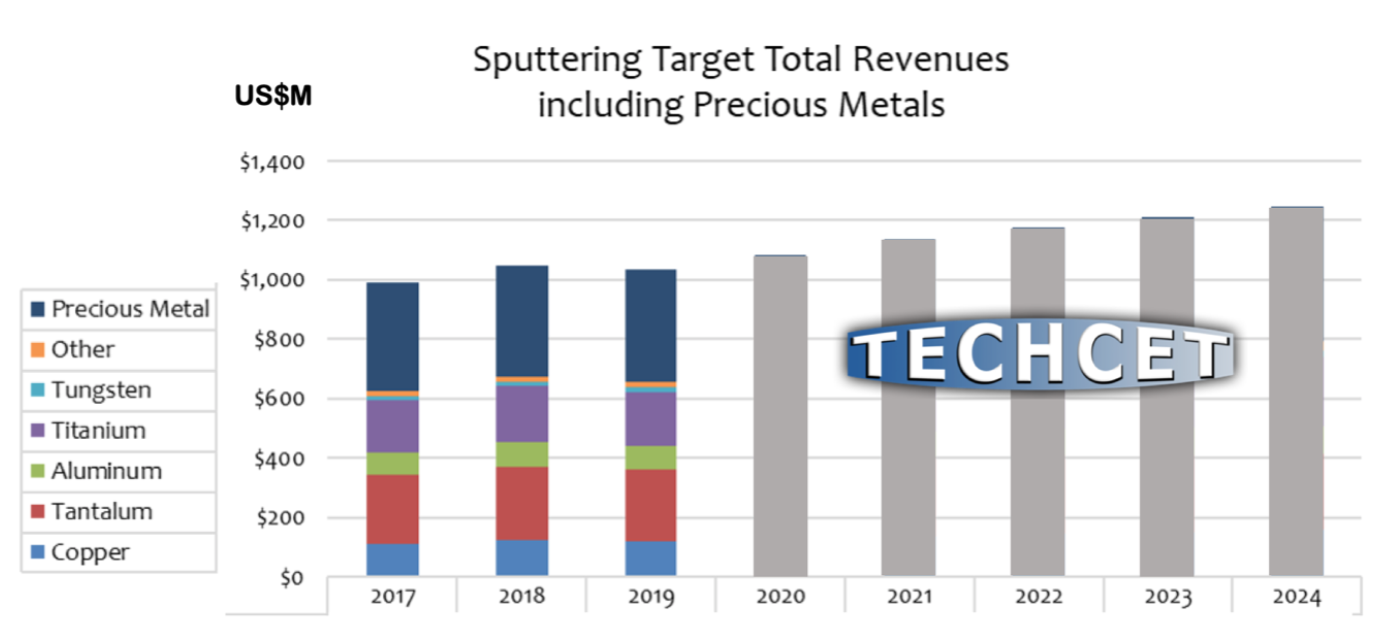

Sputter Targets & Metals Demand Met with COVID-impacted Lead-times and Costs

Delivery lead-times lengthening and costs spike as Targets Revenues push ahead 8.5% to US$740 Million

San Diego, CA, September 13, 2021: TECHCET—the electronic materials advisory firm providing business and technology information— announced COVID-19 related logistic issues remain, causing increased delivery lead-times and higher logistic costs for targets and metals among other materials. Chip fabricators and sputtering target suppliers both confirm tight supply and long lead-times for Cu/Cu alloy targets, as well as, Cu and Ta Hollow Cathode Magnetron (HCM) targets used in 200 mm Novellus (Lam Research) PVD systems. Longer lead-times for Cu and Cu alloy targets are the result of strong demand for these materials in advanced device fabrication and raw material price increases.

Raw material metal pricing is increasing in a number of segments, such as Cu, Co, Al, and Ta, given the demand increase with an improving global economy. The limited development of new Cu mines, coupled with aging, less productive existing mines, could also put pressure on future pricing as overall demand is forecasted to increase in the coming decades. The pricing for precious metals, such as Ag, Pd, Ru, and Ir has risen as well: Ag and Pd pricing up 40% from the early 2020 baseline and, versus the same baseline, both Ru and Ir experiencing triple-digit price increases.

With supply-demand out of balance especially for Cu/Cu alloy targets, fabs are more receptive to working with “smaller” target suppliers versus the traditionally larger players in the market. TECHCET is aware of memory makers looking at smaller, non-traditional semiconductor industry target suppliers. This drive to pursue alternative sources for Cu/Cu alloy target suppliers may be driven in part to seek more competitive pricing.

The sputtering target (excluding precious metals) market will total US$740 million in 2021, up 8.5% from 2020. Tantalum is the leading target revenue generator due to its high intrinsic cost and selling price, though Ta is replaced in 7nm & below Logic applications.

For more details on specific metals, and targets market segments and growth trajectory go to: https://techcet.com/product/sputter-targets/

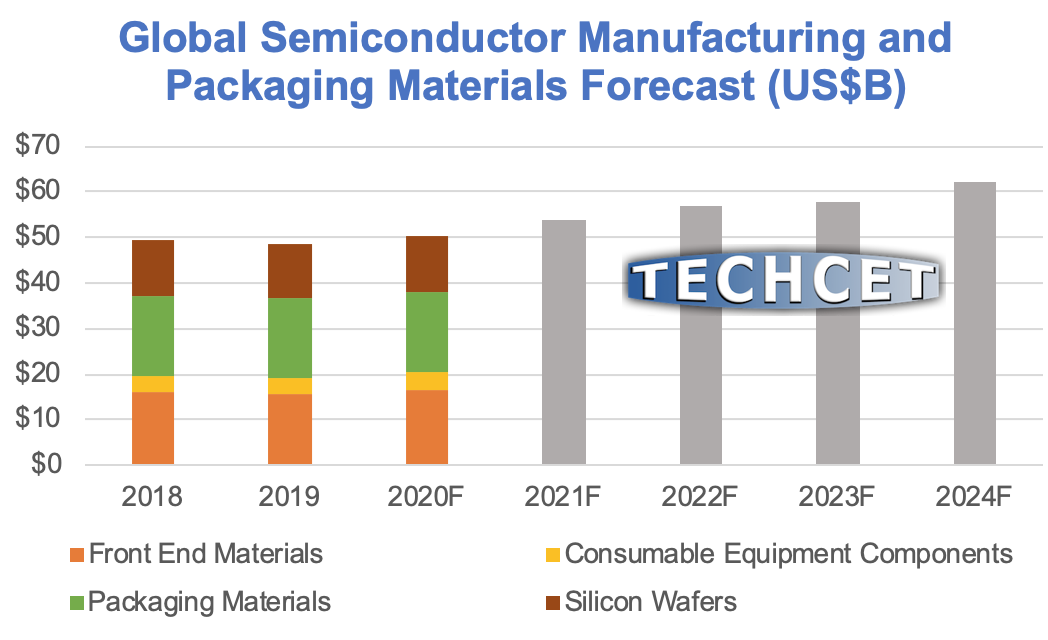

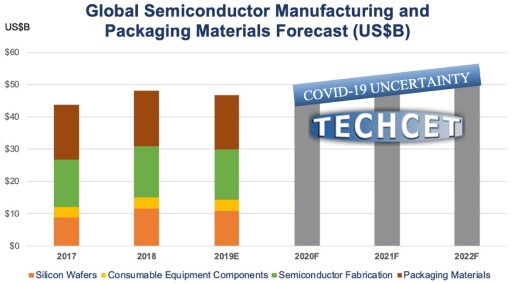

3rd Quarter Outlook on 2021 Semiconductor Materials

Revenues Top $57B With growth upsides through 2025

San Diego, CA, August 30, 2021: TECHCET—the electronic materials advisory firm providing business and technology information— announced 2021 semiconductor materials revenues will top $57B, growing by 8% to 30%, covering the spectrum of materials segments. CAGR for all materials is estimated to be at least 5.3% through 2025. The highest growth segments include wafers, equipment components, precursors, cleans, CMP, and photoresists. Wafers and chemical revenues are expected to get an extra boost as the supply-demand strain will likely push up ASPs. Additionally, there is a huge upside potential given expansions announced across the globe.

“Given the huge upsurge in chip demand, materials supply-chains are running just at demand, and lead-times are lengthening,” stated TECHCET President/CEO Lita Shon-Roy. “The equipment components area is especially hard hit. Quartz, silicon carbide, and ceramics have been quoting lead times up to nine months or longer. Wafers is another area we expect to see availability challenges, especially as we move into the second half of 2022.” Capacity expansions in several materials segments are starting to occur, which will help ease the demand strain and push up volumes and revenues in 2022. Current forecasts show a bullish 2022, with slower growth to follow as the supply-chain adjusts to easing demand. By mid-2024, the new chip fabs are expected to be ramping, resulting in another wave of good growth.

Market trends and materials supply-chain ramifications are continually tracked by TECHCET’s analysts. For a free overview download on the Impact of US Chip expansions, go here: https://techcet.com/product/fdl-briefing-impact-of-us-chip-expansion/

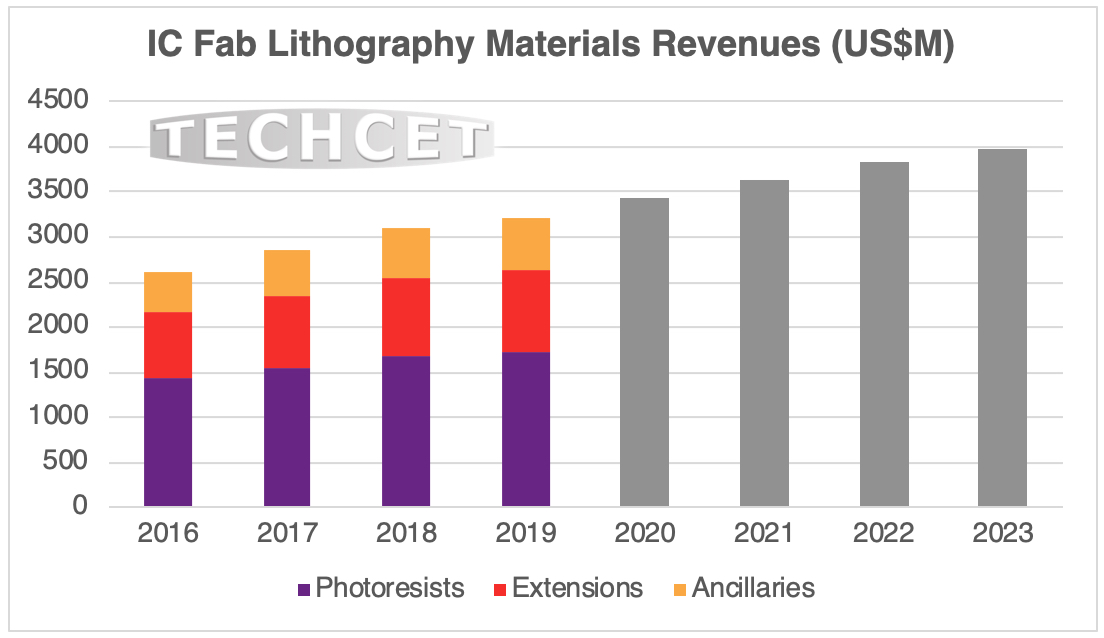

Steep Increase in Photoresists & Ancillaries Market Driven by Surge in Wafer Starts (Updated 8/24)

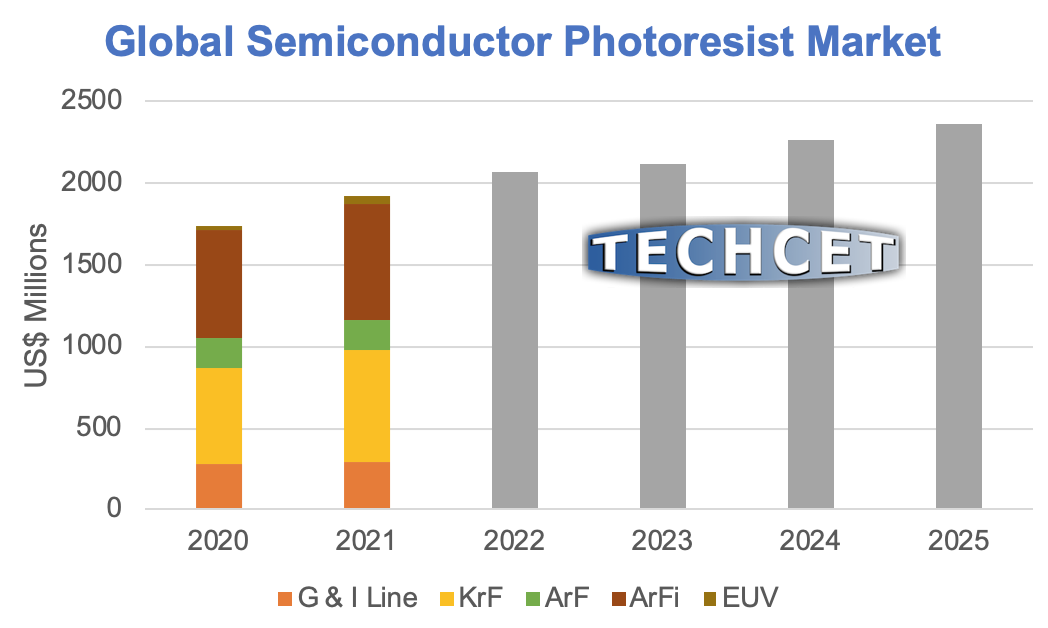

Resist Sales are projected to be $2B in 2021, ~11% over 2020

San Diego, CA, August 19, 2021: TECHCET—the electronic materials advisory firm providing business and technology information— announced that resist sales for semiconductor manufacturing will top $2B in 2021, an 11% increase over 2020. CAGR is estimated to be 7% through 2025. Ancillaries (developers, solvents, edge bead removers) and extension materials (anti-reflective coatings) are anticipated to grow 9.9% in 2021 over 2020 with a 5-year CAGR of 7.1%. “Once the new fab expansions by Intel, TSMC, and Samsung come online, volume demand and revenues will increase further,” said Dan Tracy, Ph.D., TECHCET’s Sr. Director of Market Research.

Litho Materials Trends:

- EUV materials are projected to show strong growth, 60% CAGR 2020-2025 driven by DRAM and Logic production

- ArF / ArFi resists will grow with 3DNAND and Logic wafer starts, but EUV resists will start to replace some ArFi resist steps which will dampen longer-term growth; CAGR ~6.4%

- KrF resist is also expected to see healthy growth with a CAGR of 7%

- Suppliers in China are accelerating efforts to get KrF resists qualified for chip manufacturing. They already supply I-line, and G-line resists

Wafer starts are expected to increase >13% for advanced Logic and >18% for 3DNAND in 2021over 2020. Strong growth in mobile computing, cellphone, server, and automotive segments is driving high demand for these chips and, in turn, for materials.

For more info on TECHCET’s Critical Materials Report™ on Litho Materials: https://techcet.com/product/photoresists-and-photoresist-ancillaries/

WF6 and NF3 Demand Expected To Outstrip Supply By 2025 Driven By 3D NAND Memory Evolution

2021 Recovery For Specialty Gases Stronger Than First Anticipated

San Diego, CA, August 10, 2021: TECHCET—the electronic materials advisory firm providing business and technology information— announced 3D NAND memory evolution is driving increased use of WF6, NF3, and heavy noble gases (Kr and Xe), which may lead to a supply shortage. WF6 demand growth, with a CAGR of 14.2%, is expected to outstrip supply by 2024/2025. The high growth is due to increased use of tungsten in 3DNAND and fab expansions. NF3 demand growth, with a CAGR of 15.8%, is also expected to outpace supply by 2025. It is heavily used in chamber clean and etch processes across the semiconductor and FDP industry. NF3’s demand growth is driven by 3DNAND and FDP post Covid recovery.

“Due to vertical scaling of 3DNAND, the demand for tungsten deposition (WF6) and chamber clean gases (NF3) for dielectric PECVD and tungsten ALD continues upwards and may cause a supply shortage in 2024 unless suppliers increase capacity,” said TECHCET’s Sr. Analyst Dr. Jonas Sundqvist. “As of now, no suppliers have specifically announced capacity increase.” Hopefully, in the future, suppliers will announce capacity increases for WF6 and NF3 to combat this shortage.

There is significant growth expected in Asia and in the US for gas companies. The US has announced numerous leading-edge fab expansions that will pull on the supply of specialty and rare gases (EUV). Fab Investments in Taiwan, Korea and China drive global demand adding a demand from memory fabs. Rare Air Gases such as Ne, Kr and Xe, rely on investment in Air Separation Units (ASUs) with capability to also extract those rare gases and unless the demand is high enough for all types it may cause imbalances in supply/demand of abundant Air Gases such as N2, O2 and Ar and rare gases. Due to limited investments in EU fab infrastructure, EU Fabs will more and more have to rely on gas imported from overseas.

As indicated in TECHCET’s New Critical Materials Report™ on Electronic Gases 2021, the recovery for specialty gases is stronger than first anticipated and this will continue into 2022 due to ongoing chip fab expansions. Specialty gas has a 2020-2025 CAGR of 7.6%, while bulk gas has a CAGR of 4.2% from 2020-2025.

For more information on Electronic Gases Including Ne & Xe Critical Materials Report™: https://techcet.com/product/gases/

Advanced Packaging and Next Generation Devices Accelerating CMP Consumables Growth

2021 Slurry Market is Forecasted to Reach US$1.80 B up 8% from US$1.66 B in 2020

San Diego, CA, August 3, 2021: TECHCET—the electronic materials advisory firm providing business and technology information— announced CMP (chemical mechanical planarization) consumables for advanced packaging exhibited high growth of approximately 14.1% in 2021 over 2020 and expected to grow at a CAGR of 12.7% over the next 5 years. Applications such as 3DTSV, and FOWLP represent solid opportunities for CMP, adding 1 to 2 CMP steps per wafer.

“In addition to the advanced packaging segment, we are seeing high growth of CMP consumables in next-generation logic and memory devices. The number of CMP process steps continues to increase, driving healthy growth over the next 5 years,” said TECHCET’s President, Lita Shon-Roy. 3D 7nm logic devices require as many as 45 CMP steps, while 3D NAND 128L devices have ~ 34 CMP process steps. These continue to increase as more layers and CMP steps are added into each new generation.

As indicated in TECHCET’s newly released Critical Materials Report™ on CMP Consumables 2021, the total slurry market is forecasted to reach US$1.80 B in 2021 up 8% from US$1.66 B in 2020, with a 5-year CAGR of 6%. Cu bulk, Cu barrier, tungsten, and oxide (both ceria and silica-based) slurries represent the largest segments of the slurry TAM. The resurgence of tungsten slurry growth is being fueled by the rapid increase in layers for 3D NAND. New applications related to HKMG and Co continue to grow as well.

CMP has continued to be one of the critical process steps that make ultra-flat and smooth surfaces enabling advanced electronic device manufacturing with an increasing number of thin layers. The consumables industry fared well during COVID. Despite concerns about an economic slowdown caused by the Covid-19 pandemic, the CMP consumables industry remains strong and is seeing growth as a result of the overall Semiconductor boom. The 2021 pad market is forecasted to reach US$1.11 B up 9% from US$1.02 B in 2020, with a 5-year CAGR of 5.1%.

For more information on the CMP Consumables Critical Materials Report™: https://techcet.com/product/cmp-slurry-and-pads-only/

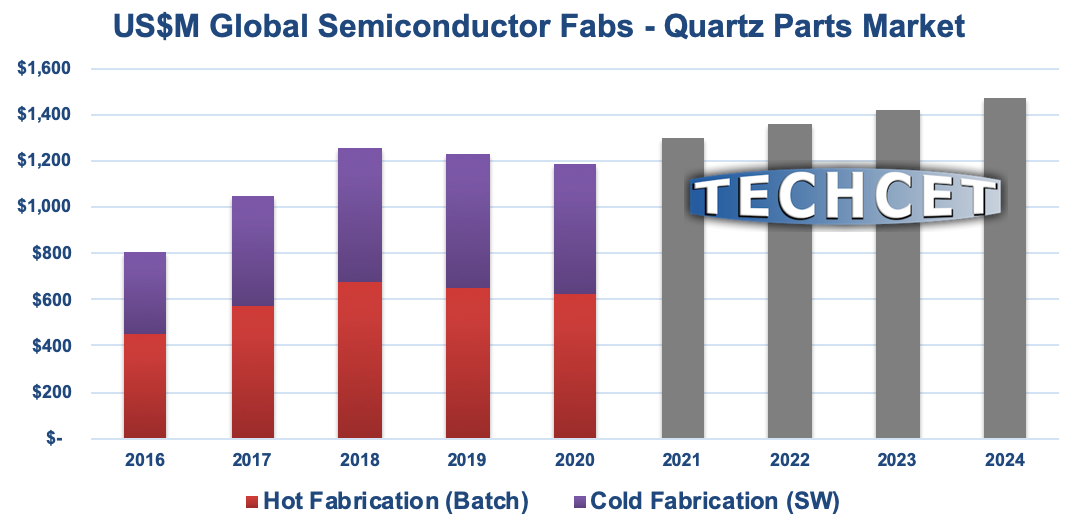

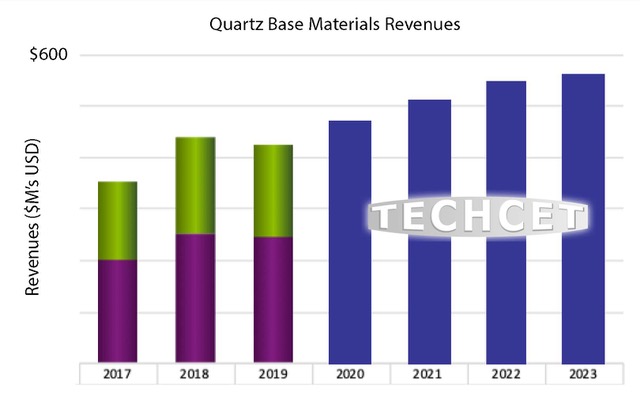

Automotive Market Driving Growth for Legacy Quartz

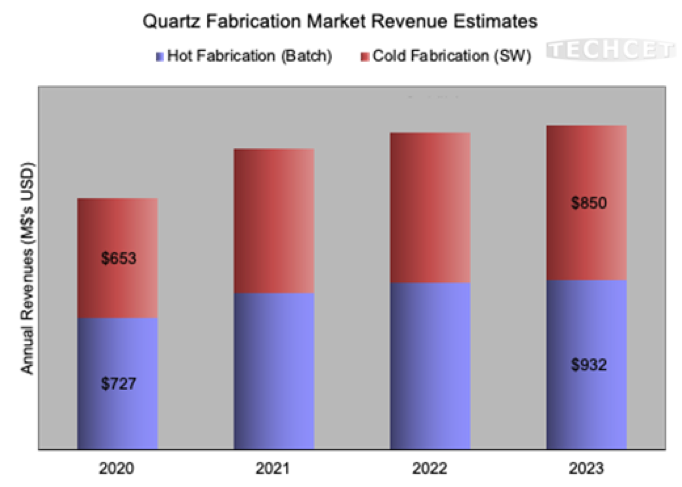

Quartz Market Is Expected To Reach US$1.66 B in 2021 up ~20%

San Diego, CA, July 13, 2021: TECHCET —the electronic materials advisory firm providing business and technology information— the automotive chip shortage is driving strong growth of < 200 mm quartz demand. Quartz suppliers have been struggling to ramp up production to meet demand. As Highlighted in TECHCET’s Quartz Report. “Even 150mm parts demand is coming back,” stated Lita Shon-Roy, TECHCET’s President & CEO. “The industry is scrambling to provide enough needed components, including silicon carbide, silicon as well as quartz components to support etch and deposition equipment/processes.”

The quartz fabrication market is expected to reach US$1,656M in 2021, growing ~20% from 2020. The 5-year CAGR (2020-2025) for both the base materials and fabricated parts market segments is estimated to be approximately 8%. In 2021, the semiconductor equipment market is expected to exceed 20% further driving demand of quartz parts. The industry will be able to meet the growing demand until 2022, by which time the next wave of quartz supply chain expansion will be needed.

Market shares have only changed slightly. Fabrication market leaders include: Heraeus-ShinEtsu/Conamics, Tosoh, Wonik QnC, Ferrotec, Hayward Quartz, Techno Quartz and Maruwa. With regard to base materials, Wonik’s acquisition of Momentive has improved its position. Major based material shareholders include: Heraeus/Shin-Etsu, Wonik, Feilihua, Tosoh, and QSIL.

Details on the Quartz fabrications market and supply-chain, including base materials and high-purity quartz powder, can be found in TECHCET’s newly released “Critical Materials Report™ on Quartz Parts.”

Critical Materials Reports™ and Market Briefings: https://techcet.com/product/quartz-equipment-components/

Shortage Threat to Semiconductor Materials from US Chip Expansions Plans

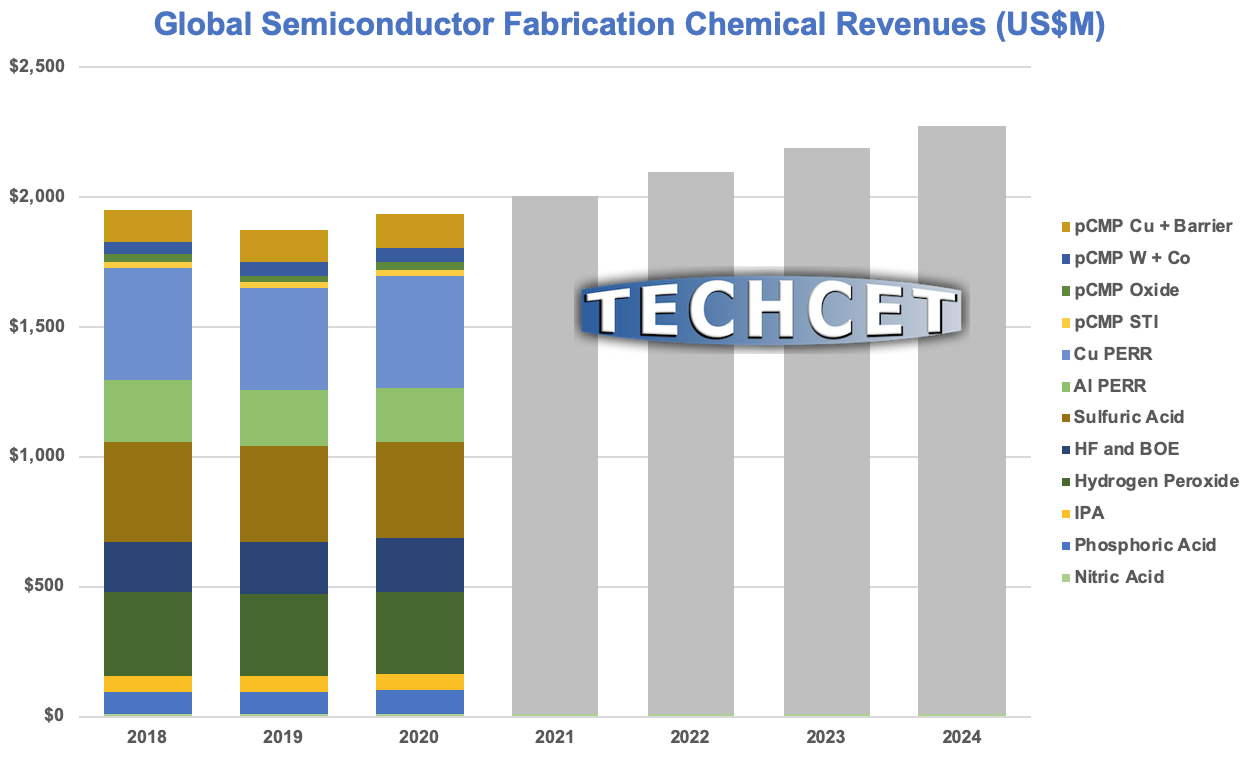

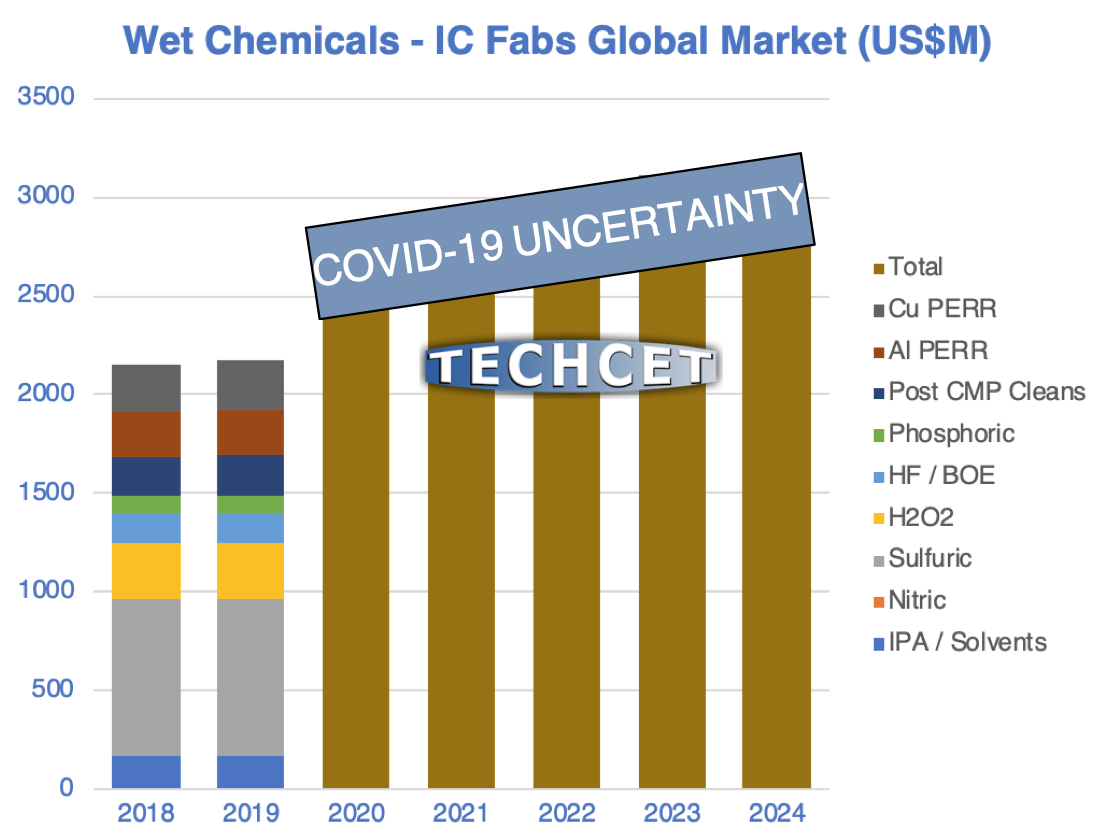

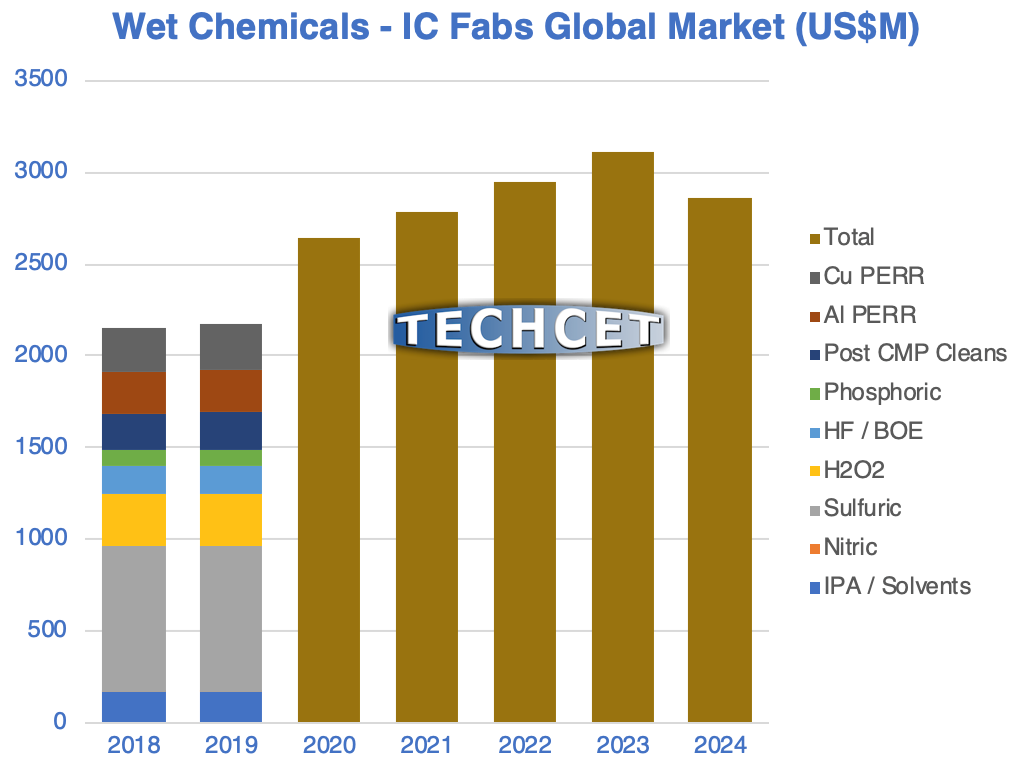

Is the US Wet Chemical Supply-Demand out of Balance?

San Diego, CA, July 8, 2021: TECHCET—the electronic materials advisory firm providing business and technology information— warns that semiconductor materials are at risk of shortage in the US. In response to President Biden Executive Order on America’s Supply-Chains, TECHCET submitted a report highlighting US semiconductor material supply-chains at risk. The oncoming expansions planned in the US by Intel, TSMC, Samsung, and others will push up demand and strain the materials supply-chains further. Those materials most vulnerable include wet chemicals, solvents, photoresists, gases, and wafers/substrates. In particular, ultra-high purity wet chemicals are in threat of running short unless additional capacity is put in place.

US Semiconductor device production over the past two decades has declined significantly from 37% of worldwide output to 12%. Now with the potential increase of 30% in US chip production over the next 3-5 years from the top 3 IC manufacturers, materials availability will tighten and may become critical. TECHCET projects that increase in domestic capacity are critical to avoid shortages. Given the time required to bring a new plant online, the time frame for new capacity is now. Note: It typically takes 2-3 years to build a plant to support semiconductor quality chemicals, given all the steps involved in the process. If capacity is not expanded soon, there may be shortages experienced by 2023.

The wet chemicals supply-chain is of highest risk because of several key variables:

- 40% increase in volume demand by 2025

- Lack of additional domestic capacity

- Increasing dependencies on Asian suppliers

- Transportation challenges and rising costs, including ocean freight, and

- Container, storage, and warehousing challenges impacting cost and quality

At present, the US Semiconductor market gets 31% of its Ultra High Purity (UHP) chemicals from Asia. Continued dependency on overseas chemical manufacturing means that as the US chip industry ramps, device manufacturers will be ever more dependent on very long, sometimes fragile supply-chains.

US supply and capacity for chemicals such as semiconductor grade purity sulfuric acid (H2SO4), hydrochloric acid (HCl), isopropyl alcohol (IPA), hydrogen peroxide (H2O2), hydrofluoric acid (HF), phosphoric acid (H3PO4), ammonium hydroxide (NH4OH), and nitric acid (HNO2), has been running at parity with demand. Few to no domestic sources of these chemicals have announced plans to invest in additional capacity, given low margins relative to the high cost of new facilities. As pointed out by Lita Shon-Roy, TECHCET’s President & CEO, “These materials continue to have US supply-chain shortages every other year, if not every year, wreaking havoc on US and European chip fabricators. Without growth in the US wet chemical supply-chain, the US semiconductor industry will continue to have shortages and availability issues, limiting chip expansion plans.”

US Expansion Plans Reliant On Imports

TECHCET estimates 14% of all US Semiconductor Wet Chemicals are supported by Imports. However, when considering only UHP products for leading-edge chip production, this number jumps to 31%, as stated in TECHCET’s latest study, Impact of US Chip Expansion on Wet chemical Supply. The need to import products such as IPA and H2SO4 is a clear indication of the shortcomings of the US UHP supply-chain. As shown in the figure, approximately 100% of all UHP IPA demand is supported by imports. The majority of chemical products coming from overseas are UHP grade because the US has very little ultra-high purity manufacturing capability for many of the semiconductor wet chemicals.

Although many chemical manufactures hesitate to add or build new capacity in the US, it is evident from TECHCET’s research that given the volumes anticipated, the costs to expand chemical production facilities should be justifiable. The key issue will be whether the IDMs will make enough of a commitment for the chemical supplier to invest in new capacity before supply shortages become critical. Failure to further expand US domestic critical materials manufacturing will likely hinder US chip expansion plans.

For more information about US materials supply-chain risks, contact TECHCET on how to get a copy of: “Impact of Chip Expansion on US Chemical Supply-Chain” https://techcet.com/product/impact-of-chip-expansion-on-us-chemical-supply-chain/

Are There New Opportunities for Tier 1 and Tier 2 CVD/ ALD Precursor Suppliers?

Precursors global market is expected to be US$1.7B by 2025.

San Diego, CA, June 29, 2021: TECHCET—the electronic materials advisory firm providing business and technology information— announced announced that there are several new opportunities in the wake of the Pandemic and unresolved Global trade issues for both Tier 1 and Tier 2 suppliers.

- Global fab expansions drive demand and R&D investments

- Continued M&A by Tier 1 suppliers reduce the number of local Tier 2 suppliers, opening up opportunities for start-up activities and smaller entities.

- Continued device design shrink requires the introduction of higher conductivity metals compatible with contact, local interconnects, and BEOL – Mo, Ru, and Ir.

- Continued focus on new lithography and patterning technologies opens new application for dry resist and new hard mask materials to support EUV.

- Multi Patterning development also continues, in search of lower temperature deposition materials.

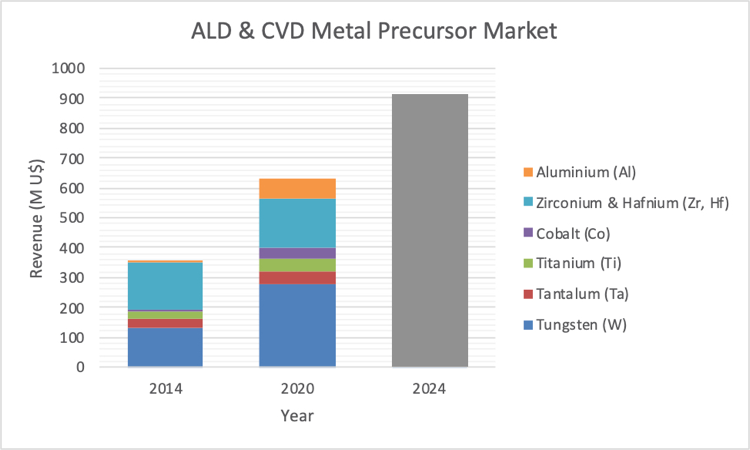

CVD/ALD Metal and High-k Precursors totaled US$624 million in 2020 and is expected to grow 12% in 2021 to US$710M, as highlighted in TECHCET’s Critical Materials Reports™ on ALD/ High K Metal Precursors and Dielectric Precursors. The 5-year CAGR (2020-2025) is estimated to be 8.0%. The key drivers for growth for various segments are:

- High-κ precursors – DRAM (90 nm and below)

- HKMG: Logic (45 nm and below),

- Tungsten (W): 3DNAND

The highest revenue growth will occur in metal precursors that include:

- Cobalt in Logic

- Ruthenium in Logic, if implemented in high volume manufacturing

- Hafnium in Memory (DRAM and emerging NVM)

- Lanthanum for HKMG

Advanced Dielectric Precursors totaled US$549 M for 2020 and is expected to grow 14% in 2021 to US$624M. The 5-year CAGR (2020-2025) is estimated to be 6.1%. The highest revenue growth will occur in dielectric precursors that support multi-patterning and newer applications areas including EUV, as follows:

- DIPAS/BDEAS precursors: Logic and DRAM patterning (SADP, SAQP)

- TSA: for 3DNAND and potentially also for EUV dry resist (SiN PEALD) in competition with a new precursor based on diiodosilane

This year, STREM was acquired by Ascensus Specialties. M&A activity of large companies is often focused on growing current product lines much to the neglect of R&D activities. Many large companies focus on acquisition to bring in new technology. TECHCET has seen an increase in consulting requests on the ALD/CVD market from potential new entrants.

Critical Materials Reports™ and Market Briefings: https://techcet.com/product/high-kald-precursors/

Critical Materials Reports™ and Market Briefings: https://techcet.com/product/dielectric-precursors/

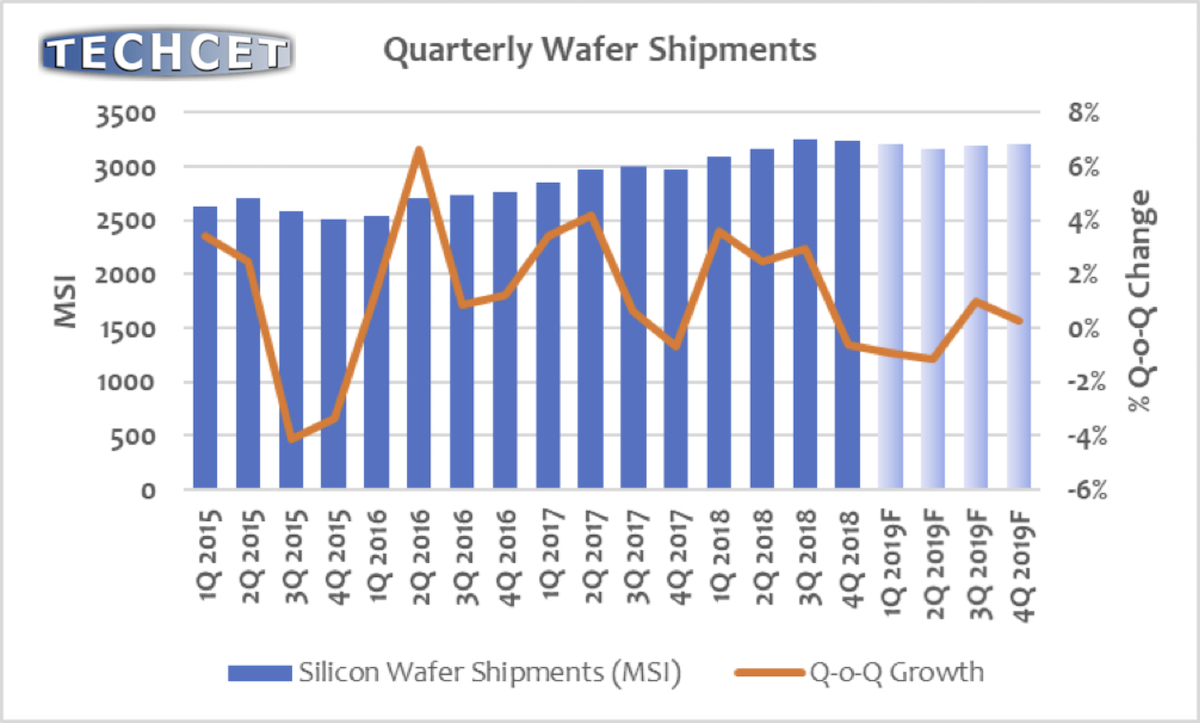

Wafer Supply Constrained Through 2024 Likely

Will there be new greenfield projects to help with tightened capacity?

San Diego, CA, June 22, 2021: TECHCET—the electronic materials advisory firm providing business and technology information— announced that the wafer supply will remain constrained into and possibly through 2024. With 300 mm wafer capacity tightening, it will likely remain tight in subsequent years unless greenfield capacity is brought online. Based on current forecasts, 300 mm prime wafer demand will be at >99% of utilization production capacity in 2022. Epitaxial capacity utilization is also likely in the 99% range currently. Global 300 mm wafer production capacity will need to expand by 6% or more over the next two years to avoid a shortage in meeting the current 300 mm wafer shipment forecast. However, no new plants have been announced, which means that large capacity additions (if investments/building plans started today) will not happen until 2024 at the earliest. With so much need for growth, new investment for 300 mm greenfield will cost at least US$2 billion and take 2+years to complete before production will be able to start. In addition, suppliers have announced new greenfield investments will require LTAs based on higher pricing.

Larger fab customers likely will not feel the full impact of supply constraints and higher prices. However, the impact is likely to be more significantly experienced by “second-tier” customers.

For 300 mm wafers, “robust” reclaim and reuse efforts in place to reduce demand for test and monitor wafers. This reduces the need for wafer suppliers to support these wafer products. There is upwards pricing pressure reported in the market, including for 150 mm and 200 mm wafers.

- Where will new greenfield investment by the top-tier suppliers occur?

- New greenfield projects will likely be in Japan and in Southeast Asia, where electricity costs are lower.

- Perhaps with funding through the U.S. Chip Acts, there will be an opportunity for 300 mm wafer manufacturing in the U.S. to support the planned fab investments announced by Intel, Samsung, and TSMC.

- New greenfield projects will likely be in Japan and in Southeast Asia, where electricity costs are lower.

Critical Materials Reports™ and Market Briefings: https://techcet.com/product/silicon-wafers/

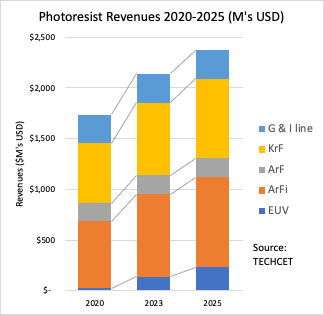

2021 Resist revenues to grow 6% to $2.0B and to $2.4B by 2025

EUV and KrF materials will continue growing through 2025 given continued ramping of leading-edge devices

San Diego, CA, June 8, 2021: TECHCET—the electronic materials advisory firm providing business and technology information— announced 2021 resist revenues are forecasted to grow 6%+ to $1.98B USD and to continue expanding to $2.37B in 2025. Market dynamics will continue to drive photoresist material revenues upward due to high chip demand and low chip supply.

- EUV

- to increase ~90% to $51M for 2021

- volumes nearly doubled from 18 Kliters in 2020 to 35 Kliters in 2021.

- Revenues 53% CAGR 2020-2025

- Driven by leading edge logic and DRAM <5nm

- 2021 KrF driven by 3D NAND

- revenues to and volumes to increase to ~12% in 2021

- I and g-line: up 2-3% for 2021

With the expansion in 3DNAND and logic production over the next 3-5 years, so will the use of photoresist thinner and EBRs which heavily rely on propylene glycol methyl ether acetate (PGMEA), the predominant casting solvent.

Technology trends to watch:

- EUV lithography is in high volume production (HVM) at TSMC and Samsung logic fabs. Intel is expected to start production with EUV in 2021, which will drive EUV ancillaries and photoresist volumes.

- Samsung Electronics is planning mass production of D1z process DRAM using EUV lithography.

- 3D NAND device sales growth and node changes, creating more exposure levels, will drive increases in KrF resist usage, specifically for the thicker formulations, in the ~20% range 2022-2025.

- Directed Self Assembly (DSA) has been demonstrating promising results ; lower defectivity and applicability to lithography pattern repair. This technology is making the sort of progress that portends a future applicability to high volume chip manufacturing.

- Nanoimprint (Canon) has shown improved defectivity and overlay capability and is being yield tested for use in production of 3D NAND memory.

Critical Materials Reports™ and Market Briefings: https://techcet.com/product/photoresists-and-photoresist-ancillaries/

ALD/CVD Metal Precursors US$640M Market Booming to US$910M in 2024

Both advanced logic and memory growing demand

San Diego, CA, April 5, 2021: TECHCET—the electronic materials advisory firm providing business and technology information—announces that the global market for atomic-layer deposition (ALD) and chemical-vapor deposition (CVD) metal precursors for semiconductor manufacturing in 2020 was worth ~US$640M. Driven by advanced logic and 3D-NAND memory chip fabrication needs, demand for ALD and CVD metal precursors is forecast to see a 2020-2024 compound annual growth rate (CAGR) of ~10% as shown in the Figure (below) from the most recent quarterly update to TECHCET’s Critical Materials Report (CMR) on CVD, ALD, and SOD Precursors.

In the short term forecast, TECHCET sees the global semiconductor market as very healthy with 15-20% Year-over-Year (YoY) growth in 2021 revenues, and overall critical materials market growth >7% YoY. The greatest material demand increases are seen in ALD/CVD metal precursors, and in specialty wet cleans that often are integrated with metal deposition and etching.

All ALD/CVD metal precursors are in healthy demand, since ALD is critical for fabs running 22-45nm nodes as well as for fabs at the leading edge. In particular, cobalt (Co) and hafnium (Hf) precursors saw 18-20% year-over-year (Y0Y) growth in 2020, and are forecasted to see strong demand through 2024. Ruthenium (Ru) metal is slowly replacing some of the Co and tungsten (W) interconnects on the most advanced logic chips, with anticipated precursor revenue growth to US$10M in 2025 for this highly strategic material.

ALD materials and Original Equipment Manufacturer (OEM) tools are needed for multi-patterning lithography used with Deep-UV (DUV) Immersion and with Extreme-UV (EUV) in leading logic and memory fabs. Multi-patterning typically uses low-temperature Plasma-Enhanced ALD (PEALD), either in clusters of 8-16 single-wafer chambers, or in “Spatial” high-throughput tools. TECHCET anticipates that fab investments in Asia will allow South Korean and Chinese OEMs to win near-term ALD orders, and they may soon compete with US, EU, and Japanese OEMs in the global tool market. For more information on the impact of global fab capacity expansions on the regional demands for critical materials, please contact TECHCET at [email protected].

Critical Materials Reports™ and Market Briefings: Purchase Reports

2021 Critical Materials Council (CMC) Conference, happening April 14-15 in virtual space, includes presentations on ALD/CVD : 2021 CMC Conference

Photoresists Revenues to be Up 11% to US$1.9B

San Diego, CA, February 23, 2021: TECHCET—the advisory services firm providing electronic materials information—announces that the global market for photoresists needed in commercial semiconductor manufacturing is expected to be worth over US$1.9 billion in 2021. After pandemic-related slowdowns last year, leading semiconductor fabrication lines are now running at full capacities with steady growth expected for the next few years. The fab photoresist market is forecasted to grow 11% year-over-year (Yo) in 2021, as detailed in the latest Critical Materials Report™ (CMR) quarterly update on Photoresists & Ancillaries (see Figure).

With EUV use in commercial IC fabs now expanding from just advanced logic to include dynamic random access memory (DRAM) chips, the forecast for materials demand growth remains aggressive. ASML claimed capacity in 2020 to build 35 NXE:3400 series steppers, and with anticipated assembly efficiency improvements should be able to ship 50 EUV tools in 2021. Estimated EUV resist sales last year doubled to over US$20 million, and extreme growth in demand calls for these strategic materials to be worth over US$200 million in 2025.

Partly due to trade-wars, China’s 14th five-year-plan published at the end of October 2020 includes a priority to strengthen the country’s independent ability to control industrial supply-chains. Many Chinese states are providing significant funding to develop local production of high-tech materials, and Chinese materials suppliers are sampling photoresists, extensions, and ancillary materials.

This report covers the following suppliers: Avantor, BASF, Brewer Science, Dongjin Semichem, Dongwu Fine-Chem, DuPont (formerly Dow), Eastman Chemical, FujiFilm, JSR, Kempur, KMG (Cabot Microelectronics), Merck/EMD, Moses Lake Industries, Nissan Chemical, PhiChem, SACHEM, Shin-Etsu, Soulbrain, Sumitomo, Suntific, Tama Chemical, Tokyo Ohka Kogyo, and Versum.

Purchase Reports Here: TECHCET Photoresist and Ancillaries Reports

CMP Consumables US$2.9B in 2021 for IC Fabs

High growth in demand for logic and memory 3D metal

San Diego, CA, February 17, 2021: TECHCET—the electronic materials advisory firm providing business and technology information—announces that the global market for chemical-mechanical planarization (CMP) consumable materials in semiconductor manufacturing is expected to grow over 13% year-over-year (YoY) to US$2.93 billion in 2021. CMP consumables including slurries, pads, and conditioning disks are all in high demand due to the need for more planarization steps with 3D devices, and supplies are stable despite COVID-19 pandemic disruptions. CMP materials revenues are forecasted to have a compound annual growth rate (CAGR) of 7.3% as shown in the table from TECHCET’s quarterly update on CMP Consumables: Slurry, Pads, and Conditioning Disks Markets for Semiconductor Applications report (below).

While there has been recent growth in demand for CMP on 200mm silicon wafers, most of the escalating demand today and for the near future is in CMP of metals on 300mm wafers. For logic chips, the largest demand segments are for copper (Cu)-bulk as well as Cu-barrier since the number of Cu interconnect levels on an advanced logic chip continues to increase, despite cobalt (Co) and ruthenium (Ru) gradually being used. For memory chips, increases in the number of layers in 3D-NAND chips drives continued rapid growth in demand for tungsten (W) slurry.

3D-NAND chips rely on W metal for reliable wordline contacts to staggered “staircase” pads within the many layers. Depending upon the manufacturing strategy 64-128 layers is the most that can be economically processed, such that commercial 3D-NAND fabs have to start stacking “tiers” of layer sets. Each additional tier requires additional CMP, so the demand for W CMP is increasing more than the silicon wafer starts.

The CMP consumables market is seeing increased focus on localization of the supply-chain, as global buyers re-examine their value-chains. South Korean giant SKC built a CMP pad manufacturing plant in Cheonan last year, and the plant is scheduled to be put into operation in the second quarter of this year.

Critical Materials Reports™ and Market Briefings: TECHCET Reports

CMC Events: CMC Conference 2021

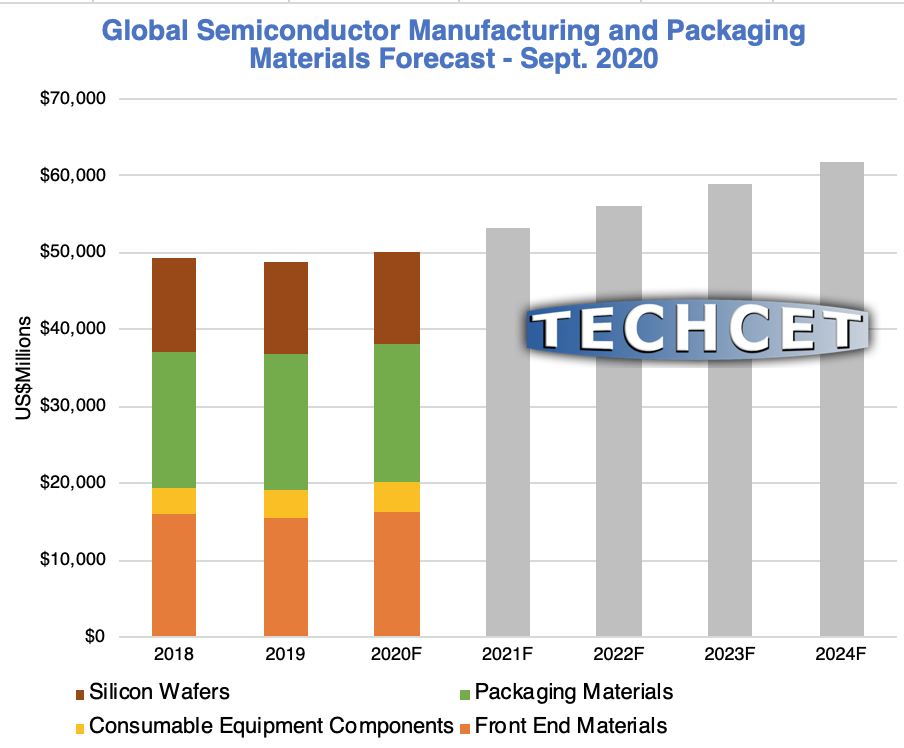

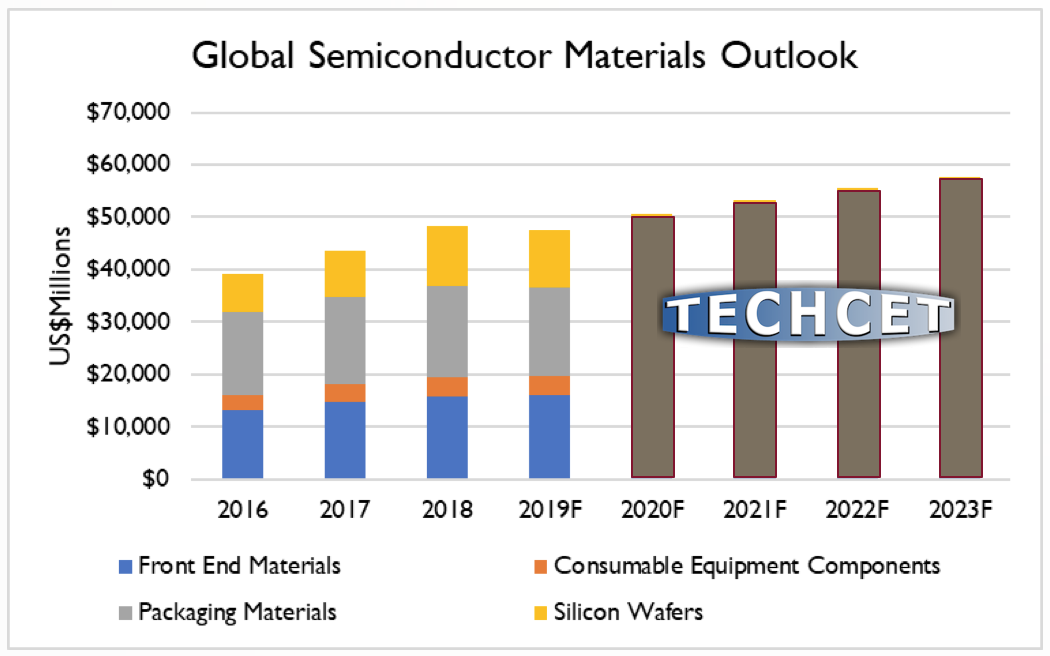

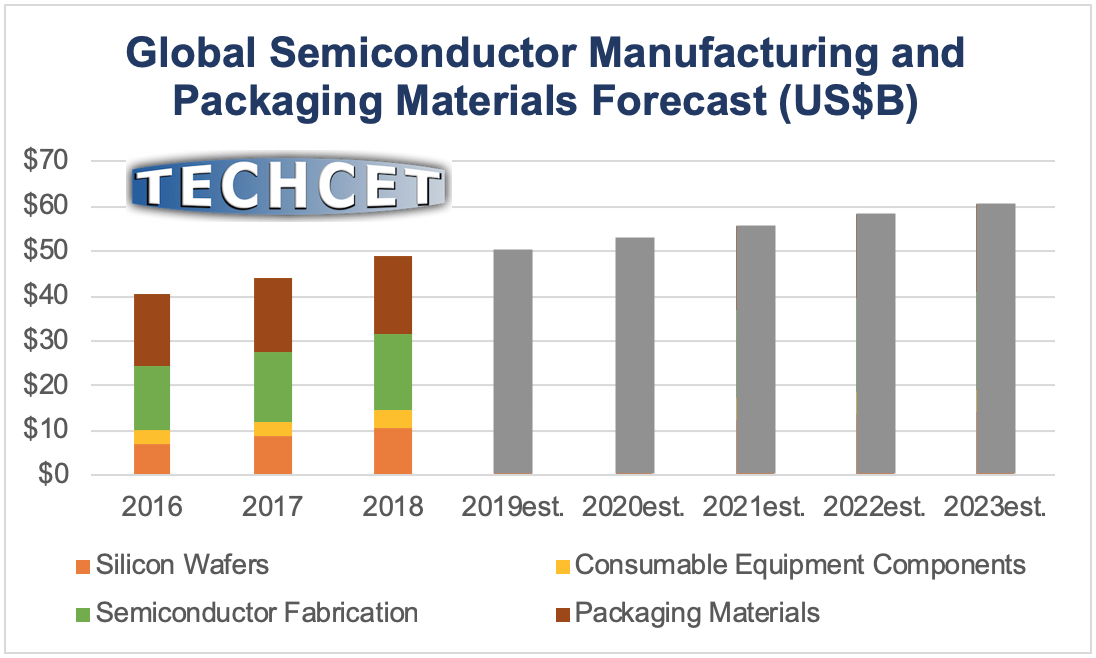

Semiconductor Materials $50B Market on a Strong Run in 2021

Pandemic pushing people to Work From Home and School From Home

San Diego, CA, January 12, 2021: TECHCET announced that global revenues for semiconductor manufacturing and packaging materials grew approximately 4% year-over-year (YoY) in 2020 to ~US$50B, and are expected to grow ~7% in 2021 to nearly US$54B. The COVID-19 pandemic has created strong demand for both logic and memory ICs to support Work From Home (WFH) and School From Home (SFH), and such demand is expected to increase despite expanding availability of virus vaccines. Also, demand for automotive ICs has recovered and will be an important driver in 2021 growth. The compound annual growth rate (CAGR) through 2024 is forecast at 5.3% as per the latest TECHCET Critical Materials Reports (CMR) and shown in the attached figure.

“Localism is an ongoing global trend, with China, the European Union, South Korea, Taiwan, and the United States all investing in electronic materials capacities due to embargoes and tariffs disrupting supply-chains,” said Lita Shon-Roy, TECHCET President and CEO. “Even without political disruptions, critical materials for the fabrication of advanced logic and memory chips such as cobalt and lanthanum have been in short supply due to competing industrial demands, and we expected tightening supply of silicon wafers in 2021.”

Such ramifications are tracked by TECHCET’s analysts, with Analysts’ Alerts emailed to CMR purchasers to help them anticipate and mitigate potential supply-chain disruptions. Excerpts have been publicly disclosed on the following critical materials (click here to read the full stories):

• IPA in “CMC Considers Bio-Solvents to Reduce Fab Risks”,

• HF in “Semi Wet Chemicals US$2B Market Threatened by Localization”, and

• Lanthanum in “Rare Earth Elements (REE) Supply Uncertain for IC Fabs”.

Any switch in material source triggers the need to re-qualify with cycles of test wafers and rigorous metrology, and similar data are needed during chip fabrication to ensure that material quality is under control. The public 2021 CMC Conference—happening April 14-15, 2020 in virtual space—is now soliciting presentations on themes surrounding semiconductor fab materials quality and metrology issues.

Critical Materials Reports™ and Market Briefings: TECHCET Reports

CMC Events: CMC Conference 2021

CMC Considers Bio-Solvents to Reduce Fab Risks

Semiconductor Grade IPA Supply Impacted by COVID-19

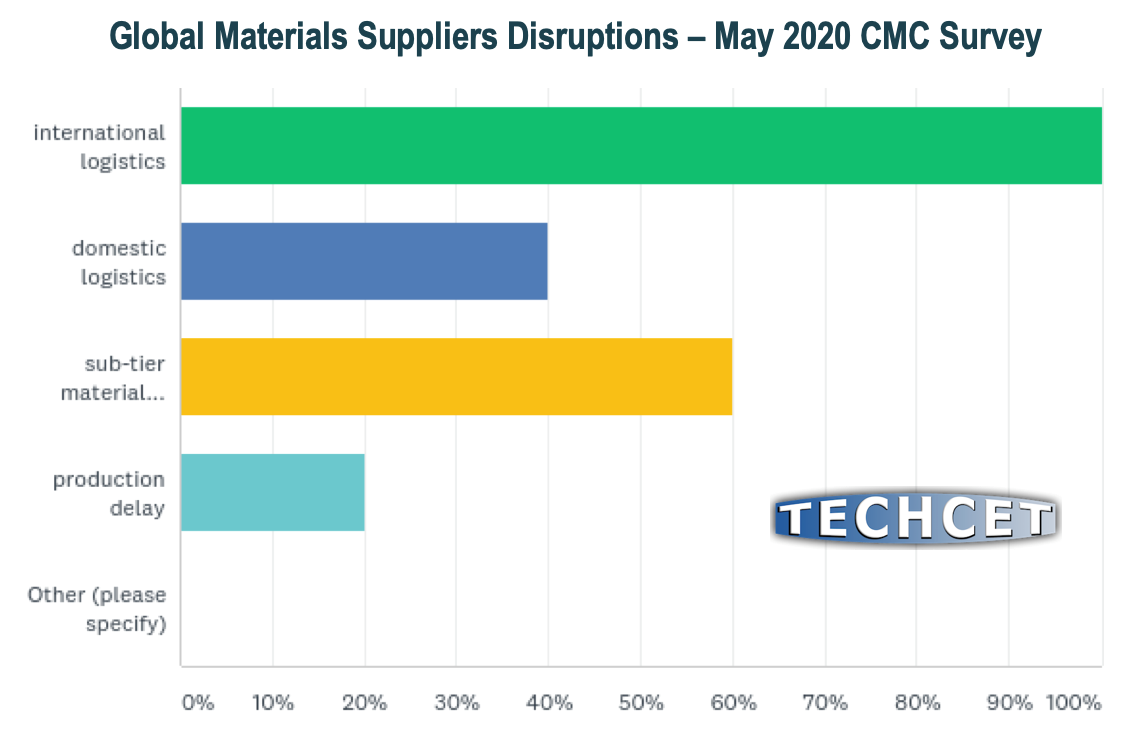

San Diego, CA – December 21, 2020: The Critical Materials Council (CMC) of semiconductor fabricators & suppliers joint-meeting in December focused on disruptions in the global supply-chain for high-purity acids and solvents due to the boom-and-bust business of oil refining. Due to COVID-19 pandemic travel restrictions reducing passenger travel, there has been a well-documented reduction in demand for oil and gasoline that has led to the idling of some petroleum refineries. Much of the world’s industrial chemical supply starts with petroleum feedstocks, so when refineries stop running they stop supplying the world with raw material.

As shown in the Figure, wet chemicals including sulfuric acid, hydrogen peroxide, and iso-propyl alcohol (IPA) are typically engineered these days using feedstock from oil refining derivatives. During the December CMC Joint Session of chip fabricators and suppliers, a representative from Cargill Corporation (annual revenues ~US$114B) presented information on sustainable bio-based feedstocks that can replace petrochemicals in the global supply chain.

TECHCET material demand models estimate that 2020 worldwide semiconductor device fabrication will use and dispose of the following:

• 291 million kg of sulfuric acid or 760,000 55-gallon drums,

• 202 million kg of hydrogen peroxide or 857,000 55-gallon drums, and

• 20 million kg of IPA or 122,000 55-gallon drums.

Earlier this year, TECHCET raised “cautionary flags” at CMC meetings to watch for 2H20 shortages of IPA and sulfuric acid, as also detailed in quarterly updates to TECHCET’s Wet Chemicals & Specialty Cleans analysis. Governments around the world have mandated that some of the industrial IPA supply-chain be re-directed to healthcare and consumer distribution to combat the COVID virus, increasing overall demand. French IPA producer Seqens had to declare force majeure on its IPA plant in Peage, Roussillon from March to July of this year, and with a nameplate capacity of 70k tons/year that plant represents >12% of total European capacity. Despite recent news of vaccines, the pandemic continues to disrupt the chemistry value-chain.

During the December 8, 2020, CMC meeting, Fab Members from around the world reported tightening supply of high-purity solvents in general. Within the solvent category, there is now serious concern that a shortage in high-purity IPA is looming just over the business horizon. To join the CMC for 2021 meetings in virtual-space to anticipate and mitigate such supply-chain disruptions, or for custom consulting please contact us – Email, +1-480-332-8336.

For more information on solvents, wet chemicals, and other critical materials used for semiconductor production: TECHCET Reports

Semi Wet Chemicals US$2B Market Threatened by Localization

Specialty Cleaning and Etching Changes Could Cause Yield Losses

San Diego, CA, December 1, 2020: TECHCET—the electronic materials advisory firm providing business and technology information—announces the global market for wet chemicals needed for global semiconductor fabrication in 2021 is forecast to reach US$2 billion. However, recent trade wars threaten the stability of global supply-chains for critical materials, with China, the European Union, Japan, and the U.S. all announcing plans to create parallel local sources for electronic materials, and South Korea and Taiwan increasing investments in chemical production. There are many specialty blends needed as well as ultra-pure neat chemicals, and all are growing in demand as seen in the Figure (below) from the latest Critical Materials Report™ (CMR) quarterly update on Wet Chemicals & Specialty Cleans.

The most advanced IC fabs for logic and memory chips require purity levels in materials so extreme that trace contaminants below parts-per-billion can cause millions in dollars of commercial yield losses. When raw materials sources or refining processes change there are corresponding changes in the trace contaminants and the chemical fingerprint so semiconductor fabs require that suppliers use advanced metrology and sophisticated analytic methods to re-qualify any changes.

“Advanced commercial ICs can only be profitably fabricated when the critical materials supply-chain is locked in from the very beginning at the mine or other industrial feedstock,” explained Terry Francis, TECHCET Director of Technology and Senior Analyst and author of the report. “For anhydrous-HF supply, we’re seeing a shift in the fluorine source from fluorspar mining to alternates including FluoroSilicic Acid (FSA), depleted uranium hexafluoride, and aluminum fluoride. All of these alternates will have different trace contaminants which will have to be re-qualified by fabs.”

SK Materials began mass producing 15 tons-per-year of ultra-high-purity (UHP) hydrogen fluoride (HF) gas at its in Yeongju, South Korea to support fabs and help reach the government’s goal of 70% local electronic materials supply by 2023. South Korea’s imports from Japan have been replaced to a great extent by an increase in imports from China and Taiwan.

In China, Wengfu has four plants producing Anhydrous-HF (AHF) from FSA, with a fifth plant due to come onstream by early 2021. The company claims that the total capacity of all five plants will be ~105,000 tons/year AHF produced using this route.

This wet chemical market report covers these suppliers: Arkema, Avantor, BASF, Cabot Microelectronics/KMG, CF Industries, Dow/DuPont, Eastman, Evonik, GrandiT, Hansoi Chemical, Hubei Sinophorous, Jianghua Microelectronics Materials, Kanto Chemical, Merck/EMD, Mitsubishi Gas Chemical, PeroxyChem, Rudong Zhenfeng Yiyang, Runma Chemicals, SACHEM, SK Materials, Solvey, Suzhou Crystal Clear, Xingfa, Wengfu.

Critical Materials Reports™ and Market Briefings: Specialty Cleaning Report

Wet Copper Deposition Materials for ICs and Packages

Steady growth in demand forecasted through 2024

San Diego, CA, November 16, 2020: TECHCET announces that the global market for wet metal deposition materials including electro-chemical deposition (ECD) and plating (ECP) chemistry blends in 2020 is forecast to be US$63 million. From semiconductor fabrication at wafer-scale in the Front-End Of Line (FEOL) to wafer-level and die-level advanced packaging, specialized copper (Cu) chemistry blends are seeing compound annual growth rates (CAGR) in demand of 11-13% over the period 2019-2024. While on leading-edge logic chips, cobalt (Co) plating is used to make the smallest connections to transistors, as detailed in the latest Critical Materials Report™ (CMR) quarterly update on Metal Chemicals for FEOL & Advanced Packaging.

While 2/3 of chip packing today still uses relatively simple wire-bonding, TECHCET sees demand for advanced packaging—including flip-chip (FC), fan-in wafer-level packaging (FIWLP), fan-out wafer-level packaging (FOWLP), and through-silicon vias (TSV)—to grow at a strong 8.9% compound annual growth rate (CAGR) over the period 2019-2024 (Figure). These advanced packaging interconnects will continue to use plated solder formulations of tin (Sn) and tin-silver (SnAg), while demand for Cu plating chemistry for interconnect “bumps” and re-distribution lines (RDL) is expected at 11% CAGR over the same period.

“While advanced packaging interconnects are adding more value to final system function, improved metal lines are still needed on most advanced IC chips in heterogeneous integration,” explained Terry Francis, TECHCET Director of Technology and Senior Analyst and author of the report. “On-chip copper metal constrains the speed of the densest ICs today, which has led to use of cobalt in the lower metal layers in 10nm-node and smaller logic devices.”

This report covers the following suppliers: Atotech, BASF, Dow/DuPont, Ishihara, MacDermid/Enthone, Materion, Moses Lake, Soulbrain, Shinhao, Uyemura.

Critical Materials Reports™ and Market Briefings: Metal Chemicals Report

Refreshing Material Advances for Logic, Memory, and Packaging

5th CMC Conference “After-Hours” Available up to December 11

San Diego, CA, November 5, 2020: How to keep semiconductor fabs supplied with critical materials despite a pandemic and trade wars was discussed by >250 industry experts gathered in virtual space October 21-22 during the 5th annual Critical Materials Council (CMC) Conference. CMC Fab Members and Associate Supplier Members were joined by leading industry analysts, educators, and investors in discussing business and technology trends in the value-chain for advanced packaging, logic, and memory. The “after-hours” virtual conversations will continue through December 11th using the conference app and website, and new people can join in through November 16th.

“There were a lot good topics especially on materials challenges for leading edge technology and heterogeneous integration, global issues on material supplies, and emerging materials development,” commented Dr. Lihong Cao, Director of Engineering and Technical Marketing at ASE, and Session 4 presenter.

This was the first year that a new conference session was dedicated to Advanced Packaging of Heterogeneous Integration using chips from different fabs. Dr. Lauren Link of Intel discussed the need to find ways to integrate more front-end fabrication materials into packaging. The challenge is how to do so in a cost-effective manner, without over-specifying materials and process requirements as shown in the screen-capture (Figure).

While materials revolutions are happening in advanced packaging, materials evolutions are also essential to improve reliability and quality. Dr. Alejo Lifschitz of DuPont showed how the clever addition of a new “Grain Refiner” additive to the company’s chemistry blend allows for electro-chemical deposition (ECD) of copper (Cu) lines that have reliability engineered into the micro-structure. As deposited, the new Cu grains for the package Re-Distribution Layer (RDL) are <0.2 micron in size with >93% in maximum density highly-twinned <111> crystallographic orientation. This makes reflowed Cu RDL lines that are inherently more resistant to corrosion and cracking when subjected to chemical and mechanical stresses in the real world.

Advanced Logic: finFETs and NanoSheets

Fin-based Field Effect Transistors (finFET) in the most minimally-scaled logic chips will soon be replaced with Horizontal Nano-Sheets (HNS) to improve device performance. HNS are Gate All-Around (GAA) CMOS FETs that reduce power-consumption while allowing for simple patterning of different gate-widths so that designers can optimize power:performance trade-offs within the IC layout. However, both evolutionary and revolutionary new manufacturing processes will be needed for commercial fabrication of HNS logic ICs.

The best example of a revolutionary new process that is needed to make HNS ICs is that of the epitaxial (Epi) growth of the layers to make the transistor channels. Pamela Fischer of ASM in presenting on, “Materials Evolution and Challenges in ALD/Epi FEOL,” explained that when growing alternating Epi layers the interface transition thickness directly determines final device performance. The company’s latest Epi tool allows for alternating ~10nm thick layers of silicon (Si) and silicon-germanium (SiGe) to be grown with extremely sharp transitions of just ~0.5nm. This means that the transition happens in ~2 atomic layers of silicon!

Advanced Memory Materials

3D device fabrication issues in logic fabs pale in comparison to the ongoing challenges with finding integrated process flows for 3D-NAND memory chips, which currently stack ~100-device-layers and will soon aim for ~200-device-layers on each silicon wafer. Dr. Ian J. Brown, VP Engineering for SCREEN Semiconductor Solutions, showed how “Wet Etching in the 3D Era” has evolved to enable 3D device structures for both logic and memory (Figure). Tools are becoming more sophisticated to allow for chemical blending on-site in the fab, which allows for cost-effective use of more complex chemistry sets. “Digital Wet Etch” (DWE) is a 2-step process similar to Atomic-Layer Etch (ALE), where a first chemistry oxidizes the surface of a metal such as copper (Cu) or cobalt (Co) following which a second chemistry selectively removes just the metal-oxide layer.

Shaun Miller, Director of Global Front End Materials Procurement for Micron Technology, showed why independent regional supply-chains can create, “Material Challenges in Leading-Edge Memory Manufacturing.” For example, differences in supplier infrastructures between the U.S. and Taiwan have led to different levels of metallic and particle impurities in wet chemicals such as sulfuric-acid and hydrogen peroxide, with Taiwan leading in purity at present. Micron is using analytics and “big data” to collaborate on a deeper level with suppliers.

In follow-on conversation, Terry Francis, TECHCET Sr. Analyst who also presented at the conference, explained how hydro-fluoric acid (HF) supply in North America is likely to change in the near term. The raw material supply is changing from mined fluorspar mineral to chemically-engineered fluorosilicate-acid (FSA), since the latter is in surplus as a byproduct of phosphate-based fertilizer production. While electronics manufacturing consumes at most 1% of industrial demand, there is insufficient volume to sustain a supply-chain independent of that for general industry. Such a change in upstream material source would inherently change the trace contaminants in the final downstream HF, which could trigger random yield losses in advanced IC fabs unless materials are carefully re-qualified.

Post-event registration is open until November 16th, so click through to access recordings of presentations and discussions, connect with attendees, and engage in follow-up Q&A!

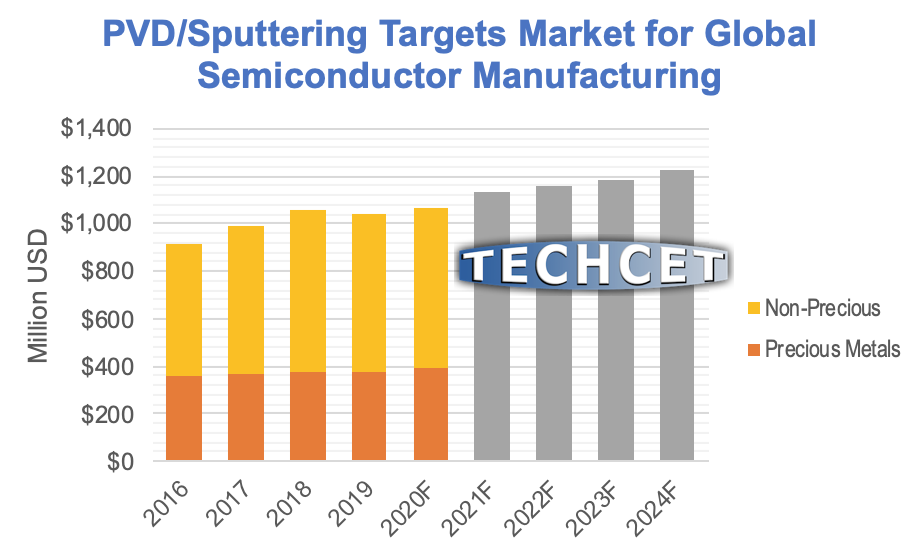

Critical Materials – PVD Targets US$1B and Growing Strong

Increasing demand forecasted through 2024

San Diego, CA, October 21, 2020: TECHCET—the electronic materials advisory firm providing business and technology information—announces that the global market for Physical Vapor Deposition (PVD) including Sputtering consumable materials in semiconductor manufacturing is expected to total over US$1 billion this year. Demand was strong in the first half of 2020 as fabs built up safety stock in response to COVID-19, and sales momentum continued into the third quarter. 2020 revenues are forecasted to be up 2.1% with even stronger growth in 2021 of 5.9% year-over-year, as detailed in the latest Critical Materials Report™ (CMR) quarterly update on Sputter Targets (see Figure).

“The top five suppliers of non-precious-metal targets control approximately ninety percent of the global market,” explained Dr. Dan P. Tracy, TECHCET Sr. Director of Market Research and author of the report. “This mature materials value-chain supports the world’s needs for on-chip metal interconnects, and TECHCET expects that some consolidation in the market is likely over the next several years through mergers and acquisitions.”

TECHCET sees a long-term trend towards recycling of most metal targets to become an increasingly important part of life cycle management. While precious metals such as gold (Au) and Rare Earth Elements (REE) have always been recycled as much as possible, there are both short-term economic incentives as well as long-term sustainability motivations to recycle copper (Cu), tantalum (Ta), and titanium (Ti).

This report covers the following suppliers: Furuya Metals, GO Element, Grikin, Honeywell, JX Nippon, KFMI, Materion, Pioneer Materials, Praxair/Linde, Sumitomo, Tanaka, Top Metal Materials, Tosoh SMD, Solar Applied Materials Technology, Umicore, VEM, and Vital Materials.

Critical Materials Reports and Market Briefings: TECHCET Shop

5th Annual CMC Conference this week: CMC Events

Semiconductor Materials Market to Hit $50B in 2020 Up 3%

Winds Reverse on the Global Supply-Chain Seas

San Diego, CA, September 21, 2020: TECHCET announces that 2020 global materials revenues in semiconductor fabrication are now forecasted upward year-over-year (YoY) despite potential disruptions to manufacturing:

• Overall revenues +2.8% to hit over $50B, versus outlook in April for -3%, • Front End Materials +5% to hit $16.4B, and • Equipment Components +10% to hit $3.8B.

While the impact of COVID-19 on the global economy is serious, IC fabrication is steady for devices to Work From Home (WFH) and School From Home (SFH). As predicted, leading-edge ICs to build out data centers are in strong demand this year, as part of forecasted 5.4% Compound Annual Growth Rate (CAGR) for fab materials through the year 2024 (Figure below).

“TECHCET now sees Front-End Materials volumes and revenues for the year 2020 to be buoyed up by cloud computing and devices to support Work From Home and School From Home,” remarked Lita Shon-Roy, TECHCET President and CEO. “In recent online meetings, the members of the Critical Materials Council of Semiconductor Fabricators have said that most fabs are running at normal levels, while leading-edge logic and memory fabs are actually having a great year.”

Advanced logic fabrication now drives a massive 30% YoY increase in demand for cobalt (Co) deposition precursors. Because of the need for speed and reliability in the most advanced finFET logic chips, the smallest on-chip wires are being converted to cobalt from copper (Cu). Interconnect metallization for semiconductors continues to grow in general, so the demand for copper remains strong albeit somewhat reduced. Sourcing cobalt is still problematic due to conflict-mining in the Democratic Republic of the Congo, yet companies such as Umicore and Australian Mines have gone to great lengths to ensure their sources are conflict-free and sustainable.

Chemical-Mechanical Planarization (CMP) Pad Conditioner revenues for 300mm wafers are growing at 4.5% for 2020, due to 3D-NAND device volume growth and overall equipment sales. CMP processing flattens the surface as device layers are stacked up, and the CMP pad lifetime is increased with corresponding manufacturing cost-reduction by use of specialized diamond-abrasive conditioning disks.

Packaging materials revenues for 2020 should be up >1% due to the relative increase in value of advanced packaging, as more and more chips require interconnects faster than wire-bonds. This is a continuance of the multi-year trend of multi-chip packages using flip-chips and interposers and embedded-bridges. Deep details on packaging materials can be found in the “Global Semiconductor Packaging Materials Outlook” report published by SEMI, TECHCET, and TechSearch, available at the SEMI website.

Critical Materials Reports and Market Briefings: TECHCET Shop

To register for 2020 CMC Conference: CMC Events

CMP Consumables US$2.5B in 2020 for IC Fabs

Stable world-wide growth in demand forecasted through 2024

San Diego, CA, August 27, 2020: TECHCET—the electronic materials advisory firm providing business and technology information—announces that the global market for chemical-mechanical planarization (CMP) consumable materials in semiconductor manufacturing is expected to total over US$2.5 billion this year. CMP consumables including slurries, pads, and conditioning disks are all in stable supply globally, despite COVID-19 pandemic disruptions. The total sub-market just for CMP slurries is forecast to be US$1.3 billion this year, with a Compound Annual Growth Rate (CAGR) of 6.2% per year over the period 2020-2024, as shown in the figure from TECHCET’s 2020 CMP Consumables: Slurry, Pads, and Conditioning Disks Markets for Semiconductor Applications report (below).

While the 2020 CMP slurry market will be down ~2.2% from 2019 levels, ongoing demand for both logic and memory IC fabs is expected to drive steady growth through 2024. For logic chips, the largest demand segments are for copper-bulk, copper-barrier, tungsten, and shallow trench isolation (STI), while slurries for HKMG and cobalt are highly value-added despite relatively lower volume demands. For memory chips, increases in the number of layers in 3D-NAND chips drives continued rapid growth in demand for tungsten slurry as well as ceria slurry for high-rate oxide planarization steps.

“Showa Denko’s recent acquisition of Hitachi Chemical was another sign of a maturing semiconductor materials supply-chain,” commented Dr. Diane Scott, TECHCET Analyst and co-author of the report. “This business unit is the world’s leader in supplying ceria slurry, a highly specialized formulation using Rare Earth Oxide nanoparticles to make ultra-smooth surfaces for the world’s most advanced ICs.”

The CMP consumables market is seeing increased focus on localization of the supplychain, with many suppliers looking at finishing product closer to the end-users. Finishing refers to final production steps of the material, which in the case of pads could include application of adhesives, cleaning, quality control (QC) inspections, and specialized clean packaging for shipment. Benefits include reduced shipping cost, faster customization, and localized buffer-inventory to support demand surges.

Critical Materials Reports and Market Briefings: TECHCET Shop

Rare Earth Elements Supply Uncertain for IC Fabs

China’s de facto monopoly control remains for now

San Diego, CA, July 29, 2020: TECHCET—the electronic materials advisory firm providing business and technology information—announces supply-chain challenges ahead for Rare Earth Elements (REE) for semiconductor device manufacturing, due to ongoing global pandemics and trade-wars. The United States is fast-tracking domestic REE refining capability to provide a global alternative to China’s current de facto monopoly, but it could be 2022 or later before new capacity is available. The global supply of Rare Earth Oxides (REO) is expected to see a Compound Annual Growth Rate (CAGR) of 4.0% per year over the period 2018-2025, as shown in the figure from TECHCET’s 2020 Rare Earths Supply-Chain Report (below).

“Although China is the global market leader for Rare Earth metals, they do not control all the mining in the world,” commented Terry Francis, TECHCET Analyst and author of the report. “By specializing in the difficult refining and separation processes, Chinese companies have maintained a near-monopoly on rare earth metals production. They own most off-take from global mines such that they ship over 83% of the world’s pure rare earth metals.”

TECHCET is tracking three new REE refining operations in the U.S.:

• Lynas Corporation of Australia and Blue Line Corporation in Texas were awarded grants in late July 2020 by the U.S. government to develop a processing plant to extract rare earths from material sent from Malaysia.

• MP Materials will go public in 4Q20 on the New York Stock Exchange at a valuation of US$1.47B where it will trade as “MP.” The company plans to invest US$489M in refining capacity in Mountain Top, California. In April 2020, the U.S. Department of Defense awarded MP a grant to pay for the design of a heavy REE separation facility.

• USA Rare Earth and Texas Mineral Resources started a heavy and light REE refining pilot plant in Wheat Ridge Colorado last December. It is working on a fullscale refinery for REE, lithium and other technology metals in Round Top, Texas.

U.S. refineries are not expected to be capable of volume supply until 2022 or later. In the meantime, China’s REE companies will control the market. China’s government recently announced a 6.6% increase in quota limits on exported volumes for 2020 over 2019. This is good news for REE buyers, but for new suppliers in the U.S. and Australia it likely means that market pricing will not follow traditional supply-demand trends. Pricing is likely to be highly variable, with possibilities of spikes in the spot market.

Another important market factor is that the handling of rare earth waste is challenging. Countries that are considering local refining capabilities must mitigate environmental risks. For example, USA Rare Earths recently announced their intention to rely on renewable energy for all of their power requirements as one way to balance environmental impacts. TECHCET anticipates more announcements inside and outside of China will be made over the next year addressing environmental concerns.

Critical Materials Reports and Market Briefings: TECHCET Shop

Quartz Parts Market for Semiconductor Fabs Downward Trend Expected to US$1.2B

Skilled Labor Shortage for Quartz Tube Fabricator Concerns

San Diego, CA, July 4, 2020: TECHCET—the electronic materials advisory firm providing business and technology information—announces that the market for quartz components and parts used in Original Equipment Manufacturers (OEM) tools is now forecasted to decline 3-5% in 2020 to reach US$1,187M. However, this market is still expected to experience a 4% CAGR from 2019 to 2024 as shown in the figure.

Other highlights from the 2020 Critical Materials Report (CMR) on Quartz Components, Fabricated Parts, and Base Components for Semiconductor Applications include:

• With the COVID-19 pandemic in 1H20, a few large fabs started increasing purchase orders by 15-20% MoM to increase safety-stock levels,

• China’s market experienced mild growth in 2019, since new local suppliers are still climbing a learning curve; only a handful of companies are able to pass qualification as suppliers to top-tier IC fabs,

• Quartz suppliers in Taiwan will generate +15% revenue growth from Taiwan chip fabs which have continuously run throughout 1H20, and

• Although reports of orders in 1Q2020 appear positive, TECHCET expects softening to start occurring in 2H2020 which will effect overall 2020 revenues.

“The global slowdown due to the COVID-19 pandemic is a good time for quartz suppliers to catch up on the talent shortage,” remarked Kuang-Han Ke, TECHCET Analyst and author of the report. “While machined parts capacity can be ramped up easily, quartz diffusion tube supply depends on experienced craftsman and talent. Many of the mid-size quartz fabricators have been able to out-grow the market with strategic hiring.”

During 2018, legacy equipment parts including furnace tubes faced longer lead-times for the second-tier fabs. This was the result of limited hot fabrication production spots taken up to fill orders from larger volume first-tier fabs and OEM equipment demand.